How Carter saved the economy – but not his presidency: ALEX BRUMMER recalls the events of 1979

On a warm Saturday in 1979, while I was mowing the lawn at my parents’ home in Washington, my wife Tricia called me on the landline.

The familiar Irish-tinged, booming voice of Joe Coyne, then spokesman for the Federal Reserve, the US central bank, was on the phone.

“Alex, can you come to the Fed at four in the afternoon? I might have something for you,” he said gruffly.

The phone call was a shock. For months, as the Guardian’s US correspondent focusing on the economy, I had routinely called the Fed to ask what it planned to do about the falling dollar in the currency markets. The answer was always the same: ‘We never talk about the exchange rate.’

But following a strategy I developed in London during the 1976 pound crisis, when I called the British Treasury and the Bank of England every day hoping for wisdom on the collapsing pound, it was natural to call the Fed to call.

The Carter administration’s handling of the oil crisis and high inflation in the 1970s following the Yom Kippur War was disastrous.

Passionate: Jimmy Carter, who died on December 29 at the age of 100, is widely praised as America’s most distinguished later president

Carter blamed a “malaise” over energy consumption among the American people. Maybe he had a point.

But the consequences were alarming. Inflation rose to 7.6 percent in 1978 and 11.3 percent in 1979.

The dollar fell 40 percent against the Japanese yen, 35 percent against the Swiss franc and 13 percent against the Deutsche Mark. The rate fell by 19 percent against a basket of currencies in nine months.

Desperate measures were needed. The US Treasury arranged $22 billion in swap lines with leading central banks.

It started with a series of gold auctions, selling 750,000 ounces of his stock at Fort Knox.

And like Britain in 1976, the country even borrowed from the International Monetary Fund (IMF), drawing on US assets worth $3 billion.

It was the low point of Jimmy Carter’s stewardship of the economy. Confidence at home and abroad had been damaged and only dramatic action would suffice.

Challenging the Federal Reserve’s traditional independence, Carter decided to remove its struggling chairman, former industrialist and Democrat fundraiser and loyalist, G. William Miller.

In his place was dropped Paul Volcker, an experienced figure who, as deputy secretary of the Treasury in 1976, played a crucial role in working with the IMF to rescue the pound three years earlier.

He was considered someone who could be trusted to solve a financial mess.

The dramatic events of that summer come vividly to mind as America today buries Jimmy Carter at a state funeral.

The 39th president is widely praised as America’s preeminent “post-president.” He continued his campaigns for human rights and democracy around the world and better housing in the US, almost until his death at the age of 100.

I remember interviewing him in 1989 at his Carter Center for Peace, based in Atlanta, as my decade in the US ended.

He was as passionate as ever about building on the Camp David Accords between Israel and Egypt, which he brokered as president.

Yet it is extremely difficult to reconcile Carter’s passion for peace and eradicating disease among Africa’s poor with the failed presidency that imploded.

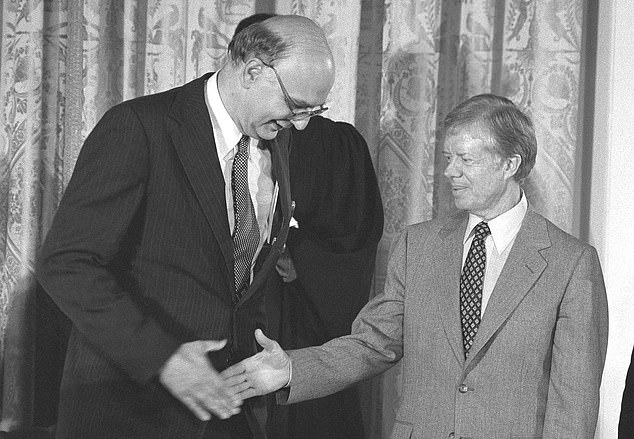

Lasting legacy: Carter (right) with Paul Volcker (left), who was parachuted in as chairman of the Federal Reserve

In 1979, that call from Joe Coyne to the Federal Reserve, when I, a Swiss correspondent and another writer were the only foreign journalists present, was a real moment in history.

It was a turning point for economic policy and, as it happened, for American politics.

Volcker, tall and slightly stooped, with a stentorian voice, sat at the end of the long mahogany table where members of the Fed’s rate-setting open markets committee traditionally deliberated.

To end Carter’s suffering that afternoon, the unelected Volcker reformed the US approach to eliminate the inflation bogey and restore the dollar’s credibility.

Traditional democratic wage and price policies, which had failed in the Britain of James Callaghan and Denis Healey, disappeared and in came an early version from Chicago School of Monetarism guru Milton Friedman.

Volcker began raising official interest rates, first to 11 percent and then to 20 percent by the end of the year.

He decided to target the money circulating in the economy – and impose a surcharge on credit card transactions in an economy where people were living beyond their means.

This amounted to hitting the brakes.

The ‘Volcker moment’ proved seismic for the American economy, Jimmy Carter’s presidency and American politics.

On the eve of the 1980 White House campaign, it sealed Carter’s fate.

The surcharge and rising interest rates saved the dollar and defeated inflation.

They also marked a deep recession, which did not fully end until 1982, paving the way for the arrival of Ronald Reagan, whose rhetoric ensured a Republican landslide.

Carter’s implosion taught Democrats a lesson that was smartly embraced

Bill Clinton in 1992, after twelve years of Republican rule, his simple slogan ‘the economy stupid’ would become the inspiration for all future sitting presidents of the White House.

- Alex Brummer, city editor of the Ny Breaking, was The Guardian’s Washington correspondent from 1979 to 1989

DIY INVESTMENT PLATFORMS

A. J. Bell

A. J. Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund trading and investment ideas

interactive investor

interactive investor

Invest for a fixed amount from € 4.99 per month

Sax

Sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals have been chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.