‘How could I be so stupid?’ FBI reveals how crafty Mexican cartels scam millions from US timeshare owners

When James, 76, got a call from a real estate agent in Atlanta, Georgia, who wanted to buy his timeshare, he couldn’t have been happier.

James and his wife Nicki, 72, had purchased the Lake Tahoe, California, property in the mid-1990s for just $9,000, but had only stayed there twice in the past two decades.

The agent made a smooth pitch and called back a few days later with “good news”: He had found a Mexican investor willing to part with more than $22,000 for the west coast retreat.

James and his wife Nicki wanted to leave their timeshare in Lake Tahoe

About six months later, James and Nicki lost nearly $1 million as part of a bizarre but sophisticated scam allegedly linked to a deadly Mexican cartel.

James told DailyMail.com about that first call, reportedly from a man named Michael from Worry Free Vacations in Atlanta in October 2022.

“He was good at ingratiating himself,” James said. “He exuded confidence. I thought, ‘This guy is legit.'”

In retrospect, he may have had a slight accent, possibly Mexican, James recalls, but it was hardly noticeable at the time.

Michael had wealthy clients who wanted to invest in American timeshares and James had four, one in Lake Tahoe, that he was eager to sell.

A few days after James heard about the Mexican investor, Michael called back. He had “come across something.”

The cross-border transaction required a $2,600 fee, which the buyer had promised to pay.

James, who did not want to give his last name, admitted that his wife had reservations about the deal from the start.

But he was reassured when Michael told him the buyer would send the money to US Commercial Escrow Corps, an escrow company with a registered address in Manhattan.

James was given details of the account and when he checked it, the $2,600 refund appeared to have been paid.

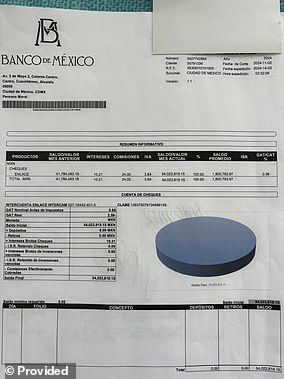

The scammers use fake bank statements that look authentic

He even made contact with a representative from the escrow company, who spoke with an American accent.

Convinced of its legitimacy, he transferred the $2,600 to a bank account in Mexico, as requested.

But then the deal hit another snag. Another cross-border registration fee would cost another $3,600, but the buyer would again reimburse James for his trouble.

He checked the escrow account and, as before, this payment appeared to have been made.

“I felt good,” James said. “I thought, ‘I’m getting paid for this, everything’s going to be OK.'”

About a week later Michael called again. And so it went on.

The total quickly reached the $50,000 mark, after which he was contacted by a man claiming to be a member of the UIF, Mexico’s financial intelligence unit.

He demanded increased compensation for various offenses James had allegedly committed, threatening extradition if he did not comply.

Meanwhile, his costs were apparently reimbursed by the mysterious Mexican investor, who clearly knew no limits to his wealth.

The money always appeared in the New York escrow account, but no funds were ever released.

The scammers even convinced James to invest $32,000 in a sustainable housing investment in Mexico.

He received papers confirming the transaction that appeared to come from the Bank of Mexico, with detailed addresses and letterheads.

In total, James had to make a dozen payments for various reasons.

He made his last payment in January, with the total amount rising to a whopping $890,000, spread across various bank accounts in Mexico.

Just under a third of this related to his timeshare, with the remainder being costs for the sustainable housing investment.

The armed Jalisco New Generation cartel is best known for its drugs, but has also defrauded American timeshare owners of millions of dollars in recent years

To finance these payments, James had to borrow $150,000 from his daughter and sell his family home.

By the time he discovered some disturbing details, it was already too late.

James discovered that the Atlanta real estate agency’s website had been registered in 2021, but was taken down just days after his initial call from Michael.

The email address he had for a man claiming to be from the Bank of Mexico, and the domain names of other “Mexican” companies involved in the fraud, turned out to be registered in Arizona and, inexplicably, Reykjavik.

“None of them had addresses or locations in Mexico,” James said.

When DailyMail.com visited the US Commercial Escrow Corps address in downtown Manhattan, it found that the suite number it had provided did not exist and that no one in the building had heard of the company.

For James, the scam cost him his entire savings – and his wife’s respect.

“It was very elaborate,” he said. “That’s why I got sucked into it. I just thought there were too many players involved to call it a scam.

‘My wife said from the beginning that it didn’t sound right. Of course I should have listened to her.

“She’s totally pissed off about it. But she’s more or less resigned herself to the fact that I was the stupid one.’