HSBC launches money transfer app Zing in Britain: can it compete with Revolut and Wise in international payments?

- HSBC is taking on challengers Revolut and Wise in a bid to attract customers

- These challengers offer cheap foreign exchange that have raked in millions

- Zing allows customers to hold 10 currencies through the app

<!–

<!–

<!– <!–

<!–

<!–

<!–

HSBC will today launch an app and debit card for international payments and foreign exchange called Zing in Britain.

It's a move to win back some of the retail customers who have flocked to challengers Revolut and Wise.

The market has been dominated by these companies, which have won millions of customers by offering cheap foreign exchange.

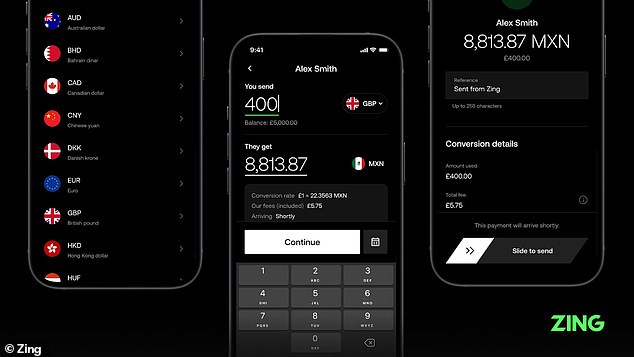

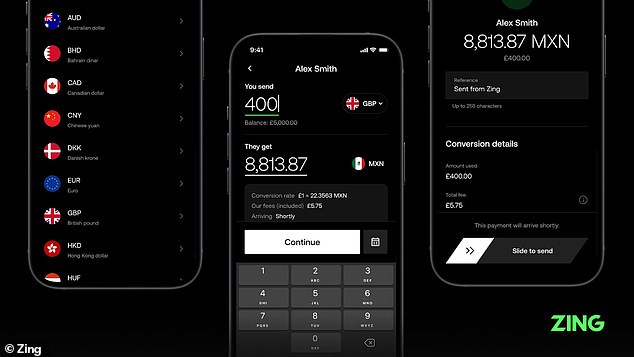

New offering: HSBC tries to fight back against challengers Revolut and Wise with new money and foreign exchange app Zing

What does Zing do?

Zing allows customers to hold 10 currencies through the app, send money internationally in more than 30 currencies, and spend around the world.

The app will be available to download for free from the Google and Apple app stores within days of launch.

Zing is owned by HSBC, but is separate from HSBC's other banking offerings, so you don't have to be an HSBC customer to become a Zing member.

What are the currency conversion fees?

There is currently a waiting list to sign up for Zing.

The first 10,000 people to join will become 'founding members', meaning they will receive exclusive rewards in their first year, including a choice of free currency conversions (for transactions up to £1,000) or 20 free international ATMs. recordings.

For those who are not founding members, Zing says the first international withdrawal per calendar month is free, and thereafter there is a fee of £2 (or equivalent) per withdrawal in the withdrawal currency.

For withdrawals in Great Britain there is a surcharge of £2 per withdrawal. For all members, the daily withdrawal limit is £5.

Is Zing FSCS protected?

Zing was developed as a fintech within the HSBC Group.

It is not a bank, although it is licensed by the Financial Conduct Authority.

Crucially, funds are not protected by the Financial Services Compensation Scheme, which protects customers' money up to £85,000 if a company goes bust.

How does it compare to Revolut and Wise?

James Blower, founder of the Savings Guru website, said: 'Without being able to compare costs and fees at this stage, it's difficult to know whether Zing is better than Wise or Revolut.'

There are three things residential customers should check when considering signing up for a Zing account.

Firstly, the exchange rates. Wise and Revolut have done much better than the big banks here, so it will be interesting to see if Zing is more in line with them, or is just a fintech rebrand of HSBC's high street rates.

Then there are the free cash withdrawals. Both Revolut and Wise allow withdrawals of £200 per month in local currency.

Zing allows 20 withdrawals per month for the first 10,000 users, but after that there is a fee of £2 (or equivalent) per withdrawal in the withdrawal currency, including in the UK.

Early bird offer: Zing offers exclusive rewards to the first 10,000 customers to sign up, including free currency conversions and 20 free international withdrawals

For customers who sign up after the first 10,000 members, the first international withdrawal per calendar month is free, but thereafter there will be a fee of £2 (or equivalent) per withdrawal in the withdrawal currency. For withdrawals in Great Britain there is a surcharge of £2 per withdrawal.

Finally, both Revolut and Wise have been successful in these markets when it comes to sending money internationally because the costs have been very low. It's not yet clear whether Will Zing will match their rates or if it will charge more in line with HSBC.

A Zing spokesperson said: 'Zing applies transparent variable fees of a minimum of 0.6 percent depending on the transaction value shown prior to the transaction.'

Currently, Wise charges £1.21 to send £250 GBP to Euro, while HSBC charges £9.26.

James Blower says: 'Zing looks like HSBC's attempt to fight back against the likes of Wise and Revolut in the fast-growing international payments market.

'It is estimated that by 2023 there will be over £800 billion worth of transactions, so it is certainly something that is becoming increasingly valuable to financial services providers.'

James Allan, founder and CEO of Zing, said: “Many people are increasingly living international lifestyles, with more than half of British adults having either lived abroad for a while or aspire to do so.

'Our research shows that these people often experience frustration when sending, spending and exchanging money.

“That's why now is the time for a new kind of international payments solution, one that combines breakthrough innovation with the backing of an experienced global bank.”