I live on a budget of just $50 A MONTH – here are my genius money-saving hacks that help me cut costs while still having fun with friends

A woman who gave herself a budget of just $50 a month to spend on non-essentials all year has revealed how she sticks to her strict budget.

Alexis Howard, 28, from San Francisco Bay, is known as @financieelbrave on TikTok, where she shares her financial journey.

The content creator started the challenge in January, but she recently listed her July spending and revealed, “I’m happy to report that I spent $41 in July.”

Under the rules she set up, she was able to transfer the extra $9 to August, the most she ever had left at the end of the month.

Alexis Howard, 28, from San Francisco Bay, has been living on a budget of just $50 a month for non-essentials since January and documents her challenge on TikTok

The content creator explained that the $50 is separate from her monthly expenses, including the cost of replacing empty or broken items

In a recent video, she summarized her July non-essential expenses and revealed that after a month of budgeting, she still had $9 left

“When I started this challenge, I knew summer was going to be the hardest season to get through,” she admitted.

‘So I’m a bit surprised that I’ve managed to underspend now, especially as I was extremely busy in July.

“But the most interesting thing to note was that I felt my $41 would be better spent on memories with friends rather than on materialistic things.”

Alexis said she spent $14.66 on ice cream for two, $8 on a cup of kava tea for a night out, $10 on a bar fee for a friend’s birthday, and $8 on a roller coaster ride for the another friend’s party.

The savvy saver also went to a farmer’s market for free for a “fun July activity.”

“These purchases confirm two things for me,” she said. ‘The first is that you don’t have to give up your social life if you’re on a budget.

‘Laughter and memories can still happen with friends, even if you opt for ice cream instead of an expensive meal at a restaurant. And two, gratitude can take you a long way when it comes to discipline.

“Focusing on what you have access to versus the things you don’t can help alleviate the challenges of budgeting.”

“The most interesting thing to note was that I felt my $41 was best spent on memories with friends rather than on materialistic things,” said Alexis, who still managed to hang out with her friends.

Alexis said she spent $14.66 on an ice cream for two and $8 on a cup of kava tea for a night out

She also explained how she took advantage of the local farmer’s market, a “fun July activity” that was free

Alexis also spent $10 on cover at a bar for one friend’s birthday and $8 to ride a roller coaster at another friend’s party

Alexis noted in the on-screen text that she is grateful to have clothes, housing, water and electricity, loving family and friends, fresh groceries, efficient public transportation, and free activities in her area.

‘I love this account! It’s a much more realistic way to approach spending,” one fan commented.

‘Omg congratulations on your achievement!!! This is huge, especially doing it in July,” someone else shared.

‘This is so fantastic! I would love to try this but I really struggle with discipline,” another admitted.

Alexis outlined the rules of her $50 spending challenge in January and has been sharing monthly updates since.

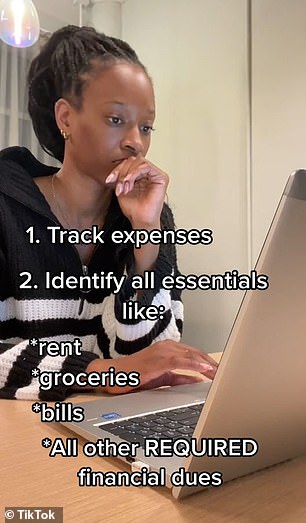

‘I keep track of my expenses on an Excel sheet with all my essentials listed. This includes rent, groceries, bills and other financial costs that I have to pay for,” she explained.

“To give myself some balance and joy during this process, I set aside a very small portion of my budget—$25 a month to be exact—for flowers, weekend coffee, or candles.”

Alexis noted that the $25 dollars do not count towards her $50 spending limit, nor does it include the cost of the times they need to be replaced because they are empty or broken.

“This year will consist of a lot less travel, dining and shopping, and a lot more of eating at home and maintaining my discipline through reading, exercising and focusing on my career,” she concluded.