Huge Dem-run city on verge of bankruptcy thanks to ultra-generous public sector pension scheme

A Midwestern city has helped fuel a shaky financial situation by offering extremely generous retirement benefits to state workers, experts say.

Chicago’s projected budget deficit is a whopping $982.4 million The Citizens’ Federation.

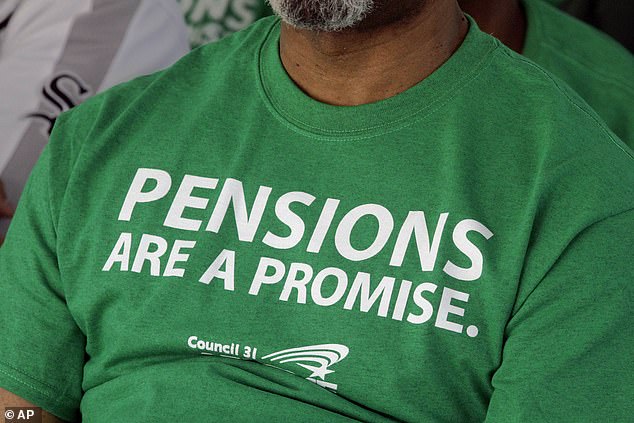

Despite several tactics to save the city from bankruptcy, politicians have failed to get to the root of the problem: increasing pension benefits to Chicago’s more than 40,000 public workers.

“Pension benefits are like free junk food to politicians: everyone loves them, and the bills come later,” Andrew Biggs, a senior fellow at the American Enterprise Institute, wrote in an article. New York Times opinions piece.

“They can be disastrous for a city’s long-term financial health.”

Democratic Mayor Brandon Johnson’s latest attempt to reduce the city’s debt — a proposed $300 million increase in property taxes — was rejected by the City Council.

The City Council this month approved a budget with far fewer tax increases than Johnson wanted, Biggs explained.

In 2022, pension benefits and debt service accounted for 43 percent of the city budget.

Chicago has encouraged a shaky financial situation by offering extremely favorable retirement benefits to public employees

In 2022, pension benefits and debt service accounted for 43 percent of the city budget

“In other words, Chicago is paying for the past and not investing for the future,” Biggs wrote.

There are several factors that contribute to the pension problem, including the age at which people retire, the amounts they receive and the contributions workers have made to their pension funds throughout their careers.

More than half of Chicago’s city workers retire before they turn 60. Illinois Policy Institute reported in 2015.

Biggs said a city employee who retires after 35 years and has a final salary of $75,000 would get $77,000 annually between his pension and retiree health benefits.

The city is feeling the consequences of their financial shortcomings.

Biggs was referring to the massive corporations — including Boeing, Tyson Foods and Citadel — that have fled Chicago in recent years because of the state of Chicago’s “business climate” and “public safety.”

Lack of funding has also led to depleted resources for public services. The city’s police force has been reduced by about 1,600 officers since 2018.

On average, 49 percent of 911 calls appear to go unanswered, city Supervisor Deborah Witzburg found in a 2023 analysis: WGNTV reported.

Democratic Mayor Brandon Johnson’s latest attempt to reduce the city’s debt — a proposed $300 million property tax increase — was shot down by the City Council

Chicago’s growing pensions have added to the city’s debt in recent decades

Biggs painted a vivid picture of the city’s dire financial condition.

He wrote, “Chicago owes bondholders nearly $29 billion. The country also faces $35 billion in unfunded pension liabilities and nearly $2 billion in unfunded health care benefits for retirees.

“And these numbers do not include another $14 billion in unfunded benefits owed to Chicago teachers.”

According to the Illinois Policy Institute, the entire state of Illinois is experiencing Chicago’s retirement dilemma.

Over the past year, pension debt across the state rose from $142.2 billion to $143.7 billion, according to a nonprofit think tank group. Illinois Policy Institute reported.

In 2023, more than 140,000 Illinois government employees and retirees collected more than $100,000 in salaries and pensions. Muddy River News reported based on data collected by Wirepoints.

Biggs said a city employee who retires after 35 years and has a final salary of $75,000 would get $77,000 annually between his pension and retiree health benefits.

The state’s pension crisis has been going on for decades, the newspaper said Wire points data from 2018.

Gov. Jim Edgar “kicked the can far, far into the future” in 1994 when he enacted a law to try to solve the then $17 billion pension deficit.

But the plan only made matters worse, with state pension obligations running until 2045.

“There may be no way for Mr. Johnson to get Chicago out of its budget mess without political and economic pain,” Biggs claimed.

“But he, and the rest of America’s mayors, have an obligation to try.”