House prices fell in December… but the market is now heating up, says Zoopla

House prices fell slightly in the year to December, but according to Zoopla the property market is now heating up due to falling mortgage rates.

The property portal reports that prices fell by 0.8 per cent in the 12 months to the end of December, but more buyers and sellers have now entered the fray and more properties are being offered.

A month earlier, real estate prices fell by 1.2 percent compared to a year earlier.

Zoopla also revealed that agreed sales are up 13 percent on last year and higher across all countries and regions.

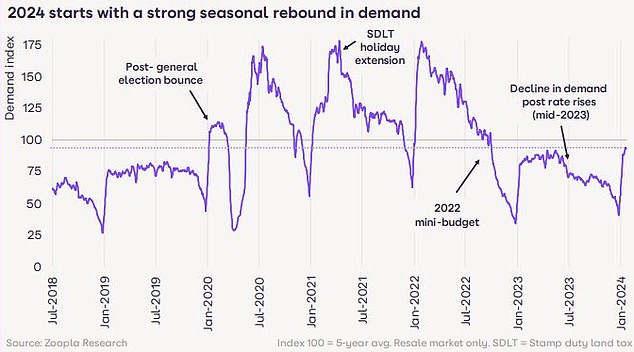

Upturn: According to Zoopla, there were more buyers, more homes for sale and a rise in sales activity in the first weeks of January

Buyer demand is said to be 12 percent higher than a year ago, but still 13 percent below the five-year average.

According to the real estate website, more and more homes are also coming onto the market. The number of available homes has increased 22 percent compared to this time last year.

The average real estate agent has 28 homes for sale, which is double the low point at the end of 2022, when there were only 14 homes per real estate agent.

> Read: When will interest rates fall? Predictions about when the base interest rate will fall

It’s still a buyer’s market

Despite the positive start to the year, it remains a buyers’ market, according to Zoopla.

It says a fifth of sellers are still accepting more than 10 percent below asking price to secure a sale. This is almost one in four in London and the South East.

Richard Donnell, executive director of Zoopla, said the main trend in 2023 was sellers reducing asking prices to attract buyer interest. He said this will continue until 2024.

“It’s a positive start to the year, with all key measures of housing activity higher than a year ago,” Donnell said.

“The drop in mortgage rates has led to a recovery in buyer demand and sales after a weaker second half of 2023, when many movers postponed decisions.

Buyer’s market: a fifth of sellers need to accept more than 10% below asking price to secure a sale, closer to one in four in southern England

Buyers back on the hunt: Buyer demand is 12 percent higher than a year ago, but remains 13 percent below the five-year average, including the pandemic ‘boom years’ (2021-2022)

He added: ‘This improvement in activity will support sales volumes which hit an 11-year low of one million in 2023.’

“We don’t see these trends as a harbinger of higher prices in 2024, as it remains a buyers’ market.

‘Sellers looking to move should be encouraged by these early signs of activity, but buyers remain price sensitive and focused on value for money.

“Over-optimism among sellers could quickly halt the current improvement in market activity.”

Will prices fall in 2024?

Zoopla revealed that house price falls were greatest in the east of England, where prices fell by 2.5 percent in 2023.

Meanwhile, house prices rose in Scotland, Northern Ireland and Northern England.

House price falls were greatest in the east of England, where prices fell by 2.5% in 2023. Meanwhile, prices even rose in Scotland, Northern Ireland and Northern England

Looking ahead, it suggests that higher levels of sales activity in early 2024, following the final weeks of 2023, are evidence of greater alignment between buyers and sellers on pricing.

Zoopla analysts therefore argue that house prices will not fall much further.

Earlier this month, property company Knight Frank predicted that house prices will rise 3 percent this year, after predicting a 4 percent fall by the end of 2024 just three months earlier.

Anthony Codling, head of investment bank RBC Capital Markets’ European housing and building materials practice, said: ‘With rising wages, falling inflation, falling mortgage rates and increasing talk of election-related housing stimulus packages, we expect house prices to rise in 2024.’

Tom Ashwood, managing director at London agent Tom Ashwood Real Estate, said: ‘I believe the increase in buyer activity, initially fueled by a reduction in mortgage rates and a lack of intention to buy until 2023, will help the to keep asking prices reasonably stable. through the first part of 2024, which will result in more properties being offered for sale.

“If interest rates remain at stable levels and appetite continues, we could even see a rise in house price inflation this year, especially due to the good sales season we often see between the spring and summer months.”

The London market looks more affordable?

London has led the recovery in demand for new buyers, up 21 percent from this time last year.

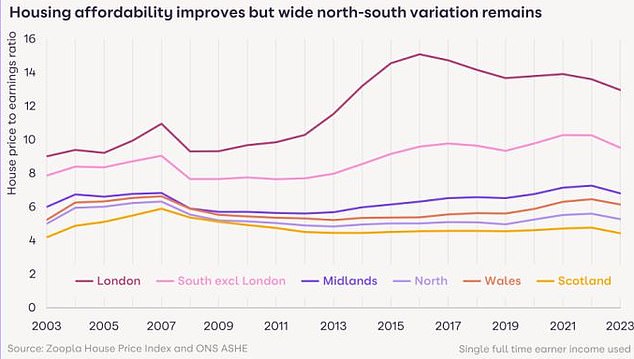

This may be because housing affordability in London is the best it has been since 2014, according to Zoopla, mainly thanks to stagnant prices and rising wages.

According to Zoopla, house prices in London have risen by just 13 percent since 2016, compared to 34 percent at the UK level.

Housing affordability in London – measured by a simple price-to-earnings ratio – is at its lowest level since 2014.

However, London remains expensive compared to the British average, with house prices at thirteen times earnings, down from a high of over fifteen times earnings in 2016.

Slowly improving housing affordability in London is positive news, but homebuyers still face a significant affordability challenge as mortgage rates have doubled since 2021.

Zoopla’s Richard Donnell added: ‘In London, this increased demand is evident across the market, with inner and outer London, in addition to the main commuter areas, all recording increased demand for housing.

‘This could be an early sign that the tide is turning for the London sales market, after seven years of lackluster activity compared to the rest of the UK.’

Matt Thompson, head of sales at London estate agent Chestertons, added: ‘2024 started with a busy property market as buyers were motivated to start or complete their property search.

‘The increasing availability of more affordable mortgage deals is playing a key role in this and is likely to continue to fuel a rise in buyer activity in the coming weeks.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.