How Uber is taking on the likes of Trainline: Taxi app is rolling out train, coach and Eurostar ticket tool with a glossy multi-million pound advertising blitz

In an eye-catching video ad for Uber, an excited man approaches the driver and asks him to open the window as the train is about to depart.

He showed him his phone to take him to Portsmouth, and the driver, looking a little confused, confirmed that he was indeed heading in that direction.

The customer answers: “You can take me anywhere near the station.”

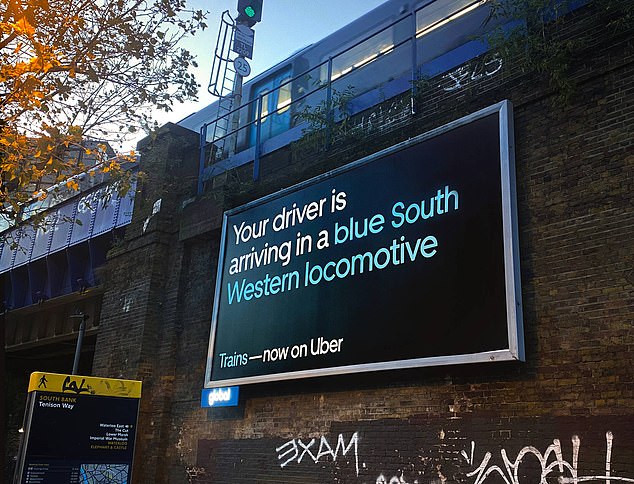

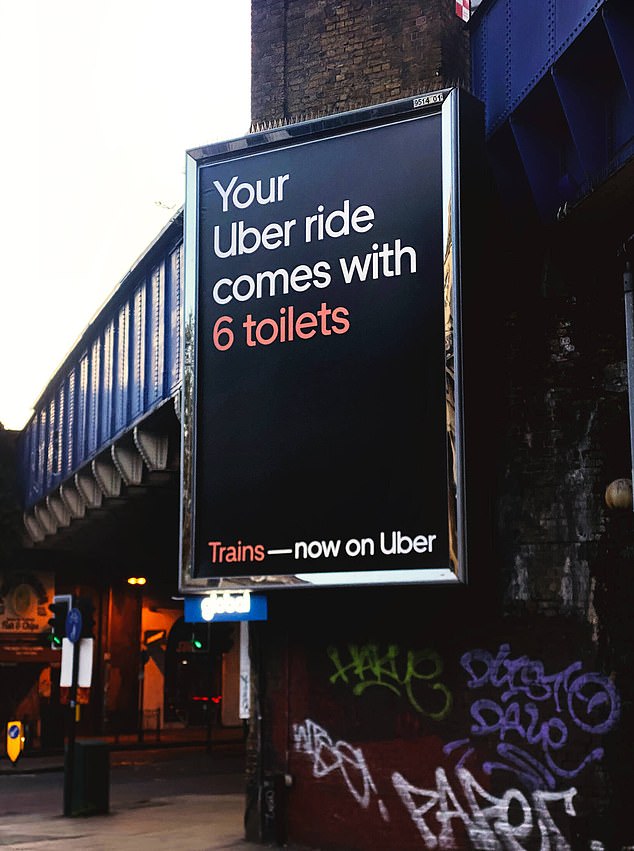

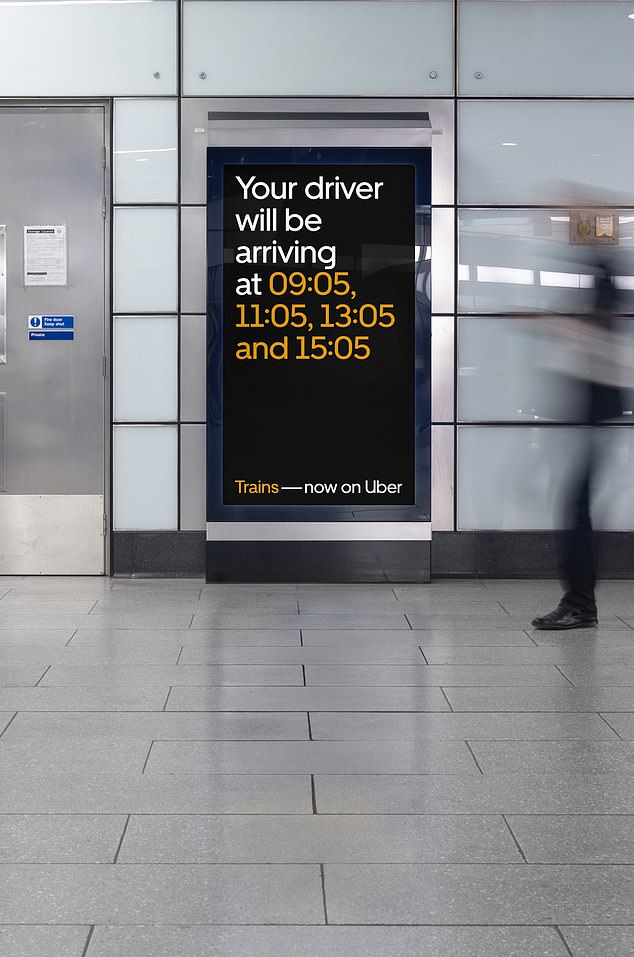

The ad forms part of a multi-million pound advertising campaign run by the ride-hailing app which has seen billboards appear across UK railway stations.

It draws attention to a service the company quietly launched about a year ago under Uber Travel.

The range of booking facilities, including flights, coach travel and Eurostar, aims to take customers door to door, covering all parts of their journey using the app.

Uber's rail ticket feature has been heavily advertised over the past few weeks at railway stations across the UK, drawing attention to the service the company quietly launched almost a year ago as part of Uber Travel.

Announcement of Uber's rail booking feature. The company witnessed a change in its fortunes this year, as it announced its first operating profit in August after incurring a total operating loss of $31.5 billion since 2014, the first year in which it revealed details of its financial conditions.

Uber witnessed a change in its fortunes this year, as it announced its first operating profits last August, after incurring total operating losses of $31.5 billion since 2014, the first year in which it revealed details of its financial conditions.

But it could not have been chosen a more difficult time to enter the market, in a turbulent year that saw discussions between unions and government reach boiling point, with walkouts and strikes causing pandemonium for passengers.

The launch of Uber's train ticket service came in the wake of a pandemic period in which travel was halted.

As the economy reopens, demand for Uber's ride-hailing services quickly outpaces the number of available drivers.

The situation has been partly resolved by increasing wages and prices, and the company now employs more drivers in the UK than before the coronavirus outbreak began.

Uber was seeing 40 percent monthly growth in train bookings before its advertising campaign.

Uber makes what it refers to as a small amount from each ticket sold, but the company has made a move into the rail ticket market as part of its broader expansion plans.

In an eye-catching video ad, an excited man approaches a train driver and asks him to open the window as the train is about to depart. He showed him his phone to take him to Portsmouth, and the driver, looking a little confused, confirmed that he was indeed heading in that direction.

By Uber's own account, it is not looking to disrupt the rail industry in the same way its ride-hailing service did. In fact, the company points out that the business model of ticketing companies would not allow it to do so.

Digital and online tickets make up about 46 percent of the market at present.

Besides Top Dog Trainline, there are around 20 train ticketing services in the UK market, all of which take just 5 per cent off the ticket price, with the other 95 per cent handed over to the train company.

Train operators, who collectively have a large share of the market, also have retail outlets, and the instant pay service offered by rail operators is also very popular in London and the south-east.

Other players in the train ticket market include the likes of MyTrainTicket and traintickets.com.

But Uber and other companies that offer rail ticket services do not compete with the rail companies themselves.

Uber says it only provides a way to purchase tickets. It has no partnership with railway companies and no say in running the trains.

Train, bus and Eurostar reservations are made through Uber's partnership with Omio, where their API plugs into the Uber app

An Uber spokesperson said the company entered this corner of the market because it noted that the top ten destinations in the UK for ride-hailing are eight train stations and two airports, where these trips are more profitable than short trips across town. For example

The company points out that integrating the network of train companies into the Uber application took a long time.

But Uber wasn't able to make this leap alone. It has partnered with Berlin-based multimodal travel platform Omio, which launched in Germany in 2013, to bundle its train booking service as part of Uber Travel.

Uber makes what it refers to as a small amount from each ticket sold, but the company has made a move into the rail ticket market as part of its broader expansion plans.

An Uber spokesperson told MailOnline: 'It's not going to generate us much revenue at all, but it's also a very low capital investment to do so.'

However, the potential rewards of entering the rail market are significant.

An Uber spokesman said the company had entered this corner of the market by noting that the top ten destinations in the UK for ride-hailing were eight train stations and two airports, with these trips being more profitable than short trips across town. For example.

If people book their train tickets or flights through the app, they'll be more likely to book an Uber to get to the train station or airport, or so the theory goes. They are also more likely to continue using the app in general.

If people book their train or flight on Uber, they are more likely to book an Uber to get to the train station or airport, or so the theory goes. They are also more likely to continue using the app in general

Uber says it only provides a way to buy a ticket and has no partnerships with rail companies, and has no say in running the trains

“It's all about providing riders with the option to book in one app, because you can't currently do that,” the Uber spokesperson added. So, we literally provide a place where you can go door to door, all in one app.

“It's not about creating massive amounts of new revenue streams through rail pricing.”

But Uber can hardly be seen as a quiet threat to major players in the rail ticket industry, which has seen unsuccessful entries from big names in travel such as Expedia and Skyscanner, after it made one of the boldest global expansions of any technology startup. higher.

As well as having deep pockets to advertise to the general public, the company is likely to strike fear into the hearts of its opponents through its audience of 5 million regular UK ride-hailing users each month, to whom it can promote and market at any time. a point.

In fact, after launching Uber Travel, the company sees its main competitors as tour operators.

Uber aims to become a fully integrated door-to-door travel booking service

Uber has partnered with Berlin-based multimodal travel platform Omio, which launched in Germany in 2013, to bundle its train booking service as part of Uber Travel.

Train, bus and Eurostar bookings are made through their partnership with Omio, plugging their API into the Uber app.

The flights are made through a similar partnership with Canada-based online travel agency Hopper.

Uber aims to become a fully integrated door-to-door travel booking service.

“The idea is that it will become the super travel app if you want to go anywhere,” the company spokesperson said.

A spokesman for the Rail Delivery Group, which was set up in 2011 to provide leadership for Britain's rail industry, told MailOnline: 'We have worked collaboratively with retailers to increase the number of platforms customers can use to buy tickets.

“Demand for online ticketing has grown significantly in recent years with Uber the latest platform to start providing this functionality.

“There is a lot of competition and innovation in this market, and we welcome the role online retailers are playing in promoting the railway and making it easier to buy tickets.”

(Tags for translation)dailymail