House prices are showing the biggest monthly increase in a year, Nationwide says

House prices rose at the strongest pace in a year in January, according to the latest figures from Nationwide.

Falling mortgage rates and buyers increasingly confident that house prices will not fall in the near future are helping to revive the property market, Britain’s largest building society said.

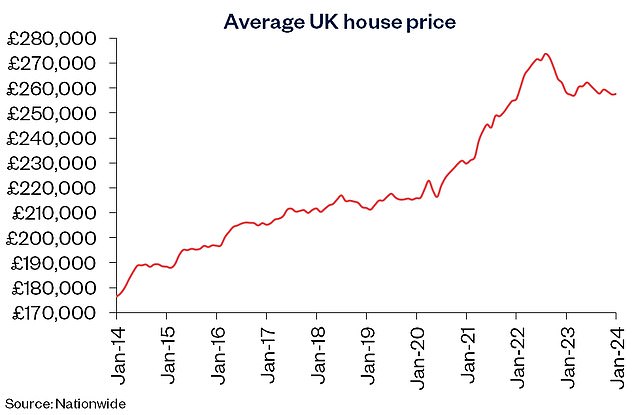

Nationwide recorded a 0.7 percent price increase in the month of January, with the average property now costing £257,656, up from £257,443 a month earlier.

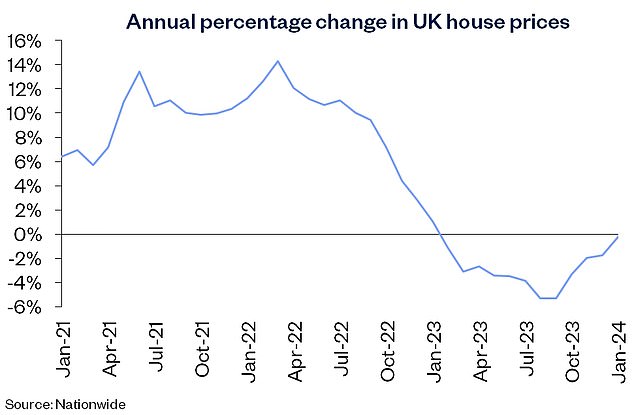

House prices fell by 0.2 percent annually in January 2024 – although this was an improvement on the 1.8 percent fall recorded in December.

Unexpected increase: Nationwide reported a 0.7% increase in house prices, better than forecast

The resilience of the real estate market continues to surprise many analysts and January figures exceed expectations: a Reuters poll of economists predicts monthly growth of 0.1 percent and Capital Economics 0.4 percent.

Robert Gardner, chief economist for the construction sector, said the price rise was mainly due to cuts in mortgage rates and more positive forecasts of a rate cut, but the outlook was still “very uncertain”.

Gardner added: ‘While a rapid recovery in activity or house prices seems unlikely in 2024, the outlook looks slightly more positive.

‘Mortgage rate developments will be key as affordability pressures were the main factor holding back housing market activity in 2023.’

> Need a new mortgage? See the best rate you can get using our deal finder

The housing market has been relatively lackluster in recent months. Rightmove reported that it took 71 days for a seller to find a buyer in December, compared to an average of 55 days in July.

However, this slower pace presents an opportunity for some buyers.

Jonathan Hopper, chief executive of estate agents Garrington Property Finders, said: ‘Prices are stabilizing in many areas, the number of homes coming onto the market is slowly increasing and we are seeing potential buyers who were reluctant last year starting to buy their properties. search seriously.’

‘With the latest data from Nationwide reinforcing the feeling that prices have bottomed out, more and more buyers have decided to act now before prices start to rise again.”

The average home now costs £257,656, up from £257,443 a month earlier.

On an annual basis, prices fell by 0.2% compared to January 2023, according to Nationwide

Mortgages consume a larger part of the net salary

Nationwide also said there had been a significant increase in mortgage payments as a percentage of average take-home pay.

By the end of 2023, a borrower earning the average UK income purchasing a typical first-time buyer property with a 20 percent deposit would typically have to spend 38 percent of their take-home pay on mortgage payments.

This was well above the long-term average of 30 percent.

If the average mortgage rate were to drop from its current level of about 5.5 percent to 4 percent, Nationwide said, that percentage of take-home pay would drop to 34 percent.

To reduce the average deposit to 30 percent, the mortgage interest rate would have to go to 3 percent.

Andrew Wishart, senior economist at Capital Economics, said: ‘While the cost of the mortgage needed to buy an average home remains high by historical standards, the rise in house prices at the start of the year shows that the a decrease in mortgage interest rates has been sufficient. so that house prices can deliver further gains.”

‘In addition to improving public sentiment on the outlook for house prices according to YouGov, we are pleased with our above-consensus forecast that they will rise by 3 percent this year, reversing the 2.4 percent decline in 2023. ‘

Nationwide highlights challenges for starters

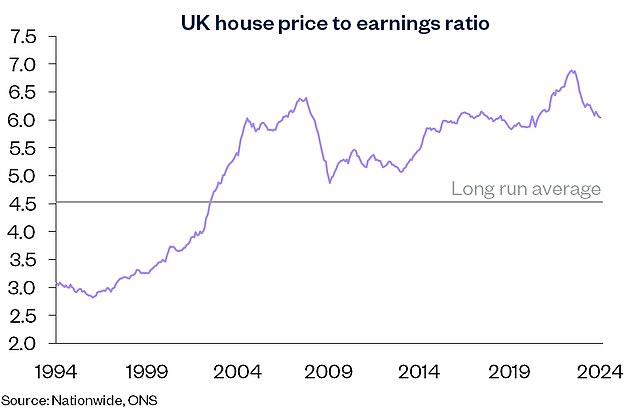

Nationwide also said the typical 20 percent deposit for a first-time buyer now equates to 105 percent of their average annual gross income.

This was down from the all-time high of 116 percent in 2022, but still close to the pre-financial crisis level of 108 percent.

House prices are still very high in relation to incomes

“This reflects that house prices are still very high relative to incomes, with the house price-to-earnings ratio at 5.2 at the end of 2023, well above the long-term average of 3.9,” Gardner said.

This has led to more and more first-time buyers needing help from family and friends, or from an inheritance, to make a down payment.

In 2022/2023, almost half of first-time buyers had some help raising a deposit, Nationwide said, up from 27 percent in the mid-1990s.

The house price/earnings ratio was 5.2 at the end of 2023

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.