Have you overpaid in realtor fees? Home buyers in Hawaii fork out FIVE times more in expenses than those in West Virginia – so how does your state compare?

Real estate prices in the United States are skyrocketing, as are real estate agent fees.

And in some states, where homes sell for almost $1 million on average, they can fetch more than $40,000 per sale.

In Hawaii, shoppers spend more than anywhere else in the U.S., averaging $44,600 per purchase, while in West Virginia, where prices are lowest, fees are less than $9,000, study finds carried out by a credit company. Self-financing.

The average real estate agent’s commission has remained fairly stable over the past 20 years, hovering just above 5% and increasing from an average of 4.94% in 2019 to 5.13% in 2023.

Nationwide, the average home purchase in 2023 cost $26,493 in real estate agent fees, with buyers and sellers paying about half each in commission to their respective real estate agents. The data used was based on a 3 bedroom house.

In Hawaii, the average home sale will earn real estate agents more than $44,000 in commission, according to a study by Self. In West Virginia, home prices are the lowest and real estate agent fees cost an average of $8,954.

Usually, the buyer’s and seller’s real estate agents split the commission 50/50, but this can vary depending on the experience of the real estate agent.

Behind Hawaii, California real estate agents are the second highest paid earners, with the average sale having both real estate agents incur a combined commission of $34,464.

Behind California, the most expensive states in terms of real estate agent fees were Washington, $29,362, and Colorado, $28,469.

Behind West Virginia, the cheapest are Mississippi, Oklahoma, Louisiana and Kansas – with average fees of just $10,088, $10,999, $11,390 and $11,578 respectively.

The Midwest had some of the highest fees as a percentage of the purchase price. In Ohio, they charge the highest commission at 5.81%, averaging $12,006 per transaction.

Georgia had the second highest fee rate, at 5.76 percent, followed by Missouri at 5.72 percent.

For a real estate agent, closing a transaction can take weeks or months and agents typically only receive payment if the property sells. According to the National Association of Realtors, real estate agents successfully help buy or sell an average of 10 homes per year.

Although the buyer’s and seller’s real estate agents typically split the commission 50/50, this can vary depending on the experience of the real estate agent.

While real estate agents made an average of $15,361.65 per home sale in 2023, the commission decreased slightly from 5.42% in 2000 to 5.13% in 2023.

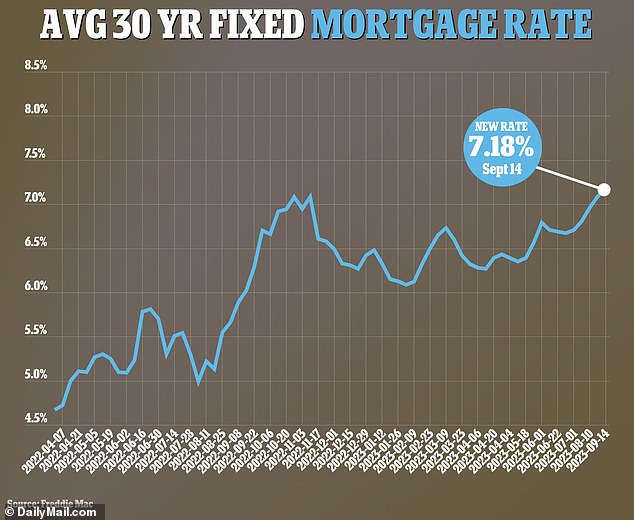

And while real estate agent fees declined between 2022 and 2023, home sales also declined as interest rate hikes by the Fed pushed mortgage rates higher.

The average 30-year mortgage rate hovers around 7.14%, according to the latest data from government-backed lender Freddie Mac.

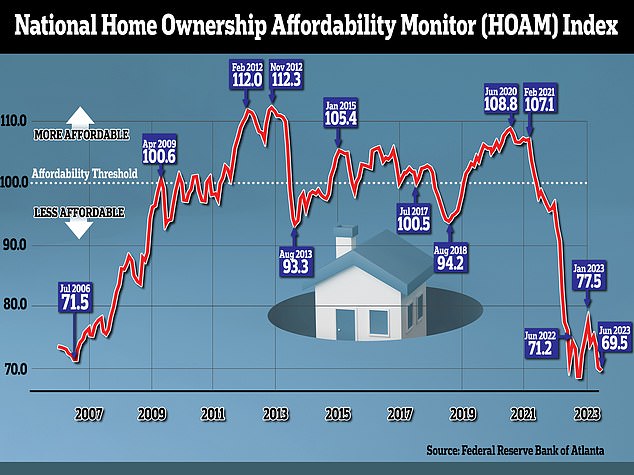

Homebuyers are facing the least affordable market since 2006, according to figures from the Federal Reserve Bank of Atlanta.

The number of new homes under construction fell last month to 1.3 million, 11.3 percent fewer than in July and 14.8 percent fewer than last August, according to data released this week by the United States Census Bureau.

The average 30-year mortgage rate hovers around 7.14 percent, according to the latest data from Freddie Mac. This is just below its highest level since 2002.

Homebuyers are facing the least affordable market since 2006 — below levels seen during the peak of the housing bubble that preceded the 2008 financial crisis, according to a separate analysis from the Atlanta Federal Reserve.

The Atlanta Fed uses home prices, mortgage rates and average incomes to calculate an “affordability” score each month.

The latest figures, from June 2023, show the score has plunged to 69.5, almost 40 points lower than it was in June 2020.