Home prices see biggest drop since 2009 as average home falls by £14,000 in a year, says Halifax

According to the latest figures from Halifax, the average homeowner has seen a £14,000 drop in property value over the past year.

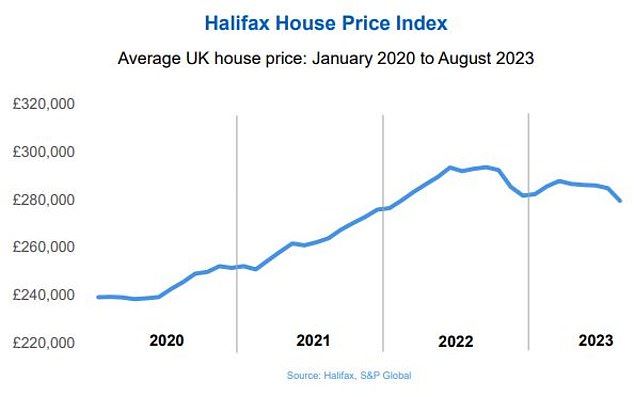

The Halifax Long-Term Index shows home prices have fallen 4.6 percent annually, the biggest annual decline since 2009, as the mortgage spike takes its toll on the real estate market.

Average home prices fell 1.9 percent in August, the largest monthly drop since November 2022, according to the mortgage lender.

According to Halifax, the average house now costs £279,569, back to early 2022 levels.

Falling: Real estate prices fell 4.6 percent year-on-year, down from 2.5 percent in July, though prices peaked last summer

Halifax’s numbers are consistent with Nationwide’s home price index, which last week suggested prices had fallen 5.3 percent annually.

Kim Kinnaird, director of mortgages at Halifax, believes that while home prices have proved more robust than some expected, prices are likely to fall further for the rest of the year.

She said: ‘It’s fair to say that home prices have proven more resilient than expected so far this year, despite higher interest rates weighing on buyer demand.

“However, there is always a lag effect when it comes to interest rate hikes, and we may now see a greater impact from higher mortgage costs feeding into house prices.

“Greater month-to-month volatility is also to be expected when activity levels are lower, although overall the rate of decline remains in line with our outlook for the year as a whole.”

The average house now costs £279,569, down around £5,000 since July, and back to early 2022 levels

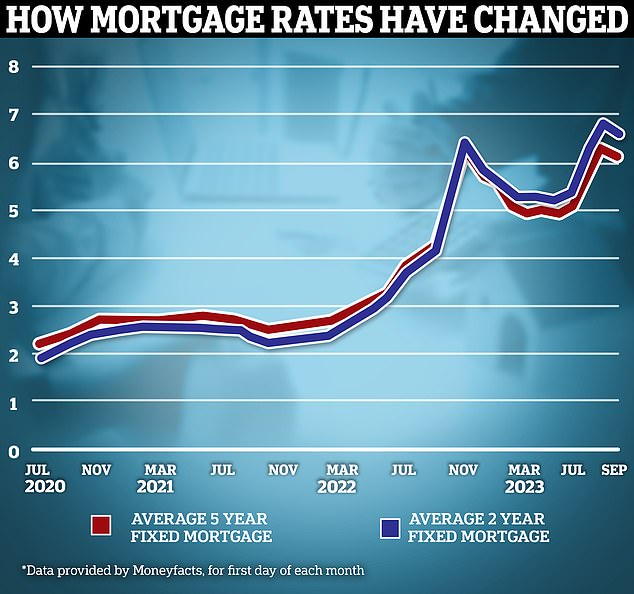

It should come as no surprise that higher mortgage rates are seen as the biggest contributor to what is happening.

According to Moneyfacts, the average two-year fixed-rate mortgage rate is now 6.67 percent, compared to 2.38 percent two years ago.

This means that the average person who takes out a £200,000 mortgage and pays it off over 30 years will pay £1,372 per month, compared to £885.

Even those who can afford the cheapest mortgages face a financial shock. The cheapest two-year solution is currently charged at 5.75 percent. Two years ago, it was possible to get a deal close to 1 percent.

Past the peak? Fixed mortgage rates appear to be falling back somewhat, but remain well above levels enjoyed by borrowers prior to last year

However, despite the dramatic shift in mortgage rates, average prices are still about £40,000 above pre-pandemic levels.

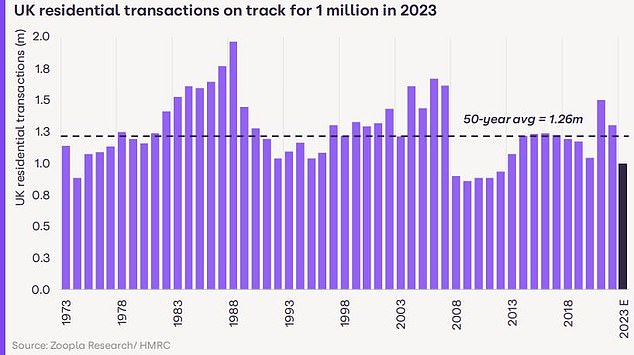

Jeremy Leaf, a North London estate agent and former chairman of the Rics housing association, believes the fall in house prices is being cushioned somewhat by the low number of transactions taking place.

The number of property sales completed this year is on track to fall by a fifth from 2022, the lowest since 2012, according to Zoopla.

“Prices continue to fall, although they are supported to some extent by the shortage of supplies and fewer but more serious buyers,” says Leaf.

“With so many rate hikes, affordability is a concern, especially for those on tighter budgets, who tend to buy smaller properties, so the market remains price sensitive.

“The penny has dropped for the majority of salespeople who realize they may not achieve what they originally expected.”

On track for 1 million sales: Sales will be 21 percent down by 2023, lowest level since 2012, Zoopla says

He adds: ‘Since many sellers are also buyers, they realize that while they may have to accept less than they initially wanted, they will also pay less for their next home, which is significant as many will trade in.

“The sellers who refuse to acknowledge that prices are softening will remain in the market and may eventually have to accept a lower price to make their move.”

Halifax expects home prices to continue a downward trend until the market finds an equilibrium where buyers are comfortable with mortgage costs.

Kinnaird added: “We expect further downward pressure on property prices through the end of this year and into next year, in line with previous forecasts.

“While a decline will not be welcomed by current homeowners, it is important to remember that prices are still 17 percent above pre-pandemic levels.”

However, some brokers predict that buyer demand will recover in the coming months.

Nicky Stevenson, managing director of national real estate group Fine & Country, says: ‘While demand has declined over the summer, this is in line with normal seasonal patterns and is expected to pick up again as we enter the autumn.

Mortgage lenders are once again competing for orders and are lowering their mortgage rates accordingly, which will ease pressure on homebuyers and further boost demand in the coming months.

“If there is a pause in key interest rate hikes this year, it should further boost buyer confidence.”

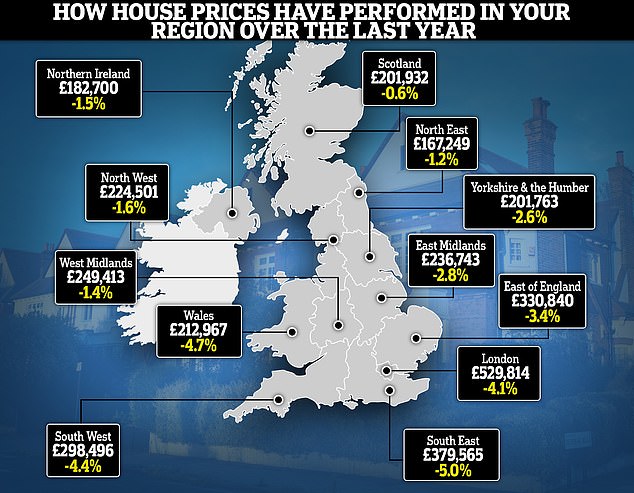

At a regional level, the South and Wales are experiencing the most downward pressure on property prices, while Scotland is showing greater resilience

Regional variation: All UK regions recorded a fall in house prices over the past year, with northern locations generally proving more resilient than areas in the south

Buyers faced with the need to find larger deposits and fund larger monthly repayments mean the Southeast is experiencing the biggest decline. House prices have fallen by 5 percent annually.

Wales, which has seen some of the biggest increases in property prices during the pandemic-driven race for space, saw property prices fall by -4.7% over the past year.

Property prices in Northern Ireland have fallen by -1.5 percent annually, while in Scotland property prices have fallen by just -0.6 percent over the past year.

London remains the most expensive place in Britain, despite the average homeowner there losing £22,777 in property value last year

London remains the most expensive place in Britain to buy a home, with an average property price of £529,814.

But with prices falling -4.1 per cent over the past year, this also represents the biggest drop of any region in cash terms: the average Londoner sees £22,777 disappear from the value of their home.

Matt Thompson, head of sales at London-based estate agency Chestertons, said: ‘As higher interest rates impact households, property buyers are looking more strategically and flexibly for property by adjusting their budget or broadening their search criteria to to find a suitable home.

“While some buyers took a break during the August holidays, others used the past month to conduct price negotiations or close the deal by signing contracts.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.