House builders are calling for an urgent cut in stamp duty to stimulate the property market

- The housing market has been hit by rising interest rates, which have increased moving costs

- Taylor Wimpey, Barratt and Berkeley say a cut in stamp duty would help

Three of Britain’s biggest housebuilders have called on Chancellor Jeremy Hunt to cut stamp duty on property purchases in the spring Budget to ‘unlock’ Britain’s housing supply and stimulate the economy.

Jennie Daly, head of FTSE 100 builder Taylor Wimpey, said in an exclusive interview with The Mail on Sunday that there was a “real case” for reducing the levy on cheaper properties and for sellers over the age of 60 who were looking to reduce.

Her comments were echoed by the CEOs of Barratt Developments and The Berkeley Group.

Bricks and mortar: Berkeley Group boss Rob Perrins believes housing supply is still the ‘key issue’

The pressure on the government to cut stamp duty comes after the housing market has been hit by rising interest rates, pushing up mortgage repayments and rents at a time when household budgets are under pressure from the cost of living crisis.

Many would-be homebuyers have been priced out of the market by unaffordable mortgage costs and deposit levels – although there is hope that the situation is starting to improve.

Speaking to The Mail on Sunday, Daly said stamp duty reform could help tackle the problem of ‘overcrowding at the bottom of the market and understaffing at the top’.

She said: “Housing movements drive the economy. Mobility is fundamental to a healthy economy.

‘If that is made more difficult because there is a tax, such as stamp duty or a lack of housing availability, then you start to limit the economic options of the individual and the economy. We need to look at the dampening effect that stamp duty has.”

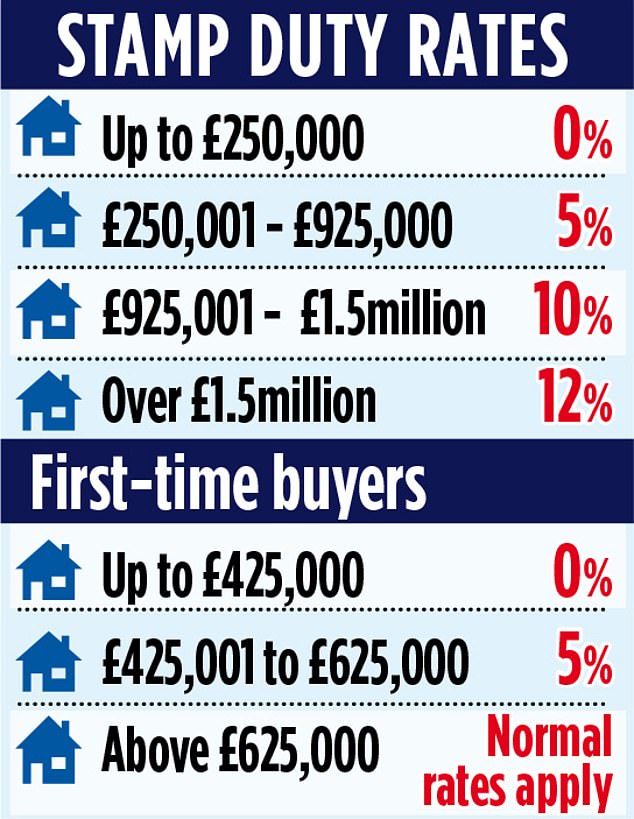

No stamp duty applies to property purchases under £250,000, but this is charged on 5 per cent of the next £675,000 of homes from £250,001 to £925,000. It then rises to 10 percent, reaching a top rate of 12 percent on the portion above £1.5 million.

First-time buyers pay no stamp duty on properties under £425,000 and face a 5 per cent tax on the proportion of homes between £425,001 and £625,000.

Rob Perrins, the boss of housebuilder The Berkeley Group, said cuts in stamp duty would “help with consumer demand” and encourage more people to move.

But he stressed that housing supply is still the “key issue” and reiterated the company’s call for “targeted cost-neutral tax incentives” for construction on brownfield or post-industrial land.

David Thomas, CEO of Barratt Developments, said the Chancellor should use next month’s Budget to ‘support young families to get a foot on the ladder’ and ‘incentivize downsizing’ to boost house sales and ‘ make more efficient use of existing stock.

MJ Gleeson, a low-cost housing provider, also supported the call for stamp duty changes.

Boss Graham Prothero said abolishing or reducing the levy would “help boost confidence and activity in a very cautious market”.

Builders are hoping for a revival of the pandemic housing boom

Builders hope the reforms will help revive the house purchase boom that emerged during the pandemic after Rishi Sunak introduced a stamp duty holiday during his chancellorship.

The policy – which meant stamp duty no longer applied to properties costing less than £500,000 – boosted demand after the housing market ground to a halt during Covid lockdowns. But the measure was criticized for driving up prices and driving away younger starters.

Former Housing Secretary Robert Jenrick last month called stamp duty “one of the most counterproductive and anti-growth taxes” and said it “damages productivity”.

He called for a cut in stamp duty, saying it would provide “a much-needed boost to the economy.”

Sir Nigel Wilson, the former boss of financial services firm Legal & General, wrote in October that stamp duty should be abolished or reduced for “older people looking to downsize” to “free up housing for the younger generations”.

He added that making downsizing cheaper would also “free up money” that could then be used to “support family members such as grandchildren and help the next generation onto the housing ladder”.

Data released by the Office for National Statistics last week showed house prices fell 1.4 percent last year as rising mortgage rates weighed on demand.