Former Greens politician’s shocking message for landlords and real estate agents: ‘Better cut the rent soon cos we ain’t gonna riot gently’

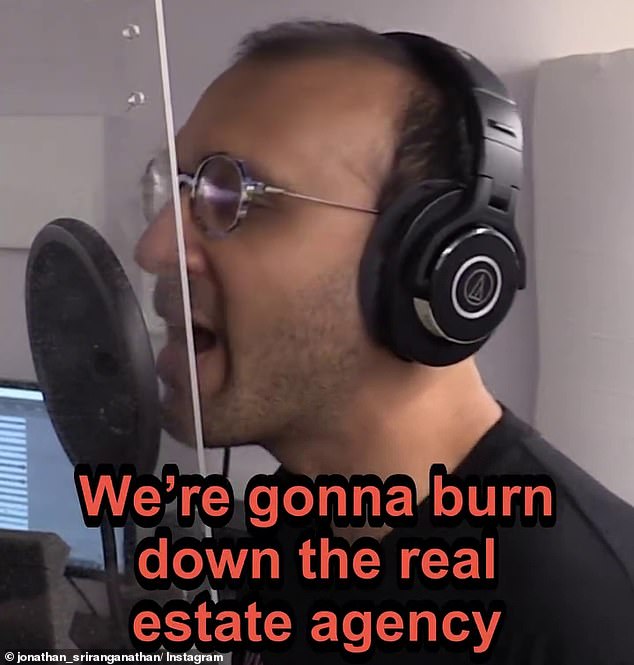

A former Greens councilor who once ran for mayor of Brisbane has released a song claiming tenants could set fire to their real estate agents’ offices if their rent is increased.

Jonathan Sriranganathan served on Brisbane City Council from 2016 to 2023 before making a bid for the city’s top public office in 2024, where he finished third behind Labour’s Tracey Price and the current mayor, the LNP’s Adrian Schrinner.

Brisbane born and bred Sriranganathan now dedicates his time to his work as a writer, musician, beat poet and community events organizer – with his band Rivermouth’s latest song entitled ‘Notice to Leave’ targeting landlords and property agents .

“It is better to reduce the rent quickly because we are not going to riot quietly,” Sriranganathan’s rapped texts warn.

‘Real estate parasites love a bit of homelessness. If everyone had housing, they would have to charge us less.”

Sriranganathan claimed that those who own property “don’t want solutions” because “the problem makes them rich” before uttering the ominous line that “nothing will change until we flip a bigger switch.”

The song’s repeated refrain reads, “If you keep raising the rent, we’re going to burn down the real estate office.”

He acknowledges that the lyrics in the song could be called incitement before justifying them as “just calling out what the mood is like” and saying, “You can’t ignore a message when it’s on fire.”

Former Brisbane Greens councilor and Brisbane mayor candidate Jonathan Sriranganathan (pictured left with Greens leader Adam Bandt)

According to a report from housing affordability advocacy group Everybody’s Home, released in October, Australians spent an average of almost $15,000 more per year to rent a home this year than in January 2020.

For people living in Sydney and Perth, that amount was more than $18,000 per year more.

In an introductory essay to the song, he explained that the lyrics were formed over a number of years “in response to Queensland’s worsening rental crisis.”

Sriranganathan himself lives on a houseboat called ‘Afterglow’ on a creek near the Brisbane River, which he bought in March 2017 for about $30,000, and pays no mooring fees.

He also owns a 4WD and a caravan, and keeps them parked on the street next to his boat.

“The lyrics speak, among other things, to the frustrations of gentrification, and to the nagging feeling that the unpaid or underpaid work that so many of us do to make our communities more creative and socially connected can ultimately work against us.”

He said the second verse of Notice to Leave – named after the eviction notice landlords sent to tenants in Queensland – draws a link between colonialism and the treatment of housing as a commodity, subdividing land to sell or rent it for a profit. .’

One of the Greens’ policies at last year’s Brisbane council election was a two-year rent freeze to “catch up wages and relieve renters”.

This would have been enforced by charging significantly higher council rates to property investors who had increased rents above January 2023 levels.

‘Some investors have been concerned about rent freezes’, but there are many others who say that if a landlord has managed its finances so poorly that it can’t cover its costs without stiffing its tenants, it should probably just to sell.’ he said at the time.

‘Tenants and owner-occupiers are very enthusiastic about our proposal for a two-year freeze on rent increases. Even people who own their own homes can see that we urgently need to do something to prevent more people from becoming homeless.”

Sriranganathan claims that his lyrics do not incite violence, but “merely raise the mood” of tenants

The federal government is trying to address the rental shortage by adding tens of thousands of additional rental units.

The changes, which were approved by the Senate last week, pave the way for more owner-occupied homes, a model in which developers and financiers stick to large-scale housing projects to rent out homes in the long term.

In Australia, most housing developments are built with the intention of selling every home.

Housing Minister Clare O’Neil said build-to-rent is not a silver bullet to the housing crisis, but it is expected to produce 80,000 new rental properties in ten years.

“I am convinced that this is a very important part of the answer to our housing problems in this country, not perfect, because nothing in life is ever anything other than a good step forward for us,” she told reporters in Canberra on Thursday.

In order to grant concessions to build-to-rent operators, they must offer a minimum of five-year leases and evictions without cause are not allowed.

Representatives from both the real estate and community housing sectors welcomed the changes.

Mike Zorbas, chief executive of the Property Council, said the build-to-rent concessions were groundbreaking.

“Eighty thousand new homes in 10 years are more important than any other effort by any federal government to address the rental shortage in this country,” he told reporters Thursday.

Wendy Hayhurst, director of the Community Housing Industry Association, highlighted the provision that 10 percent of all homes built under the rules must meet affordability definitions.

“It will also create a pipeline of truly affordable housing over a longer period of time, which is something we haven’t had in this country for a very long time,” she said.

The federal housing policy has struggled to gain the political support needed to pass parliament, but earlier this week the Greens chose to support the bill and pushed its way through the Senate.

Michael Fotheringham of the Australian Housing and Urban Research Center said built-to-rent is not a panacea for the country’s housing problems, but a good policy to pursue if the goal is to improve urban density with more townhouses and apartments.

Business owners tend to behave differently than small-scale investors, he further explained.

“They are less likely to be thinking about exchanging the property for capital gains, and more likely to be thinking about long-term stability and rental income as a source of income,” he says.

Daily Mail Australia has contacted Jonathan Sriranganathan, Brisbane City Council and the Real Estate Institute of Queensland for comment.