House prices set to rise by £84,000 from now to 2029, with the North driving the boom as Savills boosts forecasts

According to the latest house price predictions from Savills, a typical house will increase in value by £84,000 between now and 2029.

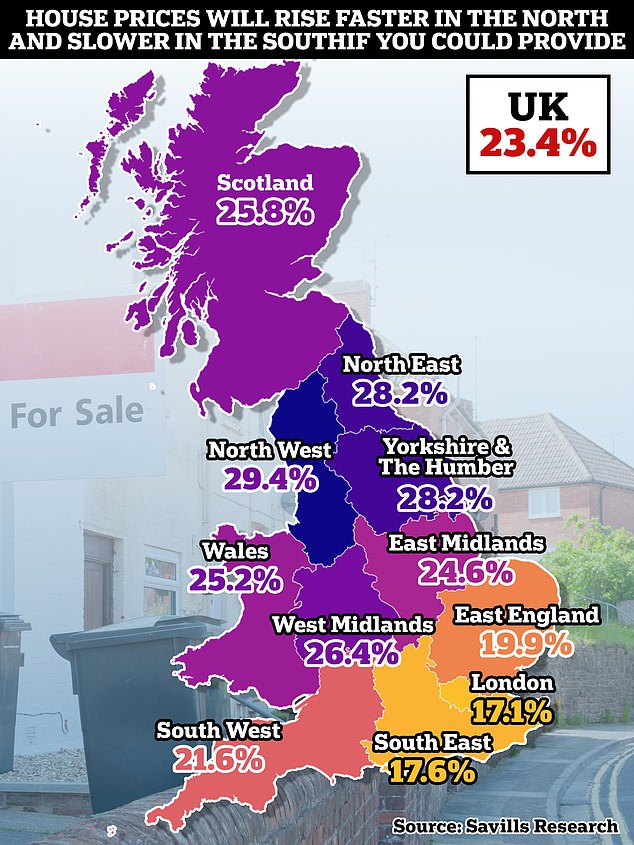

The real estate company now predicts that the average home value will increase by 4 percent in 2025, and then by 23.4 percent in early 2029.

Earlier this year, Savills predicted that house prices will rise 3.5 percent by the end of 2025 and 21.6 percent over the next five years.

Savills’ upgrade comes in light of the return of inflation to the 2 percent target and the prospect of interest rates continuing to fall over the next two years, based on forecasts by Oxford Economics.

They have taken a similar position to Santander in predicting that interest rates will fall to 3.75 percent by the end of next year.

While Santander expects interest rates to remain between 3 and 4 percent for the foreseeable future, Oxford Economics predicts they will fall to a low of 2 percent by 2027.

Forecast: Savills expects house prices to rise by 4% in 2025 (average £14,500), and by 23.4% in the five years to 2029

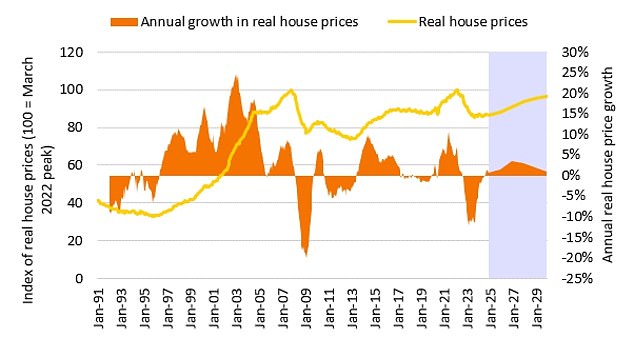

After two years in which the rate of inflation has largely exceeded the rate of house price growth, Savills now expects the opposite to happen.

With inflation back on target, Savills forecasts a return to real house price growth (after inflation) of 11 percent over the next five years – in contrast to the 10.5 percent decline in real growth since August 2022.

This, the report says, will bring inflation-adjusted prices back to pre-mini-Budget levels.

“With less external noise, house prices over the medium term will be dictated by the fundamentals of supply, demand and affordability,” says Lucian Cook, head of residential research at Savills.

“The direction of mortgage rates has been critical to buyer decisions over the past two years, and lower monthly mortgage costs are now driving greater confidence among potential buyers, fueling the moderate home price growth we have seen in recent have seen for months.

‘A steady improvement in affordability should ensure that house price growth gains momentum in the coming years. But there’s still a chance for a bumpy ride.

“The market will remain sensitive to short-term fluctuations in the cost of debt and changes in property taxes could cause some near-term disruption.”

However, house prices behave differently from area to area. The housing market is not one market, but thousands of micro markets that all behave differently.

Regional performance is largely influenced by where we are in the housing market cycle.

According to Savills, the housing market has been in the second half of the cycle since 2017.

This is where the more affordable regions of the North and Scotland are outperforming the UK average, while growth in London and the South is more limited.

However, the pandemic brought about behavioral changes that somewhat disrupted cyclical trends.

“Lower levels of working from home and the need to return to commuter hotspots near major employment hubs have delivered slightly stronger-than-expected performance in London over the past 12 months,” said Emily Williams, research director at Savills.

‘We expect there will be some residual impact from the end of the ‘race for space’ in 2025, which will see growth in the south-west and east below that of the capital.

‘But after 2025, affordability will have the greatest impact in every region.

‘Despite falling mortgage rates, buyers in London and the South East will still need to borrow more relative to their income and pay a larger deposit to buy, limiting house price growth.’

Savills expects that the more affordable markets in the North, where buyers are under less pressure with mortgage loans, will see the strongest growth in house prices.

Verona Frankish, managing director of online estate agent Yopa, said: ‘Affordability remains a burning issue for many homebuyers. Although the outlook is positive due to the predicted interest rate cuts, regions where property values have already risen too high are likely to see a more measured property market performance in the coming years.

‘In contrast, regions such as the North East are likely to see continued growth due to the more affordable costs of climbing the ladder, but we expect a greater share of activity to come from second and third run steppers rather than first time buyers .’

Market activity is recovering

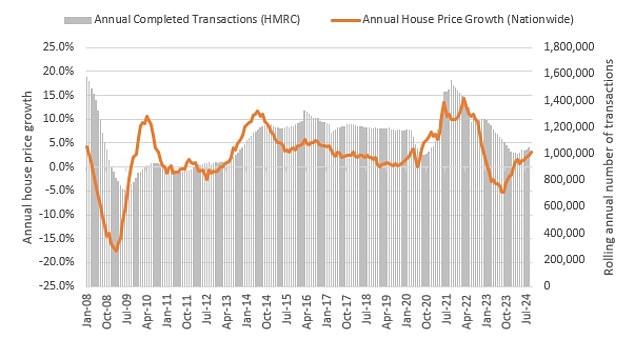

The real estate market has seen fewer transactions in the past two years due to higher mortgage interest rates.

This has had the biggest impact on movers, who are typically the most exposed to mortgage debt.

According to Savills, transactions with movers fell below 2008/2009 levels between April and June this year, the aftermath of the financial crisis.

Overall, transaction numbers are expected to remain slightly below the pre-pandemic average over the next five years, peaking at 1,150,000 in 2028.

However, according to Savills’ Emily Williams, the recovery will not be uniform.

“Looking ahead, we can expect that some home movers will continue to hold off on moving until rates are stable in 2027, when they will also have taken advantage of several years of house price growth to build equity,” Williams said.

‘As such, there is potential for a sharp increase in activity among second and third movers in the second half of our forecast period as pent-up demand from the period of high interest rates is released.

‘However, it is expected that the number of first-time buyers active in the market will remain below pre-pandemic levels due to the lack of any government support to replace Help to Buy.

‘While increased regulation in the rental sector, combined with the recently increased allowance for second homes, will further dampen demand from both cash and mortgage investors for buy-to-let.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.