How to get the best deal on your mortgage: Experts say now could actually be a GOOD time to secure a home loan, despite high interest rates

High home prices and mortgage rates may have many Americans wondering if now is the time to buy a home. But some mortgage experts suggest strategic buyers can still get good deals on home loans.

“The people buying now are actually pretty smart,” says Jeff Scott of First Option Mortgage in Atlanta, Georgia.

He claims that by looking for the right mortgage, increasing down payments and even encouraging the seller to pay for a temporary mortgage interest buyout, this can still be the right time to buy.

Although house prices are high, there are fears that mortgage rates will fall again, increasing demand and further driving up costs. On Friday, the average 30-year mortgage rate fell to 7.50 percent, according to government-backed lender Freddie Mac. That was the biggest drop since November last year.

“You can always refinance the interest rate, you can never refinance the purchase price,” Scott said. “There are thousands and thousands of people waiting for rates to drop and when they do it will be like 2022 again where you get multiple offers on every house.”

Highest mortgage rates in 20 years have meant potential buyers are now facing huge monthly mortgage payments and may be postponing their home purchase

Jeff Scott (pictured) of First Option Mortgage in Atlanta, Georgia, suggested home sellers and builders may want to close before the end of the year

He therefore urged buyers to focus on what they can get from sellers who are eager to sell, as that can make a big difference to a person’s monthly payments once they buy a house.

He gave the example of a $500,000 house. The buyer could make an offer of $475,000, or ask for other concessions.

“Most people want to dump their properties, especially builders, by the end of the year. And generally they are happy to contribute $15,000 to $20,000, in concessions – whatever it takes to get that property sold.”

Particularly useful types of concessions, according to Scott, are 2-1 or 3-2-1 buydowns. With a 2-1 buydown, the buyer receives a 2 percent discount on the loan interest in the first year and a 1 percent discount in the second year.

Because interest rates are expected to decline over time, market interest rates will have reached a more manageable level by the time the temporary buying campaign is over.

“You know, $475,000 versus $500,000 over 30 years is literally maybe $10 a month difference. It is nothing. But getting that money for closing costs is really the most effective thing.”

“The key to this, however, is that this money cannot come from the buyer; temporary interest buydowns must be paid by the seller or builder of the home,” Scott said.

That’s why he suggested that if buyers have extra cash, they should use it in the form of a higher down payment. The only other option is to purchase “mortgage points.”

Unlike temporary mortgage rate buybacks, which last a few years and are not purchased by the buyer, permanent discount points allow the buyer to spend money up front to permanently lower mortgage rates.

“I really don’t recommend anyone buy out mortgages with their own money just because we know interest rates are going to drop over the next twelve to eighteen months.” I think it’s a waste of money if someone puts their own money into it.’

Scott also said that a down payment of at least 20 percent is also important to guarantee lower mortgage costs.

‘That is usually the benchmark, because you don’t have to pay private mortgage insurance. So if you can get the 20 percent, you will definitely get a lower payment because you won’t have to incur any additional costs.”

Mortgage rates are widely expected to fall in the coming years, but if that happens, home prices could rise in response to increased demand.

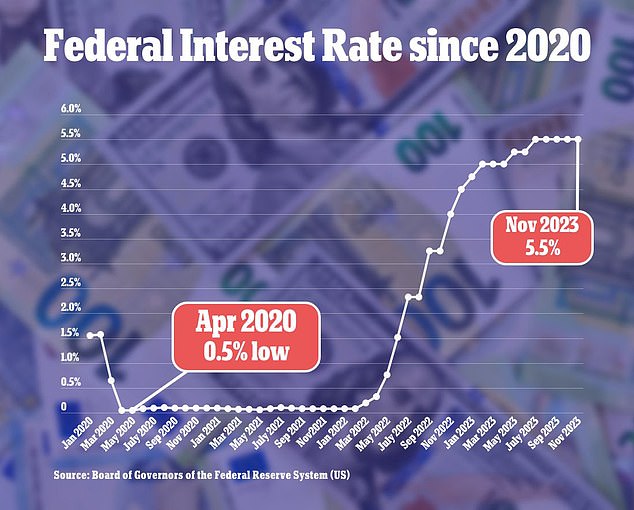

The Federal Reserve announced on November 1 that interest rates would remain at their current level of between 5.25 and 5.5 percent. Now that the Fed’s rate hikes are coming to an end, mortgage rates are widely expected to fall again

And given how quickly mortgage rates change, Scott says buyers will want to lock in rates for at least 30 days once they’re in contract.

“This year has been the most volatile market we have ever seen in the industry,” he said. “We say to people: as soon as you get a contract on a property, let’s lock it down straight away, because it’s changing so quickly.”

And while buyers should shop around and get some quotes to get a feel for the mortgage market, there may not be a huge variety. Scott recommended getting two or three quotes.

“Our industry, especially after 2008, is fairly well regulated,” he said, suggesting the variation in rates from different lenders would be minimal.

‘You will only see marginal differences. Most of the time it really comes down to the personal feeling of how you connect with someone. At the smaller companies, you can actually talk to your loan officer on Saturdays. Try calling someone at Wells Fargo on Saturday.”

The final issue Scott says buyers should pay attention to is their credit score. Although modern lenders have the technology to perform credit checks without damaging the rating, those with a rating of 620 or lower should consider increasing it before making a purchase.

“Certainly anything under 620, they really need to improve it,” Scott said. “Anything above that, and they can certainly buy a house and refinance it some time later.”