House price downturn has now spread across Britain, latest Zoopla data shows

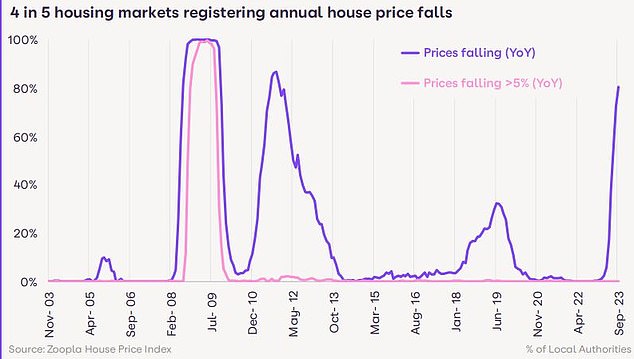

The fall in house prices is being felt across the country, with 80 per cent of local areas recording an annual decline, according to Zoopla.

Previously, house value declines were concentrated in the south. But now the downturn has spread to lower value markets including the East and West Midlands and Yorkshire and Humber, according to Zoopla.

The slowdown in the housing market is the most severe the real estate website has reported since 2009 in the wake of the financial crisis, the report says.

Widespread: 4 in 5 housing markets record small price falls each year, says Zoopla

Higher mortgage rates have translated into weaker demand and reduced purchasing power, which in turn has led to falling prices.

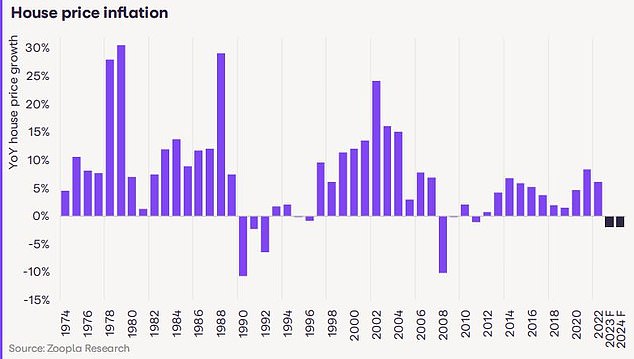

Although the housing market has transformed from double-digit house price growth to a declining market year on year, the extent of the decline so far remains limited, according to Zoopla.

Overall, the report reports that house prices are falling by an average of 1.1 percent annually. if you include the whole country.

The biggest annual falls have been recorded in commuter towns around London and in the South East.

For example, house prices are 3.5 per cent lower annually in Colchester and 3.3 per cent lower in Luton.

But no local market has recorded an annual price drop of more than 5 percent, according to Zoopla. However, it expects some markets to see such declines in the coming months given weaker purchasing power.

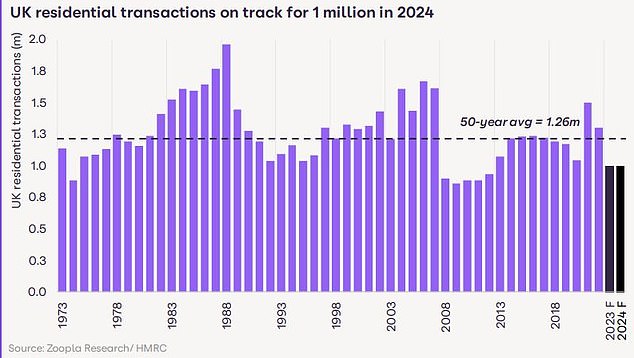

Although prices have taken a slight hit, it is transaction volumes that have been hit hardest by higher mortgage rates.

So far this year, home sales are down 23 percent compared to the same period last year.

It’s all gone quiet: transactions have been hardest hit and will be 23% lower than in 2022, with Zoopla predicting this will remain largely the same in the coming year

Richard Donnell, executive director of Zoopla, said: ‘Housing prices have proven more resilient than many expected over the past year in response to higher mortgage rates.

‘But almost a quarter fewer people will move due to greater uncertainty and less purchasing power.

‘The modest decline in house prices in 2023 means it will take longer for housing affordability to return to a level where more people move again.

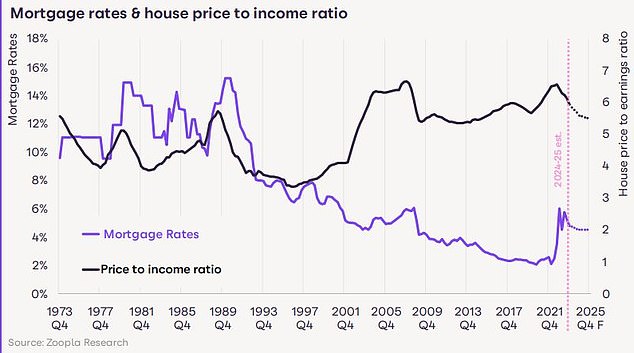

‘Income growth is finally rising faster than inflation, but mortgage rates remain at around 5 percent or higher.’

What lies ahead?

According to Zoopla, the increase in mortgage interest rates over the past eighteen months is the main cause of the current overvaluation of home values.

House prices must fall further and incomes rise, or mortgage rates must fall further to restore affordability and support demand or sales.

The fact that house prices have fallen less than expected in 2023, combined with a mortgage interest rate of 5 percent, means that buying a home for an average household still remains relatively expensive.

Assuming mortgage rates remain at current levels, Zoopla predicts that UK house price declines will remain in the low single digits over the next one to two years.

It also expects housing transactions to remain flat at around one million in 2024, although this could improve if mortgage rates fall to 4 percent in the first half of 2024.

They claim this will support a modest rebound in activity in the first half of 2024 as people who have postponed their moves decide to return to the market.

Donnell added: ‘We think house prices will fall even further in 2024, by an average of 2 percent, with one million moves.

“Slow house price growth and rising incomes over the next 12 to 18 months will improve affordability to levels seen a decade ago, creating the potential for a rebound in home relocation as consumer confidence returns.”

Should people postpone or buy in 2024?

Zoopla says there are sections of the population who are keen to move.

However, they have been biding their time in 2023 and waiting for the outlook to become clearer – in particular the likely trajectory for mortgage rates and house prices.

Upsizers are likely to remain the group most sensitive to higher mortgage rates, as they tend to buy larger homes that require larger mortgages.

However, those buying with the intention of being in it for the long term have little to fear from the current recession, said Karl Knipe, director of brokers at Kings Group.

“Very low single-digit price increases or decreases make no difference when buying a home that you will live in for many years,” Knipe, “it should be irrelevant.”

‘The forecasts show that 2024 is shaping up to be a similar year to 2023, so if you want or need to move and buy your own ‘castle’ – now is the time to do your homework and put yourself in the best position for the new year in terms of knowledge, financially and in terms of skills.

‘This way you can be sure that you can move quickly if you find a home that suits you.’

Negative territory: Zoopla says average house price inflation has fallen from 9.6% to -1.1% over the past year

Next year, first-time buyers will continue to be forced to purchase due to continued rapid growth in rental prices, according to Zoopla.

Nicholas Mendes, mortgage technical manager at John Charcol, broadly agrees.

He says: ‘Buying a home gives you more security than renting and allows you to invest in your future by building equity – rather than lining someone else’s pocket.

‘Trying to determine the right time to buy a house is impossible. For example, if rates were to drop in a year, would the property you want still be on the market?

‘If house prices were to fall, you could be faced with like-minded potential buyers, all bidding on the same property.

‘Property values fluctuate, but history shows that property values in Britain will inevitably rise, allowing you to make a profit on your initial contribution and giving you more options for the future.’

Zoopla expects the house price to income ratio to fall to levels not seen in a decade, helping the housing market recover with activity as buyers gain confidence

Cash buyers will also remain an important buyer group next year, according to Zoopla.

Nigel Bishop of buying agency Recoco Property Search said: ‘The UK property market, particularly at the higher end where properties cost at least £1 million, has seen a noticeable increase in the number of cash buyers over the past year.

“This increase has been driven by less favorable interest rates and will continue into 2024 as interest rates are unlikely to fall anytime soon.

“The presence of more cash buyers could pose even more challenges for mortgage-reliant buyers, as some sellers prefer cash transactions due to their chain-free nature, often resulting in an overall faster sales process.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.