House prices are recording their fastest annual fall since 2011, ONS figures show

British house prices recorded their fastest annual fall since 2011 in November, according to the latest figures from the Office of National Statistics (ONS).

According to the data, the average sales price fell by 2.1 percent in the 12 months to November 2023.

The typical house was worth £285,000, which was £6,000 lower than a year earlier.

Falling: The average sales price in the UK fell by 2.1% in the 12 months to November 2023

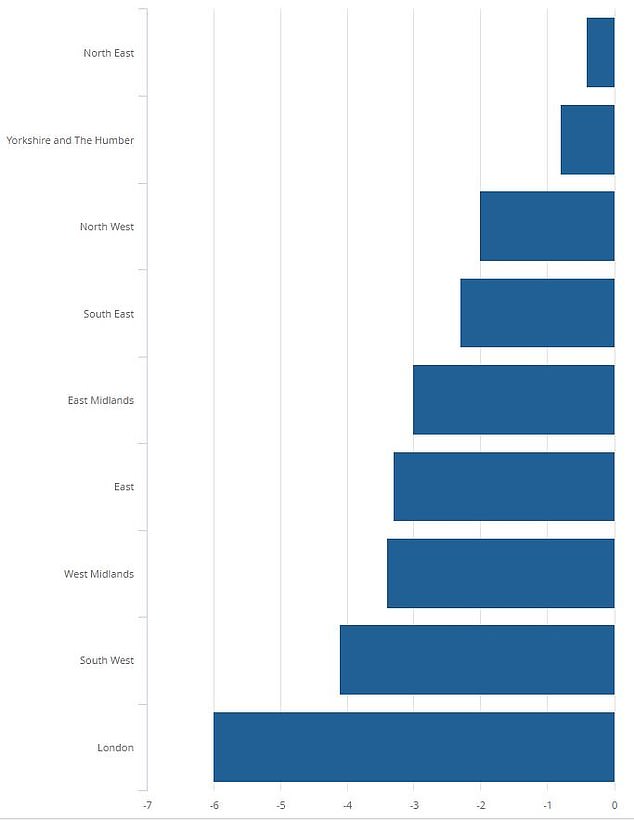

House prices in London have fallen more than in any other UK region, with an average fall of 6 percent over the past twelve months.

The south-west of England also recorded an annual fall of 4.1 per cent in the 12 months to November.

At the other end of the spectrum, house prices in Scotland and Northern Ireland rose by 2.2 percent and 2.1 percent year-on-year respectively.

In England, prices appear to have held up the most in the North East, with the area recording just a 0.4 per cent decline per year.

The ONS house price index uses data from the Land Registry and is based on average sales prices. This month’s figures are based on preliminary estimates that may be adjusted up or down in the coming months.

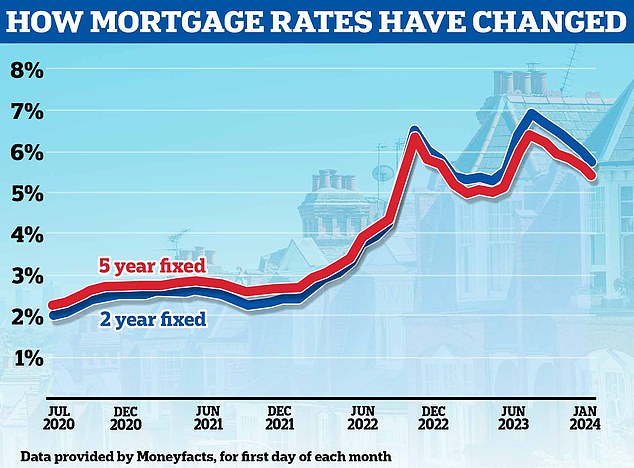

Down: Mortgage rates have fallen in recent months, with markets now predicting a cut in the Bank of England’s base rate later this year

The market has ‘turned a corner’, agents say

Although the ONS figures are often seen as the most comprehensive of all house price indexes, they may not always reflect what is currently happening in the market.

Real estate transactions also often take months to complete, meaning this may reflect prices agreed some time ago.

Brokers claim the market has changed course this month due to falling mortgage rates.

More than fifty mortgage providers have reduced mortgage rates since the start of the year, with the cheapest deals now below 4 percent.

London’s decline: The capital recorded the biggest annual fall in house prices of any UK region, down 6%

Simon Gerrard, director of Martyn Gerrard estate agents, said: ‘On the ground it is clear the market has turned a corner.

‘We have seen a 20 percent increase in the number of people registering to buy a home, compared to this time last year.

‘This is not surprising given the growing competition between lenders, with Barclays and Santander cutting rates on some of their offers by as much as 0.82 percent last week.

Alex Lyle, director of Richmond estate agency Antony Roberts, added: ‘Sentiment has improved dramatically since the start of this year, largely encouraged by what is happening with mortgage rates.

‘Buyers are more involved than at the end of last year, but are still cautious.

“They remain very price sensitive, but there is a degree of confidence that this year will be better for the market than 2023.”

According to Halifax’s latest house price index, which covers its own approved mortgage applications, house prices rose 1.7 per cent in the 12 months to December.

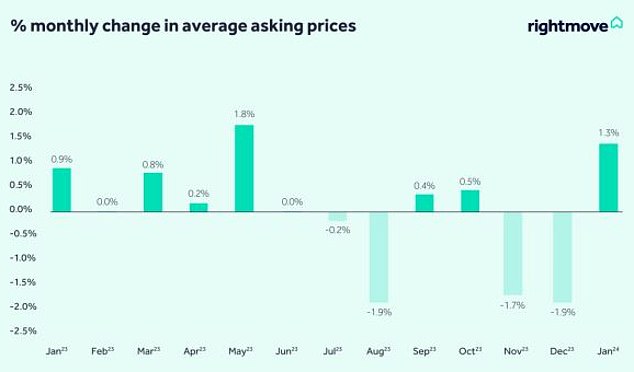

Meanwhile, Rightmove, which tracks newly quoted asking prices every month, revealed that asking prices for properties rose by 1.3 per cent in the month to January. This was the largest increase from December to January since 2020.

Rightmove also said that the number of potential buyers contacting agents about properties for sale in the first week of 2024 was 5 per cent higher than the same period last year, while 15 per cent more properties had also come onto the market.

The property website also said that the number of agreed sales at the start of this year is 20 percent higher than in the same period last year.

Jonathan Hopper, CEO of Garrington Property Finders, said: ‘The forward-looking house price indices now suggest that average prices have not only stopped falling but are slowly starting to rise again.

‘While today’s surprise rise in consumer inflation means that mortgage rates will now fall more slowly than many had hoped, buyers are returning to the market and prices are stabilizing as a result.’

No January blues: prices usually rise from a quiet December to a busier January, but this price increase is the biggest for January since 2020, according to Rightmove

What next for house prices?

Many within the real estate industry are starting to feel confident that we will actually see house prices rise this year, despite many companies and experts predicting falling prices late last year.

Earlier this week, estate agent Knight Frank said house prices would rise 3 percent this year, after previously predicting a 4 percent fall. The country has revised its forecast due to falling inflation, which it says will lead to falling interest rates, which in turn will help stimulate the market.

Property agent Martyn Gerrard says mortgage rate cuts will intensify when the Bank of England starts cutting rates, which he expects soon.

“Once this happens, I expect there will be a lot of pent-up demand,” Gerrard added.

‘The Bank of England’s decision at its next meeting on February 1 will be crucial in deciding the market’s next move.

‘If they cut interest rates, you can expect house prices to rise quite quickly, because after all, we are still dealing with a real estate market with demand far exceeding supply.’

However, not everyone is singing the same tune when it comes to future house prices.

Matt Surridge, Sales Director at MPowered Mortgages said: ‘We still expect house prices to continue on a gradual downward trend in the coming months due to higher interest rates and limited affordability.’

Others in the industry are concerned that inflation will remain a problem for longer than expected.

Today it was reported that interest rates had risen to 4 percent in December, up from 3.9 percent in November, which came as a bit of a surprise to the markets.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.