How pensioners are GUARANTEED to be £1,500 richer over the next five years thanks to the ‘triple lock’ (and it doesn’t matter who wins the general election…)

Retirees could be in line for a golden period of income increases thanks to the rising value of state, company and private pensions, analysis suggests.

According to the analysis for The Mail on Sunday of estimates in the Tory manifesto, there is more than €12 million available to boost state pension income worth at least £1,660 over the next five years.

Pensioners on the new state pension will receive at least an extra £32 per week in payments by 2029 – and possibly even more.

Next year, retirees are expected to see their state income rise by 3.7 percent, in line with forecast earnings growth

The increases are guaranteed regardless of whether a Labor or Conservative government is formed

next month.

The ‘triple lock’ promise ensures that the state pension will increase by the highest inflation, profit growth or 2.5 percent in 2029.

Both major parties have promised to respect the triple lock. As a result, the AOW will rise more than inflation every year over the next five years, according to analysis of the manifesto forecasts of pension group Aegon (see table below).

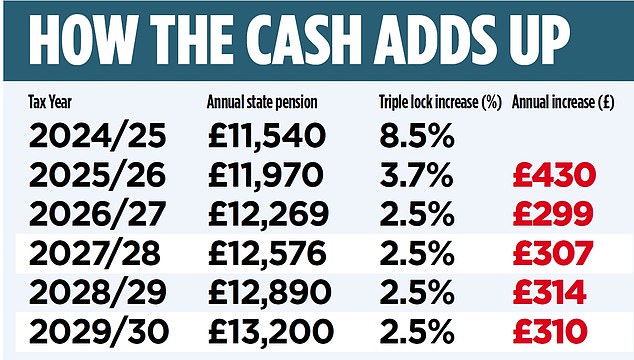

Next year, retirees are expected to see their state income rise by 3.7 percent, in line with forecast earnings growth. This would push the annual full state pension from the current £11,540 per year to £11,970 – an increase of £430.

In each of the next four years, the state pension will rise by at least 2.5 percent, analysis of Tory party forecasts shows. This means that both inflation and earnings growth are expected to be at or below the 2.5 percent threshold.

At first glance, the predicted increases appear less generous than the increases over the past five years. Our calculations show that the AOW will rise 40 percent less in the next five years than in the past five years.

Pensioners receiving the full new state pension have had a £2,772.80 increase in their annual income since the 2019/20 tax year. That is almost double the increase they will receive over the next five years, according to the Prime Minister’s manifesto.

However, in recent years the state pension has increased by the value of inflation or employee wages, while it is expected to increase by more than these amounts in the next five years.

Therefore, the purchasing power of retirees will increase as their incomes rise faster than employee wages and overall price increases.

Steven Cameron, pensions director at Aegon, said: ‘The triple lock will be very valuable in the coming years as inflation stabilizes, as retirees will outperform the working-age population.

While the predicted increases are well below the record increases of 10.1 percent and 8.7 percent in April 2023 and 2024 respectively, when inflation and profit growth skyrocketed due to exceptional circumstances.’

As the value of the state pension is expected to rise, private and corporate pensions are also expected to grow strongly. Pension funds have generally performed poorly in recent years – or worse, plummeted – as a result of major market turbulence. Those nearing retirement will be hit the hardest because they are more likely to invest more of their money in bonds, which fell dramatically in value as interest rates rose. In the worst cases, The Mail on Sunday has spoken to readers whose pensions have fallen by 30 per cent.

But the future looks much brighter for pension funds today, reassures Mike Ambery, director of pension savings at Standard Life, part of pension giant Phoenix Group. Savers will have already seen their pots grow faster over the past twelve months.

Those with a company pension who are far from retirement have made a 13 percent return on their fund in the past year, compared to an average loss of 9 percent in 2022. This is based on the average return of 25 of the largest defaults in the workplace in Great Britain. Defined contribution pensions, known as the Corporate Adviser Pensions Average. Most employees today are automatically enrolled in money purchase pensions and allocated a one-size-fits-all standard pension fund.

Those who are just five years away from retirement and who invest in less risky assets will have seen their pension pot grow by 8.53 percent last year, compared to a loss of 9.71 percent the year before.

Ambery says: ‘Don’t panic when it comes to investment returns as we expect higher growth in the coming years.’

While the future looks brighter for retiree incomes, we don’t know what lies ahead. And while the triple lock safeguards the value of the state pension, the prospects for private and workplace pension income are in the hands of the financial markets.

However, that doesn’t mean you have no control over it. Prospective and current retirees can check whether their savings are invested in funds that give them the best chance of income growth. Ambery suggests that one of the most important steps that people in their 50s and 60s can take to improve their chances of a good retirement income is to decide when they want to retire and communicate that to their pension plan.

This is because they could be automatically placed in a lower risk fund, which will generate smaller returns and therefore could miss out on more growth, Ambery adds. He says: ‘Being in the wrong fund could make a difference of more than £10,000 a year to someone with a private pension pot of £200,000, because of where the money is invested.’ Ian Cook, an accredited financial planner at asset manager Quilter, echoes this, warning that taking too little risk creates risk.

He says: ‘Many people in very low-risk pension funds have had to change their pension plans because they have lost a lot of money in recent years as bond prices fell.’

But it’s important not to have knee-jerk reactions, and those who stuck with that money could soon see their loyalty pay off.

‘There has been a lot of uncertainty around the investment markets as the interest rate path has been uncertain, but that is changing so we should see more normal market conditions.

“The Bank of England is expected to cut rates later this year and if that happens, bond prices will rise again,” he says.

When interest rates fall, bond prices tend to rise because the newly issued bonds are likely to have lower yields and investors who sell existing bonds with higher yields can do so at a higher price than newly issued bonds.

This means that the old or outstanding bonds of pension funds can become attractive.

What are your tips for a richer retirement? Email jessica.beard@mailonsunday.co.uk

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.