How the UK could take a slice of $489bn global space industry

>

The failure of Virgin Orbit’s first attempt to launch a UK-based satellite will not dampen Britain’s drive to become a leader in the global space industry, estimated to be worth $1 trillion by 2040 scare.

Nasdaq-listed Virgin Orbit shares crashed back to Earth after its launch in Cornwall on Jan. 9 dampened investor hopes, but the group vowed to try again soon as bosses joined the UK Space Agency (UKSA) and insisted it had been ‘an important step forward’. .

Virgin Orbit’s ambitions are indicative of the efforts and hundreds of millions of pounds spent each year by the private and public sectors to make Britain one of only nine countries capable of launching a satellite into orbit .

High hopes: Virgin Orbit’s LauncherOne rocket at Spaceport Cornwall

According to the latest government figures, £836 million was spent on space-related research and development in the 2019/20 financial year, up 19 per cent on the previous 12 months.

The government says increased contributions from UKSA accounted for ‘much of this’.

Meanwhile, the government has ‘invested more than £40 million to boost Britain’s spaceflight capabilities’ and is funding a range of industry-led projects, including Spaceport Cornwall.

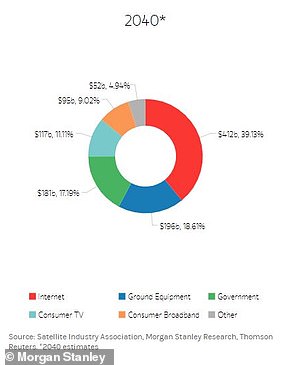

The increasing investment in the space economy should come as no surprise. The global space economy grew 9 percent in 2021 and is now valued at $489 billion (£400.3 billion), according to the US nonprofit Space Foundation.

And analysts expect this trajectory to continue for years to come, with Morgan Stanley estimating that the global space industry will be worth $1 trillion by 2040.

Virgin’s setback will not hold back the significant progress the UK space sector is making

Mark Boggett, Seraphim Space

Chief commercial and product officer at UK satellite telecoms group Inmarsat, Jat Brainch, said this type of investment enables the future use of technologies the world has yet to see.

The potential value unleashed could therefore be much greater than current estimates, she told This is Money, pointing to technology such as 3D printing and drones that would not be possible without investment in satellites.

“Most of the satellites we use predate the iPhone,” she added. “I think the numbers might be underestimating it.”

While Virgin Orbit’s botched launch was a disappointment, industry experts say the technological advancements made in the run-up have opened up other opportunities.

Morgan Stanley estimates that the global space economy will be worth $1 trillion by 2040

CEO of a London-listed investment fund Seraphim Spacewho invests in early stage ‘SpaceTech’ companies, Mark Boggett said: ‘Virgin’s setback will not hold back the significant progress the UK space sector is making.

‘The results achieved in the run-up to… [the Virgin launch] will further boost domestic and international investment, creating more opportunities for launch to become normal practice in Britain.”

“The UK Government is fully behind the industry and wants to be bold, including exciting future uses of space, especially in climate and sustainability applications.

“Rocket launch is just one part of a broad and comprehensive space strategy that will continue to position the UK as a global leader in a fast-growing market.”

Aerospace jobs are on the rise

UK ‘space-related’ organizations generated £16.5bn in revenue in the 2019/2020 financial year, with the industry directly employing around 50,000 people in the UK and supporting 190,000 jobs in the wider economy, according to government data.

It’s also an incredibly productive sector, with a gross value added per employee of £146,000 – 2.6 times the UK average of £57,000.

And in a time of slowing economic growth, that is good news. Employment in the UK aerospace industry is growing at about 7 percent each year.

In an effort to exploit the potential of this industry, the UK launched its space strategy in 2021 with amended rules to allow the Civil Aviation Authority to begin licensing spaceports.

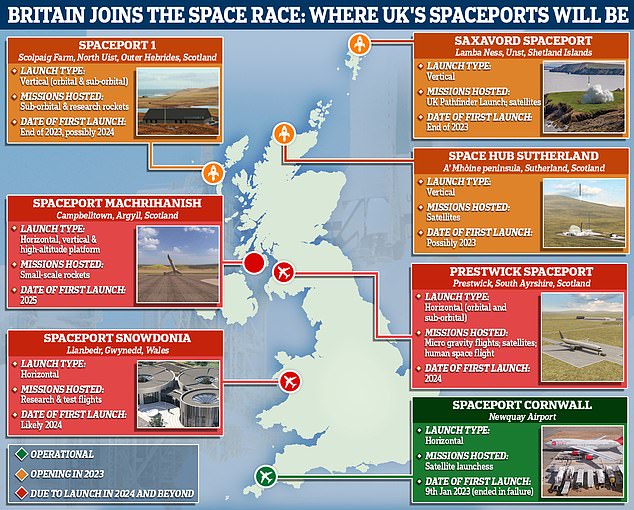

The Cornwall site is one of seven proposed spaceport sites in the UK, five of which are based in Scotland.

The Cornwall site is one of seven proposed spaceport sites in the UK, five of which are based in Scotland.

Director of spacecraft operations at UK-based satellite operator Avanti Communications Paul Collins explained that there are limited options for launch sites outside of the US, Russia and China, creating significant cost and logistical pressure for European operators.

He told This is Money: ‘For spacecraft manufactured in Europe, most of which are actually manufactured in the UK, they have to be shipped halfway around the world to be launched.

“So from a sustainability and cost point of view, it’s not ideal.

“The UK is trying to provide two or three different launch locations for different launch styles. Having these capabilities in Europe is a major advantage for all European operators and European manufacturers.”

Avanti chief financial officer Rob Plew added, “The cost of launching these payloads has historically been huge – paying the launch provider and also the insurance you need to cover the launch should anything go wrong.

“Relatively cheap launch capabilities could be a real game changer for expanding the aerospace industry.”

Lower entry costs also open up space for smaller players, Collins added, while also boosting the UK manufacturing sector.

He said: ‘The UK has always been a major global player in the space industry, especially from an operational and manufacturing perspective.

“The opportunity to have an end-to-end service from design to production and all the way to launch on UK soil suddenly becomes very interesting.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.