Houses are 8% overpriced – but prices will be ‘fair’ by the end of this year, says Zoopla

- Homes ‘overvalued’ compared to what people earn and typical mortgage rates

- Prices will rise by 1.5% this year, but wages will rise to match this, says Zoopla

- A North-South divide is emerging in house price growth

According to Zoopla, house prices are 8% too high for what people earn, and they are set to rise even further by the end of the year.

The property website said the typical cost of a home remained the same over the 12 months to May 2024.

It said that prices were now rising in some areas and that this rate was expected to rise by 1.5 per cent for the whole of 2024. That would equate to an increase of £3,900.

According to the figures, the average house now sells for £264,900.

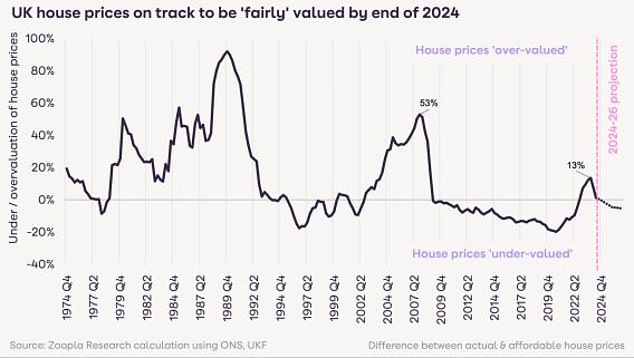

Overpriced: Zoopla says the average home is overvalued by 8% today, but predicts rising incomes will see prices become ‘fair’ by the end of 2024

But despite the slow growth, the average home was still ‘overvalued’ by 8 per cent in the first three months of this year, according to Zoopla.

This is based on its calculations, which measure the extent to which actual house prices are higher or lower than an ‘affordable house price’ – based on household incomes and mortgage costs.

By the end of 2023, house prices were 13 percent too expensive, largely due to a rise in mortgage rates, according to the report. They were as high as 53 percent just before the financial crisis in 2008.

Zoopla predicts that while prices will rise this year, the average home will no longer be overvalued by the end of 2024.

> What are the consequences for the mortgage interest rate in 2024 and how long should you fix your mortgage?

Down or up? This shows the value of property over time in the context of incomes and mortgages

That’s because people’s incomes are expected to rise to cover the additional costs.

It is assumed that house prices will rise by 1.5 percent, and that the lowest mortgage interest rate will remain at or below the current level of approximately 4.5 percent.

Several lenders have lowered their mortgage rates this week, in a sign of hope for the market.

Richard Donnell, managing director of Zoopla, said: ‘The housing market continues to adjust to higher borrowing costs due to modest falls in house prices and rising incomes.

‘Buyers who take out a mortgage also trust that their mortgage has a longer term. This way they can gain that few extra percentage points of purchasing power to buy a house.

‘Agreed sales continued to rise and more homes for sale means more buyers will be looking to move in the second half of the year.’

If the Bank of England decides to cut the base rate in August or September, as is currently forecast, Zoopla says this could ‘provide a boost to market sentiment and sales activity’, but ‘the impact on fixed rate mortgages is likely to be more muted.’

There are currently around a fifth more homes for sale than there were a year ago, but ‘there are signs that market activity is waning as the quieter summer period approaches.’

Buyers are largely undeterred by the election and agreed sales are up 8 per cent on a year ago, Zoopla added.

North-South distribution in house prices

Zoopla data shows that house prices in the South and East of England have fallen over the past year as they come back into line with people’s incomes.

In the east of England, average prices fell by 1.4 percent in the year to May, the biggest fall of any region.

It was followed by the South East (excluding London) with 1 percent and the South West with 0.9 percent.

Looking up: House prices have risen in the northern regions over the past year

In contrast, prices in Northern Ireland rose by 3.3 percent in the same twelve-month period. The North West saw the biggest growth in England at 1.5 percent and the North East saw a price increase of 1.4 percent.

Of the 20 major cities that Zoopla monitors, Belfast saw the biggest price increase, with average house prices up 3.4 per cent to £173,900. Bournemouth saw the biggest fall, down 1.5 per cent to £331,700.

However, Zoopla said prices had risen in all regions in the three months to the end of May.

Tale of 20 Cities: Zoopla monitors prices in each of these areas every month

SAVE MONEY, EARN MONEY

Savings offers

Savings promotions

Top rates plus £50 bonus until July 15th

Cash Isa at 5.17%

Cash Isa at 5.17%

Including 0.88% bonus for one year

Free stock offer

Free stock offer

No account fees and free stock trading

5.78% savings

5.78% savings

Account with 365 days notice period

Fiber optic broadband

Fiber optic broadband

£50 BT Rewards Card – £30.99 for 24 months

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editors because we believe they are worth highlighting. This does not affect our editorial independence.