Here’s how new pension changes could give young workers a £120,000 boost

Young workers could get a £120,000 boost to their pension pot when they reach retirement age, under new auto-enrolment rules introduced into law today.

More people on lower incomes and young workers aged 18 to 21 will be covered by automatic pension enrollment, although the timing is not yet set and the changes are expected to be phased in to avoid people seeing their contributions overnight to rise.

The age limit for automatic enrollment will be lowered from 22, meaning that young people who have the most to gain from compound investment growth will start saving sooner.

Lifelong savings: Young workers could get a £120,000 boost to their pension pot when they retire

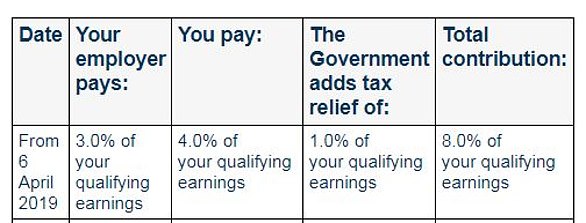

Meanwhile, the income range, currently £6,240 to £50,270, over which employees, employers and the government make at least 8 per cent contributions to pensions, will be widened.

The lower limit of that bandwidth will be abolished, allowing people to save from the first pound of income. The trigger for auto-enrolment is earning £10,000 or more.

Pensions industry experts welcomed the news that the bill to extend automatic enrollment received royal assent today – noting that the government’s own analysis says this will increase overall contributions by £2 billion a year.

The government supported the bill and pushed for the changes from Jonathan Gullis, the Tory MP for Stoke-on-Trent North. He introduced it in the House of Commons, and it was passed through the House of Lords by the former Pensions Secretary, Baroness Altmann.

The government itself first proposed the measures at the end of 2017, but warned at the time that they would not be introduced until the mid-2020s.

Young workers could get a £120,000 boost to their pension pots

Figures analysis by AJ Bell shows that every auto-enrolled worker should ultimately see their contributions rise by £500 a year – including free employer money – giving someone aged 18 a £120,000 increase to their pension pot at age 68.

That assumes the lower qualifying income limit is permanently eliminated and would otherwise have increased annually by 2 percent, and an annual investment return of 4 percent, net of fees.

AJ Bell says: ‘If an 18-year-old earning £20,000 starts saving 8 per cent of his income, he could save £386,508 by the age of 68, assuming contributions rise by 2 per cent each year in line with with the income, the upper The profit limit is also increased by this percentage, and an investment return of 4 percent after deduction of costs.

‘If the same person started saving at the age of 22, their pension pot would be £340,553 – £45,955 lower.’

Head of policy development Rachel Vahey added: ‘These auto-enrolment changes have been a long time in the making, but this week marks an important step towards better outcomes for millions of pension savers.

STEVE WEBB ANSWERS YOUR PENSION QUESTIONS

‘In 2017 the government promised to make these fundamental changes to lower the age limit and count from the first pound of income.

‘Everyone with a standard occupational pension that meets the minimum requirements will receive more money for their pension from their employer.

‘But they must remain signed up to the scheme to benefit from it, and leaving the pension means giving up the extra employer pension payment and tax relief on their contributions.’

‘While these changes may seem small, they could provide a big boost to retirement savings, especially for lower earners and younger workers.’

The change in pension contributions will probably be introduced gradually over a number of years

Kate Smith, head of pensions at Aegon, said: ‘Today is a momentous day for auto-enrolment and for pension savers, especially those on low incomes and younger workers.

‘Contributions will be based on the first pound of income rather than a range above £6,240 (meaning) contributions from both individuals and employers will increase, leading to larger pension pots later in life.

‘Employees pay 5 per cent so this works out to an extra £312 per year, but after tax relief this is just over £20 per month. But with employer contributions this will increase by an additional £499 per year.

‘The next step is to implement the changes and it is expected that the government will soon consult on an implementation plan.

‘We believe that this should happen in two to three years, from April 2025 at the latest, in phases, so that employers and employees can get used to the increased premiums. Otherwise, someone earning £12,480 would double their contributions overnight.”

Smith added: ‘It’s time to think about increasing auto-enrolment contributions to 12 per cent of income, shared equally between employers and employees, with solutions targeted at those on the lowest incomes.’

Changes will help young people, women and people with lower incomes

Work and Pensions Secretary Mel Stride said: ‘Thanks to auto-enrolment, we are enabling record numbers of British workers to invest in their financial future – saving an additional £33 billion in 2021 compared to 2012.

‘This bill means millions of people across the country can save more, earlier – increasing security in old age and helping people achieve the pensions they’ve worked so hard for.’

Gullis said: ‘Automatic enrollment is an important step forward and will dramatically improve the financial resilience in retirement of young people, women and those on lower incomes.

‘Nearly 25 per cent of people in Stoke-on-Trent North, Kidsgrove and Talke are not yet automatically enrolled in a pension scheme, and this piece of legislation will ensure part-time women, apprentices and young people have financial stability in their country. the long term.’

Baroness Altmann said: ‘Improving pensions for lower incomes and young people is welcome news, but there is of course more to do.

‘This includes enrolling all workers who earn less than £10,000 a year, especially people – especially women – who have more than one job, each paying less than £10,000 a year and who are currently missing out on automatic enrollment altogether.

‘Also extending nudge principles to the self-employed to encourage them to build up a pension and help people consolidate small pension pots that are left behind and sometimes forgotten when employees change jobs.

‘The idea of developing one ‘lifelong’ pension fund that people become owners of could be the next phase. The government is discussing measures to tackle this problem.’

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.