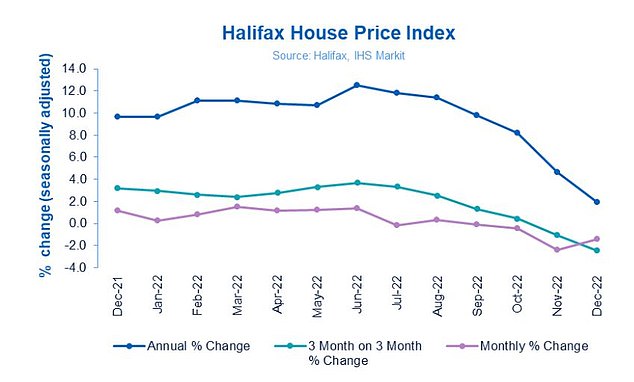

House prices fell 2% in December, says Halifax, predicting an 8% drop this year

>

Home prices fell 2% in December, Halifax says

- Monthly growth reached -1.5% in December, slightly up from -2.4% in November

- The median house price in the UK is now £281,272, down from £285,425.

<!–

<!–

<!–<!–

<!–

<!–

<!–

House prices fell 1.5 per cent in December, taking the average house price in the UK to £281,272, up from £285,425, according to Halifax’s latest house price index.

Annual growth was 2 percent, well below the November figure of 4.6 percent.

However, despite the slump, average house prices remain 11 percent higher than at the start of 2021, when the pandemic saw record price increases.

Halifax HPI: The annual growth rate fell to 2.0% in the last month of the year

Kim Kinnaird, director of Halifax Mortgages, said: ‘As we have seen in recent months, uncertainties about the extent to which cost-of-living increases will affect household bills, alongside rising interest rates, are leading to an overall slowdown in mortgage interest deductions. . market.

At the start of 2023, the housing market will continue to be impacted by the broader economic climate and as buyers and sellers remain cautious, we expect both supply and demand in general to decline, with house prices expected to fall by around 8%. will drop. percent during the year.

“It’s important to recognize that an 8 percent drop would mean the cost of average real estate returns to April 2021 prices, which remains significantly above pre-pandemic levels.”

A forecast of an 8 percent price drop puts Halifax’s forecast within the scale of other views in the market.

Forecasts vary, but several analysts have suggested house prices could fall by 10 to 15 percent over the next two years.

The Office for Budget Responsibility has said that house prices will fall by 9 percent between the end of 2022 and the end of 2024.

And elsewhere, real estate agent Savills has revised its forecast to a 10 percent fall in house prices by 2023.

>> Read our overview of the real estate market forecasts for the coming year

All countries and regions saw annual house price inflation, although the rate of growth has slowed, Halifax said.

On a year-over-year basis, the Northeast saw the biggest slowdown in growth, with house prices rising 6.5 percent annually, compared to 10.5 percent the previous month. Average house prices in the region are now £169,980.