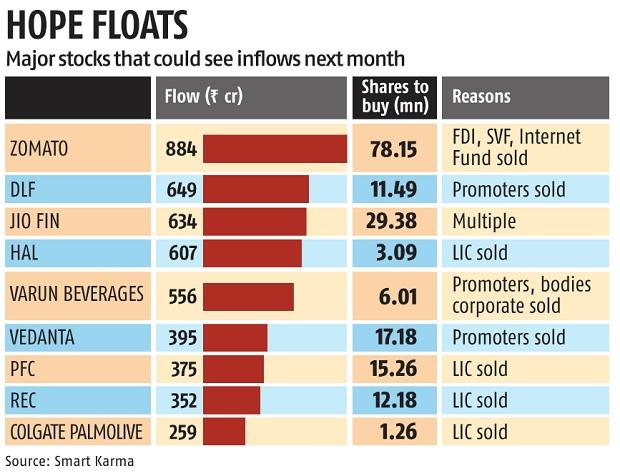

Higher free float to stoke passive flows in Zomato, DLF and Jio Financial

Zomato, DLF and Jio Financial Services are among the nine stocks that will see inflows from exchange traded funds (ETFs) that track local and global indices. The move follows an increase in free float in these stocks due to selling by promoters and large institutions such as Life Insurance Corporation (LIC) and Softbank Vision Fund (SVF).

More companies could be added to the list if they announce their shareholder pattern for the September 2023 quarter.

“In recent weeks, companies in India have announced their shareholder pattern from the end of September. We looked at the shareholder patterns of large companies to check for changes in the free float over recent quarters, especially where there might be passive flows into the shares from index trackers,” said analyst Brian Freitas of Periscope Analytics, which publishes on Smartkarma . . He estimates that the highest purchase value is almost Rs 900 crore in Zomato, where SVF sold shares worth almost Rs 1,000 crore in August.

DLF is expected to see passive inflows of Rs 650 crore. On August 1, founder KP Singh divested 0.59 percent stake in the real estate company to raise Rs 731 crore. Among public sector stocks (PSUs), Hindustan Aeronautics (HAL), Rural Electrification (REC) and Power Finance (PFC) will increase their weightage following the share sale by LIC. Interestingly, Adani Enterprises and Adani Green Energy have also seen an increase in free float as the promoter group has divested stakes. However, Freitas said this may not lead to changes in their weightings. For other stocks, the free float changes will occur at the end of the global indices on November 30.

First print: Oct 19, 2023 | 11:33 PM IST