How to Save $1 MILLION in Your 401(K): Experts Explain What Each Age Group Needs to Put Away to Generate a Seven-Figure Balance—But Is That Enough?

- A 22-year-old must start saving $325 a month to earn $1.01 million by age 62

- Analysis shows how much each age group needs to save to reach seven figures

- But experts speculate that $1 million may not even be enough for a comfortable retirement

- Are you a 401(K) millionaire? Did you succeed, despite having a lower income, by making important sacrifices? Email us at money@dailymail.com

Traditionally it is considered the benchmark for a comfortable retirement. But how do you save $1 million in your 401(K)?

Experts have broken down the amount you need to put away each month to generate a comfortable savings, depending on the age you start.

And it may not be as difficult as it seems. According to personal finance The motley foola 22-year-old would have to save $325 a month throughout his career to retire with $1.01 million by the time he turns 62.

If a worker didn't start saving in his 401(K) until age 27, he would have to set aside $500 a month to reach $1.03 million by the same age.

The figure rises to $750, $1,200 and $1,900 for a 32-year-old, 37-year-old and 42-year-old respectively.

Experts have broken down the amount you need to put away each month to generate a comfortable savings, depending on the age you start

The analysis assumes that the investments generate an average annual return of 8 percent, slightly lower than the average 10 percent return generated by the stock market.

According to The motley fool, A common rule of thumb when investing is to subtract your age from 110. The result is the percentage of your portfolio you should then allocate to stocks.

For example, if you are 35 years old, about 75 percent of your portfolio should consist of stocks, while 25 percent should be reserved for bonds and other conservative investments. The idea behind this theory is that younger investors can take greater risks.

Experts also point out that returns will differ depending on what you invest in. A 401(K) or an individual retirement account (IRA) offers a different return than just investing in stocks.

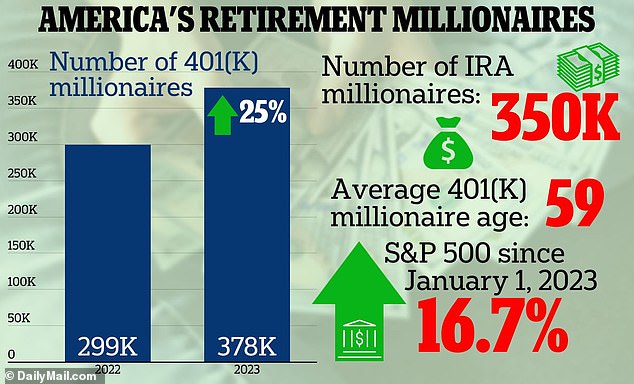

Earlier this year, an analysis from asset manager Fidelity found that the number of 401(K) savers with at least $1 million increased 25 percent between 2022 and 2023. The increase was attributed to a rally in the stock market.

In 2021, approximately 442,000 of Fidelity's 401(K) accounts and 376,000 IRAs had more than $1 million in them. This number fell by 32 percent in 2022 as stock market turbulence sapped employee savings.

With a balance of more than $1 million, a Fidelity customer ranks in the top 1.64 percent of accounts. For IRA owners — who tend to be wealthier — a seven-figure balance puts them in the wealthiest 2.5 percent.

A stock market boom has boosted the number of savers with $1 million in their 401(K)s by 25 percent this year, according to figures from Fidelity Investments.

Certified financial planner Marissa Reale told DailyMail.com that a $1 million pot probably wouldn't provide most people with a comfortable retirement

Still, experts warn that this figure is not necessarily a good measure of a comfortable retirement. Assuming someone retires at age 65 and has a life expectancy of 90, this would only give them $40,000 a year to live on.

Certified financial planner Marissa Reale told DailyMail.com: '$40,000 a year is not going to be enough for most people to live on.

'I always advise my clients to also invest part of the money in shares. So it is not the case that you will receive the full amount in cash.

“If you really want the money to last, most people need more than a million dollars.”

But she points out that retirees also get a boost from Social Security benefits.

Social security benefits are expected to increase by 3.2 percent in 2024, in line with inflation. It means the average retired worker can expect to make $1,907 a month from January, up from $1,848.

To safeguard your pension fund, Reale is in favor of the '4 percent' rule. This means savers look at the lump sum of their pension pot and assume they will spend 4 percent of that total each year.

To figure out how much you need, she recommends households examine their living costs and calculate what they actually spend in a year.

From there, they can multiply it by the number of years they predict they will be in retirement, based on when they want to retire and their life expectancy.