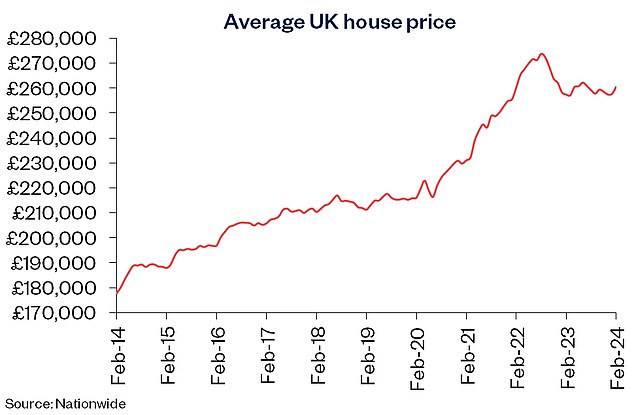

House prices rose in February, Nationwide says, with annual growth rising for the first time in 13 months

According to the latest Nationwide house price index, property prices rose in February as a result of lower mortgage interest rates.

Britain’s largest housing association recorded a 0.7 percent increase in the average house price, taking seasonality into account.

It means house prices have risen 1.2 per cent since this time last year, the first time Nationwide has recorded a positive annual value since January 2023.

But prices are still about 3 percent below all-time highs in summer 2022.

Annual increase: Nationally, house prices recorded an annual increase for the first time in 13 months

According to Nationwide, average house prices peaked at £273,751 in August 2022. They currently stand at £260,420 as of February.

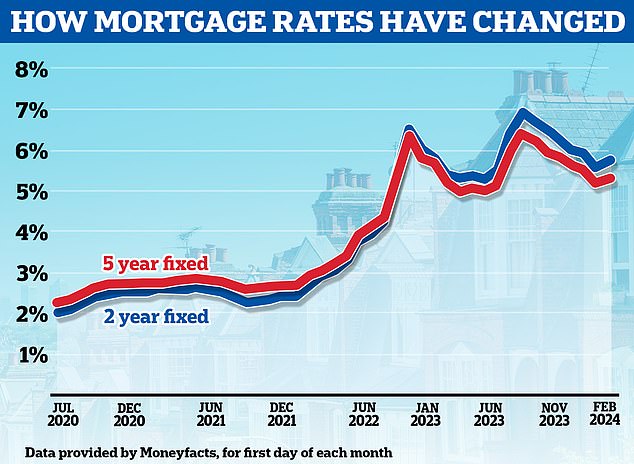

The recent increase in prices is attributed to lower mortgage rates. Although interest rates rose last month, this came after five consecutive months in which mortgage rates fell.

The average two-year fix has fallen from a high of 6.86 percent to 5.75 percent, while the average five-year fix has fallen from a high of 6.37 percent to 5.33 percent, according to Moneyfacts.

For homebuyers with the largest deposits, it is now possible to secure a five-year fix of 4.09 percent and a two-year fix of 4.39 percent.

Robert Gardner, chief economist at Nationwide, said: ‘The fall in borrowing costs at the turn of the year appears to have led to a revival in the housing market.

‘Indeed, industry data sources indicate a noticeable increase in mortgage applications at the start of the year, with surveyors also reporting a rise in new buyer applications.’

More affordable? Mortgage rates have fallen from summer 2023 highs

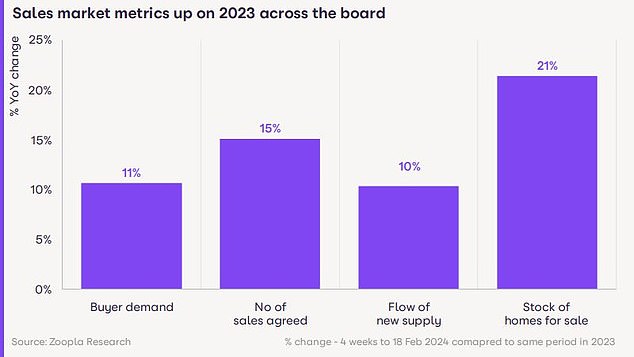

Yesterday, Zoopla’s house price index reported a rise in the number of buyers and sellers on the market, resulting in more sales in early 2024.

Many in the property sector have welcomed Nationwide’s figures as evidence that the property market is recovering.

Nicky Stevenson, managing director of national property broker group Fine & Country, said: ‘Positive signs for the property market are turning from a trickle to a flood this year, with the annual house price change increasing for the first time in thirteen months.

‘Demand is increasing as lower mortgage rates have encouraged buyers to resume their property search, and falling inflation suggests better news is on the way.

“We are entering one of the best home selling seasons, and sellers should view this as a great time to get their home on the market.”

Heat up? Zoopla reported that buyer demand is 11% higher than a year ago, while the number of agreed sales is up 15% year-on-year

Jonathan Hopper, chief executive of Garrington Property Finders, added: ‘It’s a setback, not a blip. Nationwide’s data shows that house prices have risen in four of the past five months, and the upward momentum is now so strong that prices have risen this time last year.

‘It is crucial that the market has also started to flow more freely. For sale signs are starting to pop up across the country, and real estate agents are reporting a steady increase in interest from both buyers and sellers.

“More and more buyers who sat on their hands last year are deciding that now is the time to strike before prices start to rise.”

Rising: But Nationwide says house prices remain about 3% below all-time highs in summer 2022

Further increases ‘will depend on mortgage interest rates’

Nationwide’s chief economist had a word of caution about future interest rates.

‘The near-term outlook remains highly uncertain, partly due to continued uncertainty about the future path of interest rates.

“Borrowing costs remain well below last summer’s highs, but if the recent upward trend continues, it threatens to limit the pace of a housing market recovery.”

Although house price indices show the general trend across the country, the picture varies depending on where you live in Britain.

Nationwide’s house price index reflects its own approved mortgage applications and therefore does not include cash buyers or mortgage data from other lenders.

Another lender that also tracks house prices based on its own mortgage applications is Halifax. According to the report, average prices rose by 2.5 percent in the 12 months to January.

The ONS house price figures are widely regarded as the most comprehensive and accurate index. This is because the report from Britain’s official statisticians uses land registry data and is based on average sales prices.

However, property transactions often take months, meaning the ONS figures do not necessarily reflect what is currently happening in the housing market.

Earlier this month, the ONS revealed that the average UK house price fell by 1.4 per cent in the year to December 2023.

Another monthly index comes from Rightmove. As a result, newly quoted asking prices are tracked every month, which can provide a more direct picture of what is happening in the market, but does not measure what houses ultimately sell for.

Rightmove reported that average asking prices rose 0.9 percent in February to £362,839, according to the company’s latest data, following a 1.3 percent increase in January.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.