House price rises are forecast as buyers rush to meet the stamp duty deadline

The property market continues to heat up as buyers look to meet the April deadline when stamp duty will rise, according to the latest research from the Royal Institution of Chartered Surveyors.

The closely watched monthly survey provides a snapshot of what’s happening on the ground in the real estate market across the country.

This month’s research found that more Rics members, including estate agents and surveyors, have seen house prices rise over the past three months than those who reported a fall.

Heading higher: More Rics members report house prices have risen in the past three months than those who say prices have fallen

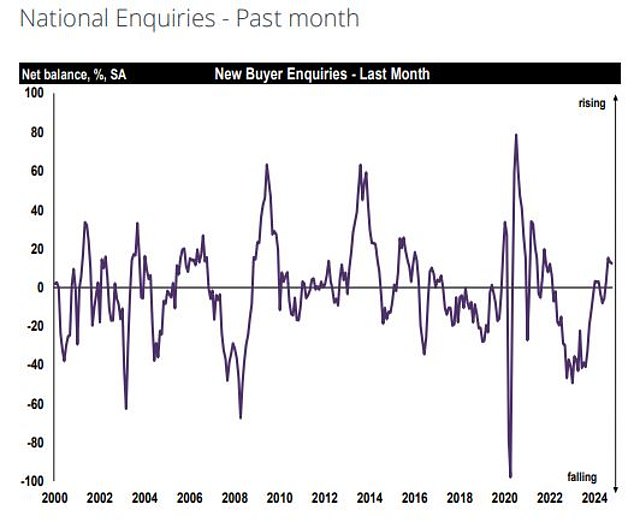

Also, more Rics members report an increase in buyer inquiries than those reporting fewer buyer inquiries.

Rics says this is the fourth month in a row of growing buyer demand.

There are more Rics members reporting an increase in sales than those reporting a decline in sales.

Tarrant Parsons, head of market analysis at Rics, said: ‘The UK housing market saw a continued upturn in activity through October, with the recent improvement in buyer demand translating into a growth in the number of agreed sales.

“Just as importantly, forward-looking sentiment suggests this better trend will continue in the coming months.”

Tina Paillet, president of Rics, added: “T“The wait for the higher stamp duty threshold to expire in spring 2025 could see homeowners and first-time buyers rush to take advantage of the current rate, but this is likely to be followed by a weaker trend after the deadline has passed.”

From April 1 next year, the price at which stamp duty is charged will return to £300,000 for first-time buyers, up from the current level of £425,000. For movers, the threshold at which they start paying tax drops from £250,000 to £125,000.

This follows temporary changes implemented in 2022.

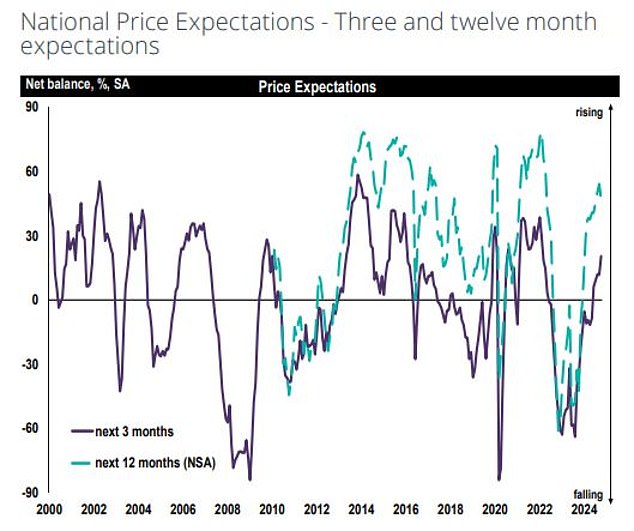

Looking ahead, more surveyors and agents expect prices to rise over the next three months than those who expect prices to fall.

More house hunting: agreed sales and new buyer inquiries continue to rise

Northern Ireland and Scotland are leading the way in house price increases

House prices are expected to rise in almost all parts of Britain in the coming year, driven by strong growth in Northern Ireland and Scotland.

The optimistic market research comes despite the fact that mortgage rates have risen.

NatWest this week became the sixth major lender to announce that fixed home loan prices are going up.

The wave of rate hikes will seem counterintuitive given that the Bank of England cut rates from 5 percent to 4.75 percent last Thursday.

Lenders are pricing up due to higher inflation expectations following the Labor Budget and Trump’s election victory.

“The rise in bond yields following the budget, alongside a general rise in financial markets, has implied interest rate expectations over the past few weeks,” said Parsons.

“This will likely create a headwind that the market will face in the near term.”

Turnaround: After the negativity around house prices in recent years, positivity has returned, with more Rics members now expecting prices to rise rather than fall in the future

Still, home prices have hit a new high, surpassing the previous peak set in June 2022 during the pandemic real estate boom, according to Halifax data.

The price of the average home rose for the fourth month in a row in October, according to the bank, which bases its figures on its own mortgage applications.

Typical real estate rose 0.2 percent this month, while prices rose 3.9 percent year-over-year.

It means the average property price has reached a record high of £293,999, surpassing the previous peak of £293,507.

Hottest and coldest real estate markets

Yorkshire and the Humber and the South West of England were the only regions where more Rics members reported prices falling rather than rising.

Mark Hunter, from Grice and Hunter in Doncaster, South Yorkshire, said: ‘There has been, as expected, a lull in activity due to the budget. We expect to remain in limbo until at least mid-January.”

Howard Davis of Howard estate agents in Bristol said: ‘We are seeing a lot of negotiation over asking prices. As a result, values drop.’

However, the majority of respondents in the North of England, the North West, Scotland and Northern Ireland report that prices are rising.

Clare Murphy of Countrywide Surveying Services, based in Manchester, said: ‘Demand for house purchases is high, new build home sales are still high.

Ian Fergusson of Shepherd Chartered Surveyors in Scotland said: ‘Strong market with good seller and buyer activity – prices are rising.

In Northern Ireland, Rics members report that a shortage of homes on the market is contributing to rising prices.

Kirby O’Connor from GOC estate agents in Belfast said: ‘We have noticed that our new developments are selling well, increased demand and I think this is due to interest rates.

‘This opened the market for more starters. The investor market also remains strong.

Samuel Dickey of Simon Brien Residential in Belfast added: ‘Lack of supply is still the trend, which is why most properties are bidding competitively.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.