Home sellers earn an average of six figures: we reveal where they earned the most

Homeowners in England and Wales typically made a six-figure profit on the sale of their property last year, new data shows.

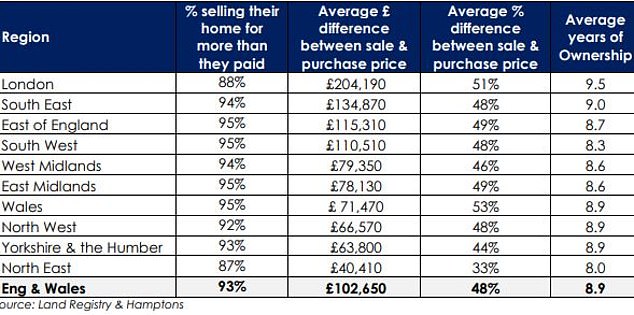

The average household in England and Wales that bought in the last 20 years and sold in 2023 will have sold their home for £102,650 more than they paid for, according to a Hamptons analysis.

While this is slightly less than the average £112,930 profit made by sellers in 2022, it is only the second year ever in which the average seller has made more than £100,000 more than they paid for their property.

Hamptons estimates that the average seller will sell for 48 percent more than they paid for their home in 2023. This is a decrease compared to 54 percent in 2022.

Average seller profit in England and Wales: The average household that bought a property in the last 20 years and sold it in 2023 earned £102,650

Whether someone has done better or worse than average depends of course on where and when he bought and sold.

While many will have made a six-figure profit when they sold, a small minority sold at a loss in 2023, Hamptons said.

Overall, 93 percent of households sold their property last year for more than they paid for it, owning it for an average of 8.9 years.

Aneisha Beveridge, head of research at Hamptons, said: ‘Households rarely move when faced with the prospect of selling their home for less than they paid.

“Generally speaking, the chances of selling at a loss are highest in the first few years of ownership.”

Where did sellers make the biggest profits?

Slower house price growth in London in recent years has meant that sellers in Wales are now making larger profits than Londoners in percentage terms.

In 2023, the average home in Wales sold for 53 percent more than its purchase price, surpassing the London average of 51 percent, which has fallen over the past five years.

According to Hamptons, this reflects the end of the housing market cycle, with Wales having seen stronger price growth in recent years.

This is partly due to the slow recovery of house prices in Wales following the 2008 financial crisis.

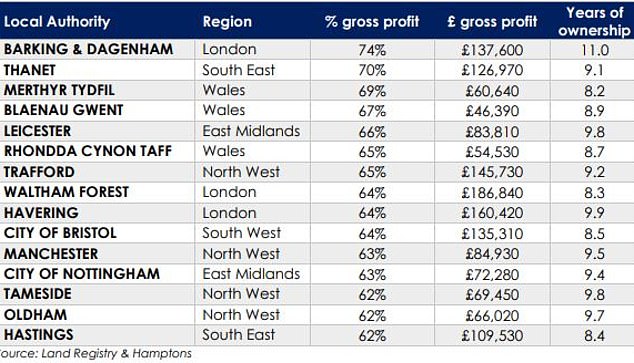

Changing market: 12 of the 15 local authorities where sellers saw the biggest gains were outside London, up from six before the pandemic in 2019

That said, sellers in Barking and Dagenham saw the biggest percentage gains, with an average gain of 74 percent for households who sold there last year, according to Hamptons.

London was one of the fastest housing markets to recover and prosper following the 2008 financial crisis.

Since 2016, house prices outside London have risen faster. In total, 88 percent of London sellers sold their home in 2023 for more than they initially paid.

However, only 72 percent of those who bought in 2016 and sold in 2023 made money on their home.

Most of these sellers owned homes in Prime Central London, where the average property still costs less than when the market peaked in 2016.

In the City of Westminster, for example, the average flat or maisonette fell from £973,000 at the end of 2016 to £814,000 in November last year. That is a price drop of 18 percent over the past seven years.

Despite this, higher property prices mean that most Londoners are still making the biggest gains in cash.

The average Londoner sold their home last year for £204,190 more than they paid for it, after owning it for an average of 9.5 years.

Having owned the property for an average of 10.8 years, households in Kensington and Chelsea made the biggest cash gains after selling their home last year for an average of £680,580 more than they initially paid – more than double the average house price in Britain .

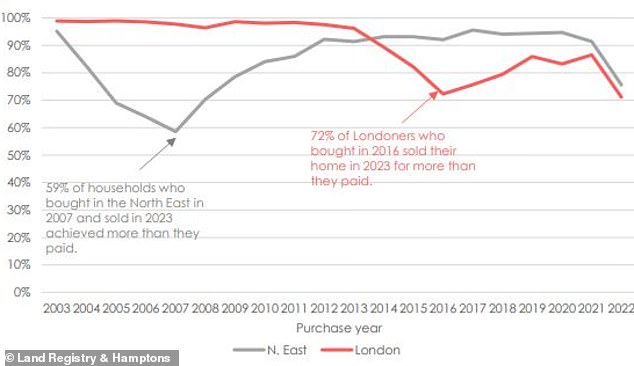

London versus North East England: share of households selling their home in 2023 for more than they paid in the year of purchase

Meanwhile, merchants in the Northeast continued to post the smallest profits, both in cash and percentage terms, according to Hamptons.

The average household selling in 2023 earned £40,410, or 33 per cent more than they initially paid.

While 98 percent of Londoners who bought in 2007 and sold in 2023 made a profit on their home, only 59 percent of sellers in the North East made a profit.

Yet the nature of the house price cycle means that those who bought in the North East between 2014 and 2022 were more likely to sell their home at a profit in 2023 than those who bought in London.

Seller profits in 2023 by region: There are 156 local authorities in England and Wales where the average homeowner made a six-figure profit on the sale of their home, according to Hamptons

Aneisha Beveridge from Hamptons added: ‘Despite falling house prices last year, 93 per cent of households still sold their homes for more than they paid, making an average of just over £100,000.

‘These proceeds are largely reinvested in the housing market and go towards the purchase of another home, so they are rarely realized in cash.

“However, the figures illustrate how the magnitude of historic price growth last year sheltered movers, freeing up money to cover moving costs.

Why sellers made smaller profits last year than in 2022

Hamptons attributes the decline in average profits partly to the small decline in home prices last year.

British house prices recorded their fastest annual fall since 2011 in November, according to the latest figures from the Office of National Statistics.

According to the data, the average sales price fell by 2.1 percent in the 12 months to November 2023.

The figure was also dragged down by a spike in the number of households moving after just two years.

According to Hamptons, 8 percent of households that sold a home last year had purchased just two years earlier in 2021.

This compares to 5 percent of sellers in 2022 and 6 percent of sellers in 2019 who bought two years earlier.

Share of sales by length of ownership: About 8% of households that sold a home last year had purchased a home just two years earlier in 2021. This compares to 5% of sellers in 2022

It suggests last year’s post-pandemic movers had second thoughts about their rural homes. About 12 percent of sellers in 2023 sold a home in the country, compared to a long-term average of 9 percent.

Yet the average seller who bought in 2021 sold their home last year for £56,170, or 23 per cent more than they initially paid.

“Double-digit increases in house prices since Covid have meant that households moving within two years could realize a higher price than they paid,” Beveridge added.

‘Historically, these are people who move because of changed circumstances. However, the spike in the share of households moving within two years goes further than that and signals an end to the ‘race for space’.

“Most of these sellers are selling larger homes in rural areas, often in favor of moving back to the suburbs or the city.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.