Homeowners in blue state face having no home insurance as State Farm issues grim warning

California’s largest insurer has issued a somber update for homeowners and businesses amid a growing crisis in the state.

State Farm says the fund used to cover claims in California will dry up in 2028 unless it can charge as much as 52 percent more to insure properties.

That would mean the company wouldn’t be able to pay for repairs in the event of another wildfire in the state, such as those in recent years. In fact, the company says such an event would put it out of business.

The dire warning came in documents filed with the California Department of Insurance on September 10, as part of a standoff between State Farm and the regulator. State Farm insures 3.1 million homes there.

Earlier this summer, State Farm bosses gave the department an ultimatum: Let them raise home insurance rates for millions of citizens or cut coverage entirely.

Considering State Farm writes one-fifth of the policy, this would be a huge blow. It’s not simply that Californians are moving to a new supplier; rivals are making the same moves.

Several insurers — including Allstate, Farmers Direct and State Farm in an earlier move — have limited coverage or have stopped doing business in the Golden State altogether.

State Farm has asked California to raise home insurance prices again

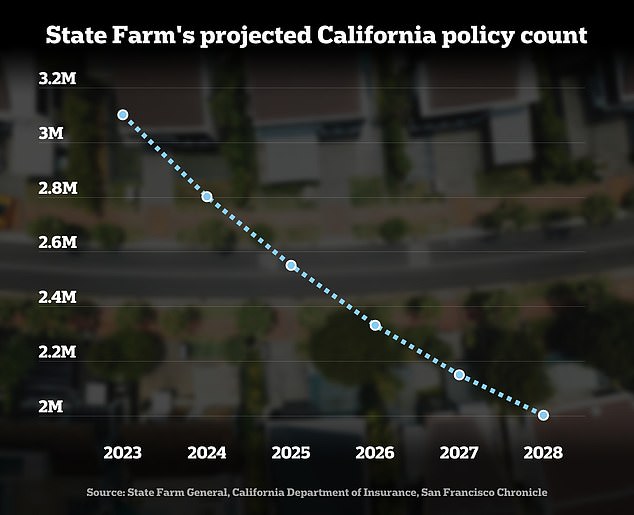

In the same filing, State Farm showed how the number of properties it covers will decline in the coming years.

The company insures 3.1 million homes as well as tens of thousands of businesses in the state, but has warned this could fall to just two million by 2028.

State Farm stopped issuing new property insurance in the state last May as part of the fight to raise prices.

It then refused to renew tens of thousands of policies in California this summer.

Together, these factors mean that the number of Californians covered will steadily and rapidly decline.

The latest figures are calculated based on the assumption that the company will lose policies at a similar rate to what it is now, including for customers who have chosen to leave or were terminated due to non-compliance.

In an effort to avoid bankruptcy, State Farm says it wants to raise prices by 30 percent for homeowners, 36 percent for condo owners and 52 percent for renters.

If the sharp increase in premiums is allowed, the state-owned company would be able to raise about $1.6 billion over five years, bringing its claims-paying surplus back to 2017 levels. the San Francisco Chronicle reported.

The company’s surplus was hit hard by the wildfires that ravaged California in 2017 and 2018, forcing the company to pay out millions to customers.

As climate change increases the risk of forest fires, floods and other natural disasters, the insurer says it must increase premiums to meet claims.

If the insurer is not allowed to increase its premiums, the insurer claims its surplus will fall to less than $200 million by 2028, a drop of $2.2 billion in ten years.

The company said in documents that a wildfire season like 2017, which cost insurance companies a combined $12 billion, would put it out of business.

Based on this, she is asking the state to impose sanctions to increase rates by 30 percent for homeowners, 36 percent for condo owners and 52 percent for rental properties.

Just this year, it increased its rates by an average of 20 percent for homeowners across the state.

State Farm’s declining insurance customers in California will impact the surplus

State Farm calls increase in wildfires a need to increase premiums (Blue Ridge Fire in 2020)

The California Department of Insurance is currently assessing State Farm’s financial health, based on which it will determine whether or not to grant the increase.

The first increase in State Farm customer bills would occur in 2025, according to the documents.

State Farm was expected to have a net worth of approximately $143.2 billion in 2021.

At the time, the company generated about $87.6 billion in annual revenue, and last February it released a statement saying its net profit for the previous year was an impressive $1.2 billion.

That was up more than 100 percent from the year before, when the Illinois-based insurance company raked in $588 million in revenue.

More than half of all Californians say they have been hit by rising property costs or had their insurer drop them in the past year. Because there are so few companies that offer coverage, they can’t simply switch to a new provider.

State Farm did not respond to DailyMail.com.