Hunter Biden’s top lawyer Abbe Lowell tries to convince LA federal judge to dismiss tax crimes case against president’s son, but is told there isn’t ‘any evidence’ for his arguments

Hunter Biden’s attorneys appeared in Los Angeles federal court on Wednesday in an effort to get his tax crimes case dismissed — as special counsel David Weiss watched from the public benches.

The First Son’s attorneys tried to convince LA federal Judge Mark Scarsi to dismiss the tax crimes case filed against him by Special Prosecutor David Weiss.

But two hours into the afternoon hearing, Hunter’s top lawyer Abbe Lowell appeared to take a back seat, with Judge Scarsi telling him that “any evidence” had not been presented for some of his legal arguments beyond a certain timeline.

Justice Department Attorney Leo Wise and Lowell traded blows, with Wise admonishing Lowell for appearing to call him a “major partisan,” and Lowell accusing the Justice Department of “succumbing” to pressure from Republican lawmakers to to impose a ‘vengeful’ persecution of the First Son. .

Lowell also argued that the entire prosecution was invalid because of the alleged improper appointment of David Weiss as special counsel when he was still a U.S. attorney — as he sat in a blue suit watching from the front row of the court’s public seats in LA.

Hunter himself did not appear at the hearing, which will decide whether he will stand trial in June.

Hunter Biden’s legal team appeared in Los Angeles federal court on Wednesday in an effort to have his tax crimes case dismissed

Hunter’s legal team argues that special prosecutor David Weiss was improperly appointed, invalidating any prosecution he initiates

The First Son’s attorneys tried to convince LA federal Judge Mark Scarsi to dismiss the tax crimes case filed against him by Special Prosecutor David Weiss.

Over the past two months, Winston & Strawn attorneys Abbe Lowell and Angela Machala filed a series of motions claiming:

- The prosecution is a political witch hunt under pressure from Republican lawmakers and Donald Trump

- Hunter’s “sweetheart” plea deal shot down by a Delaware judge was still in effect

- The statute of limitations for Hunter’s alleged crimes had expired

- Los Angeles was the wrong location to hear his case

- Weiss was wrongfully appointed, making any prosecution he initiates invalid

6. IRS whistleblowers who shared case information with Congress ruined the case by going over the line

Weiss and his deputies, Leo Wise and Derek Hines, refuted all the claims with their own filings, portraying Hunter’s attorneys as resorting to desperate and flawed legal arguments rather than going before a jury.

Hunter’s team expressed outrage at what they claim is the Justice Department’s abandonment of a plea deal that would have released him without prison time and effective immunity for other possible past crimes.

The deal fell apart during a dramatic hearing on July 26, when federal Judge Maryellen Noreika in Delaware revealed disagreements between prosecutors and Hunter’s legal team over his protection from new charges — such as for illegal lobbying abroad.

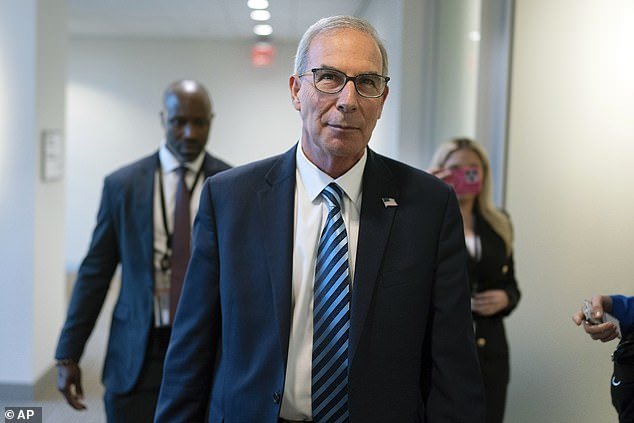

The First Son’s lawyers tried to convince LA federal judge Mark Scarsi (pictured) to dismiss his tax crimes in nine cases

Weiss’ team claims the agreement was only a “draft,” explicitly requiring signature by the U.S. chief probation officer, which never occurred.

Hunter was charged in December with three felonies and six misdemeanors. The president’s son is accused of deliberately evading taxes, falsifying his returns and failing to pay $1.4 million on time – instead spending the money on a “lavish lifestyle.”

The charges cover the tax years of 2016 through 2019 and could land him in prison for up to 17 years.

Lowell told the judge in legal documents that Hunter’s charges for failing to pay taxes in 2016 exceeded the five-year statute of limitations.

But Wise returned with paperwork stating that the First Son’s lack of payment did not become “intentional” – and therefore criminal – until 2020, meaning the clock started running much later.

Hunter’s lawyers argue that he was not living in California in 2018, meaning no tax bills can be filed against him there.

But records from Hunter’s abandoned laptop show he spent a lot of time there during that period, and prosecutors allege he lived in both Wilmington, Delaware, and Los Angeles in 2018.

In an apparent slam-dunk, Weiss’ team wrote to review Scarsi on March 25: “The suspect moved to California during the first week of April 2018 and expressed his intention to remain in California in a text message he sent from California to his sister-in-law on April 12, 2018, in which he wrote : ‘I will stay here indefinitely.’

Special Counsel David Weiss and his deputies Leo Wise and Derek Hines (pictured) refuted all the claims with their own documents, portraying Hunter’s attorneys as resorting to desperate and flawed legal arguments rather than standing before a jury

Some legal documents have been sealed due to ongoing investigations into other suspects, adding intrigue to the case and raising the possibility of new charges.

“The redacted information in the file and the sealed exhibits relate to a possible ongoing investigation,” prosecutors wrote in a legal statement this month, adding that they are “not references to any investigation into (Hunter).”

In January, Weiss’ team accused former FBI informant Alexander Smirnov of lying, claiming he was acting as a Russian double agent. Smirnov denies the accusations.

The informant became a key figure in the Biden investigation when he told his handler in 2020 that Ukrainian oligarch Mykola Zlochevsky bragged to him about paying $10 million in bribes to then-Vice President Joe Biden and Hunter for killing a criminal investigation into his gas company Burisma. .

Since last year, top Republicans have been investigating Joe Biden’s ties to Hunter’s shady overseas deals aimed at ousting the president.

Lowell claims that “political pressure from President Trump and his MAGA allies” was the only reason Weiss filed charges against Hunter.

Weiss’ team says they have been investigating Hunter for years and were willing to make a deal with him until he pleaded not guilty to alleged gun crimes in Delaware in July.

In January, Weiss’ team accused former FBI informant Alexander Smirnov of lying, claiming he was acting as a Russian double agent. Smirnov denies the accusations

Prosecutors say he received approximately $1.2 million in 2020 alone “in financial support to fund his extravagant lifestyle,” from his “sugar brother” Hollywood lawyer Kevin Morris (left)

Hunter’s California tax complaint, filed on December 7, states that despite receiving millions in personal income and financial support from a friend, he “spent this money on drugs, escorts and girlfriends, luxury hotels and rental properties, exotic cars, clothing and other stuff’. of a personal nature, in short, everything except his taxes’.

“The defendant spent approximately $1 million in 2016, $1.4 million in 2017, $1.8 million in 2018 and $600,000 in 2019,” the complaint alleges.

According to the documents, Hunter earned more than $7 million in gross income between 2016 and 2020.

Prosecutors say he received about $1.2 million in 2020 alone “in financial support to fund his extravagant lifestyle” from his “sugar brother” Hollywood lawyer Kevin Morris.

Morris’ total support for Hunter amounts to at least $4.9 million, according to congressional testimony from IRS agent Joseph Ziegler, who investigated Hunter for five years before bringing up the DOJ’s allegedly lackluster prosecution.