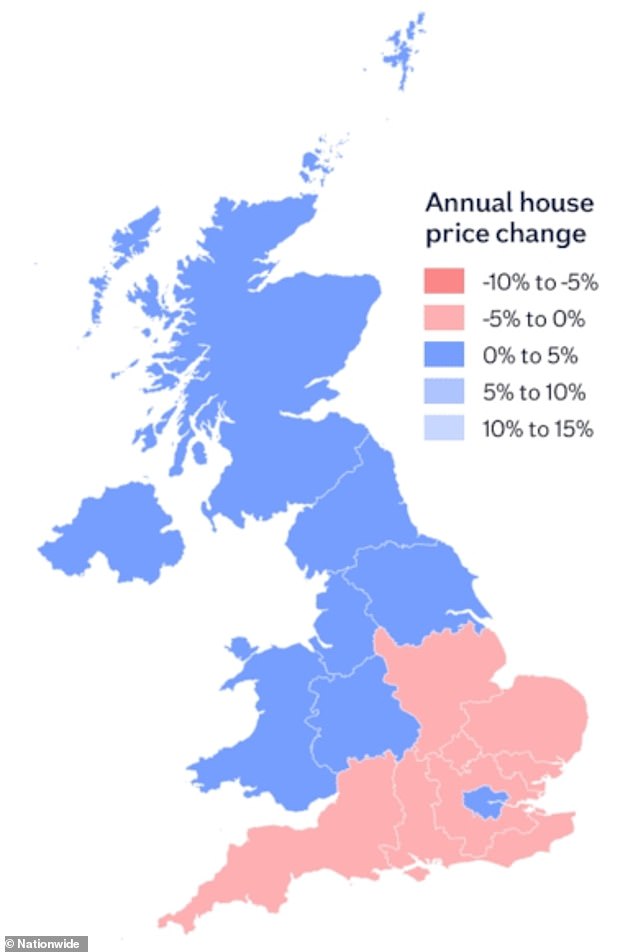

House prices are rising in the north, but falling in the south, as the mortgage crisis hits expensive homes

House prices are rising again, according to Britain’s largest building association, but a divide has emerged between north and south as mortgage rates remain high and expensive homes in the south are hit hardest.

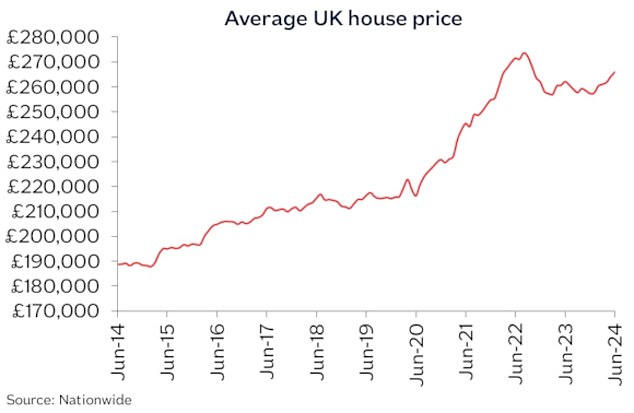

The average house price rose by 1.5 per cent or £3,825 in the year to June, according to Nationwide, but homeowners in southern England have seen their property values fall before.

The average home in Britain is now worth £266,064, up 0.2 percent or £1,815 from May, according to the building society.

The notable exception to the North-South divide is London, where house prices have risen by 1.6 percent over the past year.

On the rise: Average house prices rose 1.5% in the year to June, according to Nationwide

In May, prices rose by an average of 0.4 percent month-on-month and 1.3 percent year-on-year.

Despite the recent rebound, home prices are still about 3 percent below their all-time high in summer 2022.

In England, house prices rose fastest in the more affordable areas of the North and Midlands, where combined annual growth was 2.4 per cent.

In the more expensive south of England, on the other hand, there was a decline of 0.3 percent.

London was the best performing southern region, with annual price growth of 1.6 percent.

East Anglia was the region with the worst performance, with prices down 1.8 percent year-on-year.

| Region | Average house price | Annual increase or decrease |

|---|---|---|

| Northern Ireland | € 190,300 | 4.1% |

| North West | €213,580 | 4.1% |

| Yorkshire and the Humber | £206,653 | 3.8% |

| north | €158,467 | 2.9% |

| London | €525,248 | 1.6% |

| West Midlands | £242,873 | 1.4% |

| Wales | £207,650 | 1.4% |

| Scotland | €181,186 | 1.4% |

| East Midlands | €231,745 | -0.2% |

| Outer metropolis (includes parts of Buckinghamshire, Hertfordshire and Surrey) | £418,919 | -0.5% |

| Outer South East (includes parts of Bedfordshire, Oxfordshire and East Sussex) | €331,995 | -1.1% |

| Southwest | €301,139 | -1.5% |

| East Anglia | €270,597 | -1.8% |

| Source: national | ||

High mortgage rates continue to dampen housing market activity, according to Nationwide.

The total number of transactions is down about 15 percent compared to 2019, when prices were at record highs. However, the number of mortgages has fallen even more, by almost a quarter.

The average five-year fixed mortgage rate for someone buying with a 20 percent deposit is now 5.09 percent, up from 2.24 percent in 2019, according to data from UK Finance.

Divided: Southern areas saw more frequent declines, while northern areas saw increases

Growth: House prices have risen more sharply in northern regions of England

However, there are hopes that interest rates will fall as a possible cut in the Bank of England’s base rate approaches.

Several major mortgage lenders have cut interest rates over the past two weeks.

Robert Gardner, Nationwide’s chief economist, said: ‘Although earnings growth has been much stronger than house price growth in recent years, this has not been enough to offset the impact of higher mortgage rates. It is still well above the record lows of 2021 due to the pandemic.

‘As a result, housing affordability is still under pressure. Today, a borrower earning the average UK income who buys a typical first-time buyer property with a 20 percent deposit would have a monthly mortgage payment equal to 37 percent of take-home pay – well above the long-term average of 30 percent. .’

Affordability problem: The average house price has risen by around £70,000 since 2014

Higher interest rates and low demand prompted Capital Economics analysts to lower their forecast for house price growth in 2024, from 3 percent to 0.5 percent.

Andrew Wishart, senior UK economist, said: ‘Looking ahead, we think the national average house price will fall in the third quarter (July to September).

The average mortgage interest rate is still above 4.5 percent, which represents a tipping point for demand. In addition, the number of homes for sale appears to be increasing.