House prices set to rise 2% this year as housing market picks up, says Zoopla

According to Zoopla, the housing market is heating up, with more homes being sold and buyers having to pay more than the asking price.

According to the property website, house prices rose across all regions of the UK in the first six months of 2024 and are on track to end the year with a 2 percent increase compared to January.

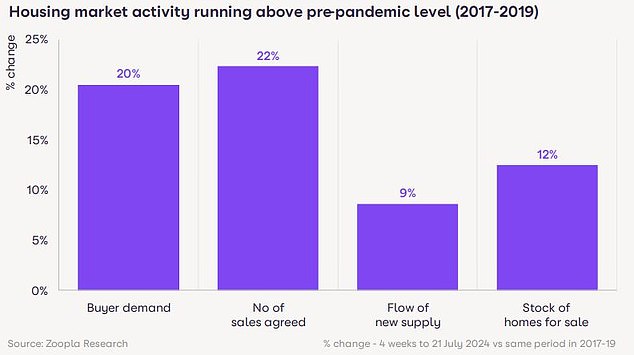

According to Zoopla, the improved outlook for the market is being reinforced by more homes coming onto the market.

On the rise: House prices have been broadly flat over the past 12 months, but prices are set to rise across all regions and in the UK in the first half of 2024

According to the report, the average real estate agent has 33 homes for sale, more than at any point in the past six years.

Rather than leaving homes unattended on the market and causing prices to fall, Zoopla believes the increased choice for buyers actually means more homes are sold.

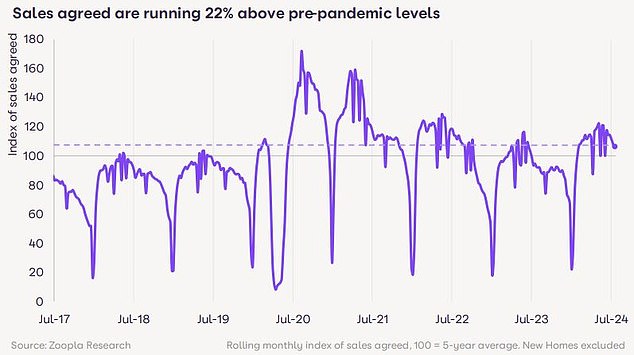

The number of agreed sales is up 16 percent from a year ago, with sales across all regions. It says agreed sales are now 22 percent above pre-pandemic levels.

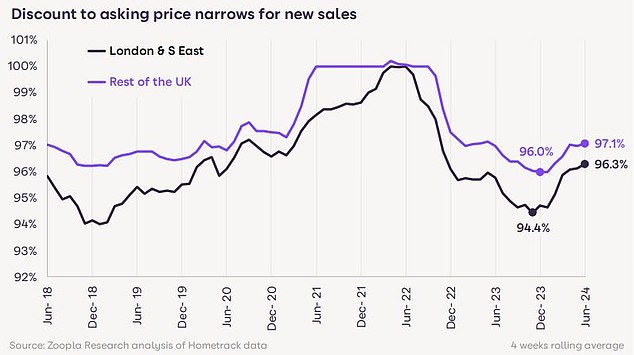

Buyers are also paying a larger share of the asking price than last year, when demand fell due to higher mortgage rates.

According to Zoopla, buyers are currently paying 96.8 per cent of the asking price, the highest amount in 18 months.

In real terms, this equates to houses selling for an average of £16,600 below asking price.

In October last year, buyers paid £23,000 below the asking price.

More sales: A greater supply of homes for sale and more buyers have resulted in the number of closed sales being 16% higher than a year ago

According to Zoopla, homebuyers will benefit in the longer term from economic growth, rising household incomes and increased house building.

According to the report, average incomes will rise by 4.5 percent this year, and incomes are expected to rise faster than house prices in 2025.

Richard Donnell, director of Zoopla, said: ‘The housing market is starting to warm up again after a freezing 2023.

‘There are clear signs of growing confidence among buyers and sellers, with many more homes for sale and buyers paying a greater share of the asking price.

‘The housing market is essentially an extension of the UK economy. Government policies that focus on economic growth that contributes to income growth will help both homebuyers and renters.’

Buyers are paying a larger share of the asking price than last year, when higher mortgage rates hit demand

Interest rate cut would boost housing market

It is likely that lower mortgage rates will encourage buyers and homebuyers to act on their plans this year.

Last week, the lowest five-year fixed mortgage rate fell below 4 percent for the first time since February.

The average five-year fixed-rate mortgage across the market is currently 5.4 per cent, according to Moneyfacts. This time last year, the average was 6.35 per cent.

According to Zoopla, the first cut in the base rate will boost consumer confidence and market activity.

The Bank of England will make its next decision on the base rate on Thursday. Market forecasts are currently divided on whether the first cut will take place this week or in September.

Warming up: More sellers are continuing to list homes for sale. More sales are being negotiated and buyers are paying a larger share of the asking price as confidence increases

The number of approved mortgages for home purchases, an indicator of future borrowing, remained broadly stable at 60,000 in June, slightly below the pre-pandemic average, according to the latest figures from the Bank of England.

Anthony Codling, head of European housing and building materials at investment bank RBC Capital Markets, sees this as a sign that the housing market is relatively cool, rather than a sign that it is warming up.

“We believe the UK housing market is sitting still and waiting for the first rate cut,” Codling said.

‘There is a small chance of a cut on Thursday, but we think the first cut will likely happen in September.

‘Once mortgage rates start to fall, we expect housing market activity to pick up.’

Unchanged: The Bank of England has kept the base rate at 5.25% since August 2023

Simon Gerrard, director of estate agents Martyn Gerrard, is optimistic about the impact of the first rate cut. However, he believes there are several factors that point to house prices rising again soon.

“Inflation has held steady at the Bank of England’s target of 2 percent, so there is a good chance that the base rate will fall in August or September, kick-starting house hunting that has been on hold until now,” Gerrard said.

‘From a broader perspective, it is also a great relief that the government is prioritizing the construction of new homes.’

House price forecasts for 2024

At the start of the year, most forecasts indicated that house prices would fall through 2024.

Zoopla itself predicted a 2 percent fall at the beginning of the year. It now expects house prices to end 2 percent higher.

Halifax expected house prices to fall by 2 to 4 percent. Knight Frank predicted a fall of 4 percent and Savills predicted an average fall of 3 percent.

Nearly eight months later, Knight Frank expects house prices to rise by 3 percent this year.

Tom Bill, head of UK housing research at Knight Frank, says the current forecast is likely to come true unless Rachel Reeves comes up with nasty tax rises in her autumn statement.

‘Demand and transaction volume are expected to increase in the second half of the year as the first rate cut since March 2020 is imminent.

‘As more and more mortgages fall below the psychological threshold of 4 percent, we expect house prices to rise by 3 percent in 2024.

‘One risk on the horizon is the possibility of tax rises in Labour’s first budget, which could dampen demand, particularly at the higher end of the price spectrum.

‘The other is the Tenants Reform Act, which could lead to greater supply on the housing market if the new rules are punishable for landlords.’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.