Has YOUR 401(K) shrunk? Average American’s retirement balance falls 4% as more and more savers dip into their later life savings to make ends meet

Rampant inflation and persistent economic uncertainty have caused the average U.S. 401(K) balance to plummet by nearly 4 percent, a new analysis shows.

Figures from Fidelity Investments, one of the largest retirement plan providers in the US, show that the average 401(K) fell to $107,700 in the third quarter of the year, compared to $112,400 in the second quarter.

Individual retirement account (IRA) balances also fell to $109,600 from $113,800 in the same period.

A 401(K) is generally offered by an employer – and allows higher annual contributions – while an IRA is typically set up by an individual through a broker or bank and has more investment options.

Researchers noted that this trend is partly driven by an increase in the number of workers receiving hardship payments and loans from their 401(K)s.

Rampant inflation and persistent economic uncertainty have caused the average U.S. 401(K) balance to fall 4 percent, a new analysis shows

Despite the gloomy findings, pension pots remain much healthier than a year ago, the report said.

In the third quarter of 2022, the average 401(K) held $97,200 – $10,500 less than today.

Kevin Barry, president of Workplace Investing at Fidelity, said: “Americans have become accustomed to riding the economic waves in recent years, and this quarter is no different.

“They learn how to stay afloat in very challenging financial circumstances, including having enough money set aside in case an emergency arises.”

The analysis also found that younger workers invested more in their savings later in life, especially in IRAs.

The average IRA of a Gen Z investor — born between 1997 and 2012 — grew 63 percent in the past year, according to Fidelity.

But researchers also noted an increase in withdrawals from retirement accounts. In the third quarter of the year, 2.3 percent of workers withdrew from hardship, up from 1.8 percent in the three months before.

Anyone who wants to use their 401(K) will be liable for income taxes on the withdrawal. And if they do so before age 59.5, they have two options: they can take out a loan or take a hardship claim.

With the latter, an employee can only use it if he is in “immediate and severe financial need,” such as an unexpectedly high medical bill. The amount may only be the amount necessary to cover this need.

They will then receive a fine worth 10 percent of the withdrawal. Some exceptions exist, for example if this is agreed under a qualified domestic relations decision.

The rules surrounding hardship withdrawals from IRAs are more flexible. Owners of these accounts can avoid the 10 percent penalty if the money goes toward: higher education expenses, a first home – although this is limited to $10,000 – unreimbursed medical expenses more than 10 percent of adjusted gross income, health insurance premiums while unemployed.

Employees also have the option to take out a loan from their pension pots. With a 401(K), they have the option to withdraw $50,000 or half of the amount in your account – whichever is less – provided they pay it back within five years.

IRA owners do not have the option to take out a loan from their accounts.

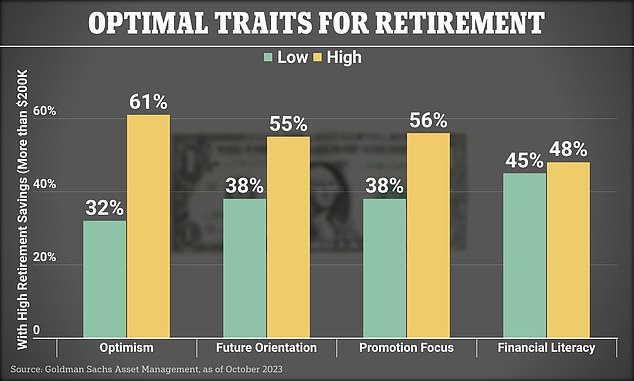

Researchers have identified four key traits among those with the best savings, including: high optimism, future orientation, financial literacy and reward orientation.

According to Fidelity, 2.8 percent of 401(K) plan participants took out a loan from their pot in the third quarter of the year, up from 2.4 percent in the same period in 2022.

Because withdrawals are costly and cause a dip in retirement savings, Fidelity previously advised households to focus on building emergency funds rather than relying on their retirement savings.

A previous report from the provider said: ‘Employees who have access to short-term savings when they need them have greater financial security and score higher on financial well-being.’

Crucially, emergency funds must be highly liquid and provide households with quick access to cash, without forcing them to explore high-interest alternatives.

The Fidelity report comes after separate research from Goldman Sachs identified the four key qualities employees need to build a healthy retirement.

Goldman Sachs Asset Management surveyed 5,261 American employees and retirees for the report.

Researchers identified four characteristics of those with the best savings, including: high optimism, future orientation, financial literacy and reward orientation.

Yet only one in ten respondents had all four characteristics and 5 percent had ‘suboptimal’ characteristics, meaning they had low optimism, future orientation, financial literacy and risk orientation.