HSBC announces latest mortgage rate cuts, including sub-4% deal

HSBC is the latest lender to announce a new wave of lending mortgage interest cuts, including a rate of less than 4 percent.

The bank's cheapest five-year solution for people refinancing their mortgages will drop from 4.79 percent to 3.94 percent from tomorrow, according to industry insiders.

The cheapest two-year solution will also drop from 4.93 percent to 4.49 percent for customers who refinance their mortgage.

Both deals are the best bargains and will provide some much-needed breathing space for anyone nearing the end of their current fixed rate deal.

Best buy: HSBC is the latest mortgage lender to announce a new wave of mortgage cuts, including sub-4% interest rates

An estimated 1.6 million mortgage holders will take out a new mortgage this year, with many bracing for much higher interest rates than they are currently expecting.

HSBC's cheapest five-year solution will be available to eligible borrowers who take out a new mortgage with at least 40 per cent equity in their home. This involves a mortgage amount that does not exceed 60 percent of the home value.

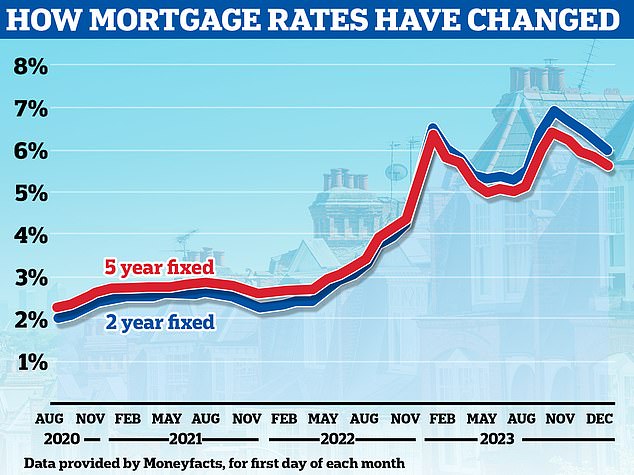

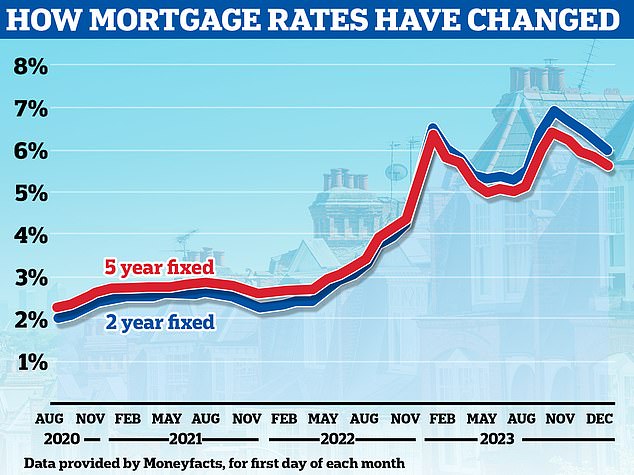

According to Moneyfacts, the average five-year term for these 60 percent mortgage deals is currently 5.05 percent.

The second lowest remortgage deal after HSBC is offered by Generation Home at 3.99 per cent. But after that, the second lowest rate is 4.49 percent for households that refinance.

> What next with the mortgage interest rate, and for how long should you fix the mortgage interest rate?

HSBC's cheapest two-year solution could prove even more popular as many borrowers expect interest rates to fall in the future.

The 4.49 per cent rate for homeowners with high equity is well below the market average of 5.39 per cent, and at 4.6 per cent is better than the second lowest rate on the market offered by Virgin Money.

David Hollingworth, associate director at broker L&C Mortgages, said: 'These cuts are just the latest salvo in an increasingly fast-moving market.

“These deals offer some of the lowest rates since last summer's rate spike.

“While borrowers coming to the end of their current fixed rate this year will still see an increase in payments, these new lower interest rates will take at least some of the sting out of the inevitable increase.

Hollingworth added: 'HSBC's move is notable as the rates are being offered to borrowers looking to remortgage, a departure from the recent trend of pricing in favor of movers.

'With large numbers of borrowers anxiously approaching the expiry of a solution taken during the ultra-low interest rate period, this is a welcome step and hopefully a signal for more lenders to follow suit, improving options for those facing payment shock confronted.

“These cuts come on the heels of Halifax's New Year improvements and others will no doubt follow suit.

'We thought the new year would start with a bang and that turns out to be the case.'

Will mortgage rates fall further?

Market commentators are almost certain that we will see further rate cuts in the coming weeks.

Nicholas Mendes of mortgage broker John Charcol said: 'In recent days, lenders have sought to capitalize on pent-up buyer demand among those coming to the end of their fixed rates in the first half of 2024, so we should expect an ongoing battle between lenders.'

The reason why brokers are so adamant that rates will continue to fall is due to market expectations surrounding the future of rates.

These market expectations are reflected in the swap interest rate. These are agreements where two counterparties, such as banks, agree to exchange a stream of future fixed interest payments for a stream of future variable payments, on a fixed amount basis.

Mortgage lenders enter into these agreements to protect themselves against the interest rate risk associated with providing fixed-rate mortgages.

Simply put, swap rates reveal what financial institutions think the future holds in terms of interest rates, and mortgage lenders use them to price their fixed rate products.

Five-year swaps are currently 3.43 percent and two-year swaps are 4.05 percent – both well below the current base rate of 5.25 percent.

Falling: The average fixed mortgage rate is falling slightly after a barrage of rate hikes in the first half of last year

“It looks like lenders are likely to give movers the belated Christmas gift of lower mortgage rates in early 2024,” said Matt Smith, mortgage expert at Rightmove.

'After the reduction in the swap rate that we saw before the holidays, this is now starting to affect mortgage rates now that the festivities are over and the working year has started.

“Unless things change, the signs are positive that lenders will cut rates further in the coming weeks.”

Chris Sykes, technical director at mortgage broker Private Finance, added: 'I have heard on good authority from more than one other lender that we will see interest rate rises below 4 per cent in the coming week.

'Lenders often want margins of about 0.3 to 0.5 percent above the swap rate, depending on how competitive they are.

Sykes added: “We are unlikely to see two-year money below 4 percent for some time to come, with two-year swaps currently at 4 percent, but we think we will still see further declines.

“It's not just nominal interest rates that we're seeing declines, we're seeing declines in average interest rates across the board, so that helps average borrowers as well.”

Mortgage shock: About 1.6 million people will face mortgage shock when they take out a new mortgage next year as their low interest rates come to an end

What to do if you need to take out a new mortgage

For those approaching their remortgage date, the advice is to secure a mortgage quote as soon as possible.

Mortgage deals typically have a term of six months, meaning borrowers can lock in an interest rate within six months before their current deal expires.

In the meantime, they can always secure another offer if rates continue to fall.

“The problem facing lenders right now is how quickly they can make changes,” says Sykes.

'Lenders will hedge their positions based on current lending requirements, but we as brokers encourage clients to lock in as early as possible and consistently adjust rates if they drop.

'We have now saved customers hundreds of thousands, if not probably millions, in interest, and the banks have to swallow that.

“So some of the mortgages that lenders are doing right now are probably not as profitable or even loss-making, as lenders hedged against that debt months earlier.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.