Home prices hit a new record after surpassing the pandemic peak

Home prices have hit a new high, surpassing the previous peak set in June 2022 during the pandemic real estate boom, according to Halifax.

The price of the average home rose for the fourth month in a row in October, according to the bank, which bases its figures on its own mortgage applications.

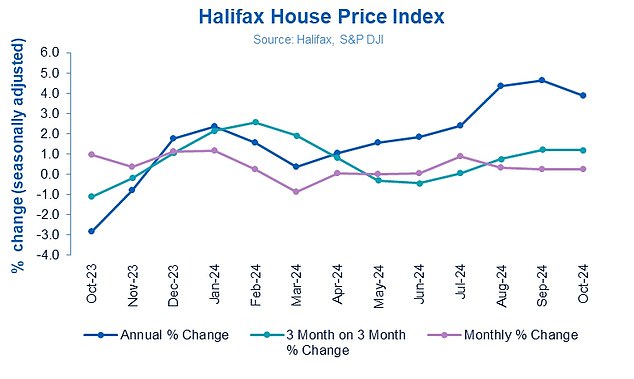

The typical property rose 0.2 percent over the month, while prices rose 3.9 percent year-over-year.

It means the average property price has reached a record high of £293,999, surpassing the previous peak of £293,507.

New heights: According to Halifax, the average house is now worth almost £294,000

Amanda Bryden, head of mortgages at Halifax, said: ‘That house prices have once again reached these heights in the current economic climate may come as a surprise to many, but perhaps even more remarkable is that they have not fallen very far in the first place.

‘Despite the headwinds of higher interest rates, house prices have largely stabilized over the past two and a half years, with an overall increase of 0.2 percent.

“That’s a significant slowdown compared to the 21 percent increase we saw in the comparable period from January 2020 to summer 2022.

Why have house prices risen?

Lower interest rates and a more stable mortgage market have helped more people buy homes this year.

Although mortgage rates rose slightly in the first half of this year, they have since fallen back. Most borrowers can now take out a two- or five-year fixed-rate mortgage of between 4 and 5 percent. Some can even get below 4 percent if they have a large enough deposit.

The average mortgage interest rate is now more than 160 basis points lower than in the summer of 2023. Meanwhile, household incomes have risen.

According to data from the Bank of England, the number of new mortgages recently reached a two-year high.

> Need a new mortgage? Find the best deal for you using our search function

However, interest rates have risen slightly in recent weeks, with some major lenders adjusting home loan prices in response to changing market forecasts of rate cuts in the future.

Halifax’s Amanda Bryden suggests we’re likely to see only minor house price growth in the coming months.

“Looking ahead, borrowing restrictions remain a challenge for many buyers,” Bryden said.

‘Following the Budget, markets expect the Bank of England to cut interest rates more slowly than previously expected, which could keep mortgage costs higher for longer.

‘New policies such as higher stamp duty for second home buyers and a return to previous thresholds for first-time buyers could also impact demand.

‘While we expect house prices to continue to grow, this is likely to remain at a modest pace for the rest of this year and into next year.’

Tom Bill, head of UK housing research at property firm Knight Frank, thinks higher mortgage rates could drive prices down again.

‘The interest rate landscape has become more unfavorable than a fortnight ago, which will increase downward pressure on house prices in the short term.

“For now, anyone deciding whether to commit to a two-year or five-year rate fix should consider whether he or she thinks Labour’s revenue-raising plans will work or whether more interest rate turbulence lies ahead during this Parliament.”

Where are house prices rising the most?

Northern Ireland continues to record the strongest property price growth of any region, up 10.2 percent since last October. The average price of a house in Northern Ireland is now £204,242.

House prices in Wales also showed strong growth, up 5.6 per cent, compared to the previous year, with homes now costing an average of £225,543.

Once again, Scotland saw a more modest rise in house prices. A typical property now costs £206,480, which is 1.9 percent more than the year before.

The North West remains the region of England with the strongest growth, up 5.9 per cent over the past year, to £235,587.

House prices in Yorkshire and the Humber have risen by an average of 5.3 per cent year-on-year.

Meanwhile, house prices in the Midlands have performed strongly. The average number of homes in the East Midlands has increased by 4.4 per cent year-on-year. In the West Midlands, prices have risen by 4.7 per cent year-on-year.

London still has the most expensive property prices of any region, now averaging £543,308. Prices in the capital have risen 3.5 percent compared to last year.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.