Home loans are falling by 23% as interest rates rise

- Lending for home purchases has fallen to £130 billion by 2023 – the lowest in seven years

- High interest rates and the cost of living are taking their toll

- This figure is expected to fall to £120 billion next year, before picking up again in 2025

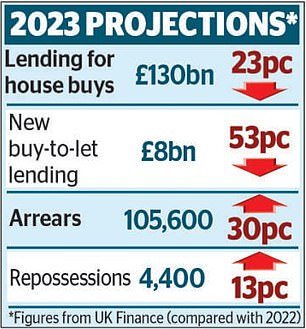

Mortgage lending is expected to fall by a quarter this year, while the number of borrowers in arrears exceeds 100,000 – with worse consequences in 2024, data shows.

Lending for home purchases has fallen by 23 percent to £130 billion by 2023 – the lowest in seven years, as high interest rates and the cost of living take their toll.

And this figure is expected to fall to £120 billion next year, before rising again in 2025, according to a report from UK Finance, which represents banks and building societies.

Dive: Lending for home purchases down 23 percent to £130 billion by 2023 – the lowest in seven years

The report states: 'The outlook for 2024 is one of continued challenges; However, the pressure on affordability appears to be reaching its peak. We expect things to look better in 2025.”

The number of customers in arrears will reach 105,600 this year – the highest number since 2014 – and then 128,800 in 2024 and 137,800 in 2025.

Seizures are expected to reach 4,400 this year and then rise further, but remain relatively low compared to historical levels. In 2012 there were more than 30,000.

UK Finance says affordability rules for mortgage borrowers introduced in 2014, as well as low unemployment, are preventing repayment problems.

The figures come as homeowners face pressure from rising interest rates. The Bank of England said last week that while around five million households had already seen their deals reviewed, around five million households remained to be affected.

At the same time, families are put under pressure by high inflation.

James Tatch, head of analysis at UK Finance, said: '2023 has been a challenging year for both potential and existing mortgage lenders, with affordability under pressure due to higher interest rates and the increased cost of living, as well as house prices still at high levels. level compared to income.

“We expect lending to remain weak in 2024, with a modest increase in activity in 2025.”