House prices have risen by £12,000 in 2024 – and are expected to continue rising in 2025

According to Nationwide Building Society, a typical house increased in value by around £12,000 last year.

According to the report, the average house price increased by 4.7 percent over the course of 2024, from £257,443 to £269,426.

However, Nationwide says prices remain just below all-time highs recorded in the summer of 2022, before mortgage rates peaked.

Prices have risen consecutively over the past four months. In December there was a monthly increase of 0.7 percent, taking into account seasonal effects, after an increase of 1.2 percent in November.

The recent price spike is linked to buyers trying to avoid the stamp duty changes that come into effect from April 1 this year.

Recovering: House prices ended 2024 on strong footing, up 4.7% compared to December 2023, although prices were still just below the all-time highs recorded in summer 2022

These changes will increase purchasing costs for both first-time buyers and movers.

The price at which stamp duty is charged will return to £300,000 for first-time buyers, from the current level of £425,000.

For startersthis would mean that instead of paying no stamp duty on a purchase worth £425,000, they will pay £6,205.

Home movers currently pay stamp duty if their home costs more than £250,000, but from April 1 this will drop to £125,000 – the level it was before temporary changes were made to the 2022 mini-budget.

Nicky Stevenson, managing director of national property broker group Fine & Country, said: ‘December continued to defy expectations, with house prices continuing to rise despite the usual seasonal slowdown.

‘This reflects strong demand as buyers moved quickly to secure deals ahead of the April 2025 stamp duty threshold changes, driving both monthly and annual growth.’

Where will house prices rise the most in 2024?

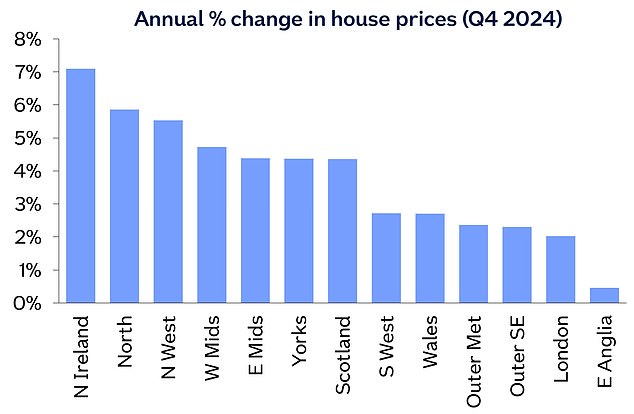

The northern regions still show higher price growth than the southern regions.

Northern Ireland is the best performing area for the second year in a row, according to Nationwide, with prices rising by 7.1 percent in 2024.

The north of England was the best performing English region, with prices rising 5.9 percent year-on-year.

Meanwhile, East Anglia was the weakest performing region, with prices rising just 0.5 percent over the past year.

North-south divide: The northern regions have seen higher price growth than the southern regions

Will house prices rise in 2025?

Nationwide predicts that house prices will rise by 2 to 4 percent this year.

It says the upcoming stamp duty changes are likely to cause volatility as buyers bring forward their purchases to avoid the extra tax.

This will lead to a jump in the number of transactions in the first three months of 2025 and a corresponding period of weakness in the subsequent three to six months, as happened in the wake of previous stamp duty changes.

“As 2025 unfolds, the urgency of transactions before April may decrease, potentially leading to a more balanced market,” Stevenson said.

“If demand declines due to fewer buyers actively purchasing, sellers may feel pressure to lower prices or offer more favorable terms to attract buyers.

‘This creates opportunities for those still in the market as they may find it easier to get better deals, potentially making 2025 a ‘buyer’s market’.

Buying agent Jonathan Hopper of Garrington Property Finders also expects a strong start to the year.

“Many who held off in 2024 now have both the will and the means to move, and this is likely to take the market strongly off the blocks in the coming weeks,” Hopper said.

‘Money flows where attention goes, which is why price rises have been sharpest in the most affordable parts of Britain and among first-time buyers.

‘In the meantime, the large supply of owner-occupied homes offers plenty of choice for buyers and price growth remains under control.

“While many buyers remain very price sensitive, steadily improving sentiment will encourage more people to push through with their moving plans before prices rise further.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.