How much would a 2p National Insurance discount save you?

Chancellor Jeremy Hunt is expected to cut national insurance contributions by 2p in tomorrow’s spring budget.

It comes just months after another 2 percentage point cut to National Insurance (NI) came into effect in January, following an announcement in the Autumn Statement.

There had been some expectation that Hunt could cut income tax in what is expected to be the final budget before the general election.

We explain why the Chancellor has set his sights on cutting national insurance and what benefits this will bring to employees.

Chancellor Jeremy Hunt is widely expected to cut National Insurance by 2p in the Budget

Who benefits from cuts in national insurance?

National Insurance (NI) is a tax on earned income and is paid by employees and the self-employed.

The amount of NI contributions paid depends on how much you earn and your personal circumstances.

Currently, workers pay 10 per cent on income from £12,570 to £50,270, following a 2p cut on NICs that came into effect in January.

Hunt also made changes to the rates self-employed people paid.

From April 6, the headline rate for class 4 standalone NICs will be reduced from 9 to 8 percent and class 2 standalone NICs will be abolished entirely.

A reduction in NI will therefore mirror the effect of a reduction in income tax and increase take-home pay, but will have no impact whatsoever on those over state pension age who do not pay NI.

However, in the autumn statement the chancellor confirmed that pensioners will see their state pension rise by 8.5 per cent thanks to the triple lock.

Laura Suter, director of personal finance at AJ Bell, said: ‘This move will also help to quell some claims of inter-generational unfairness, as those on state pensions are likely to get another big increase through the triple-lock.

‘Given that Jeremy Hunt has already made cuts to National Insurance, he could also point to the overall tax savings for individuals from the combined cuts – which would make for a juicier headline to win over voters.’

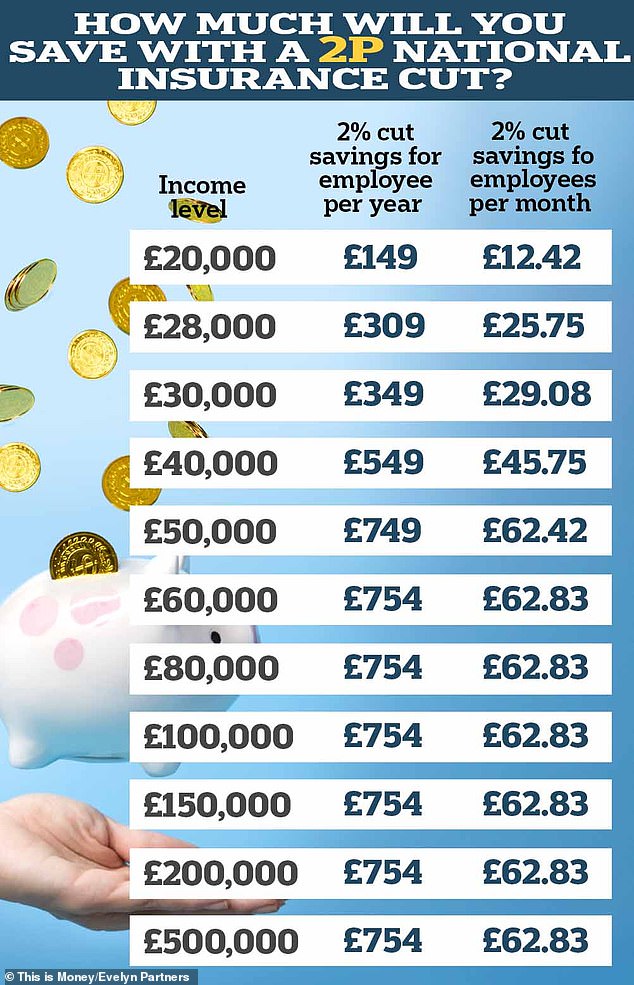

A 2p discount on National Insurance contributions will save an average worker £25 a month (figures from Evelyn Partners)

Why is Hunt going to cut back on national insurance?

Since the autumn statement, there have been many rumors about tax cuts.

Millions of workers have been hit by rising taxes, which have risen to the highest level since records began 70 years ago, according to the Institute for Fiscal Studies.

However, lowering taxes can be pricey. Although Conservative backbenchers have called for a cut in income tax, it is estimated that it will cost the Treasury £13.7 billion to deliver a 2p cut.

The cost of cutting national insurance by 2p is, by comparison, around £10 billion a year.

The Times reported that Hunt and Rishi Sunak had decided not to cut income tax after the Office for Budget Responsibility reduced the amount of budgetary space available for tax cuts.

There were also concerns that an income tax cut could be inflationary, and the last reading still had the CPI higher than the Bank of England’s 2 percent target.

How a 2-cent tax cut will impact your take-home pay

A further cut in the NI will be welcomed by workers, who will see another small increase in their monthly take-home pay, following the 2p cut that took place in January.

A 2p cut would equate to £149 a year – or £12.42 a month – for someone earning £20,000, according to figures from Evelyn Partners.

While someone earning £30,000 would have £309 more per year, or £29.08 per month.

Those earning £40,000 will be £549 better off, while higher and additional rate taxpayers will save £754 a year.

The average worker earning £28,000 a year would receive £309 – or £25.75 a month.

This, combined with the 2p cut introduced in January, could mean a big tax cut for workers but will not benefit those paying income tax but not the NIC.

The decision to keep tax thresholds frozen at their current levels means that many taxpayers will not see much benefit in their take-home pay.

Increasing the current thresholds with inflation would actually have a greater impact on take-home pay for some taxpayers than NI and income tax.

Keeping the thresholds in line with the CPI value of 6.7 per cent in September would see the personal allowance increase from £12,570 to £13,412 and the tax threshold for the higher rate increasing from £50,270 to £53,638.

Anyone earning above this revised higher rates threshold would be £842 a year better off, according to AJ Bell’s analysis, while taxpayers would save £168 a year.

An income tax cut would better benefit basic rate taxpayers, says AJ Bell. A 1p cut would mean a saving of £224 for someone earning £35,000 a year, while a 2p cut would reduce their tax bill by almost £450 a year.

A cut to 18 per cent for higher earners would save them £754, while changes to the threshold would increase their take-home pay by £842.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.