Greedy designer brands are forced to slash prices of most popular purses after bid to alienate middle class shoppers in favor of ultra-rich tanked profits

Luxury brands are quietly slashing the prices of designer bags after being presented with ideas that are beyond their means.

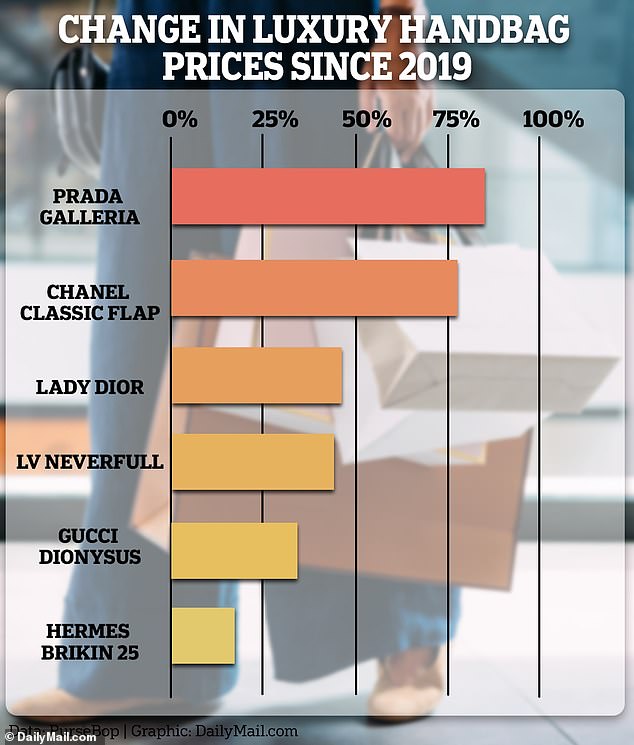

Brands like Burberry and Yves Saint Laurent have been raising the price of their coveted accessories for years in an attempt to improve their image.

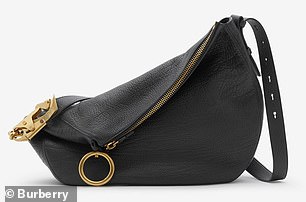

But Burberry has slashed the price of its medium-sized Knight handbag by 22 percent and YSL has cut the price of its Loulou bag by 10 percent after discovering they had been squeezing the customers who kept them in business.

“When you move upmarket, you can’t start by raising prices; you have to start with desirability,” said Pauline Brown, former chairman of LVMH, which owns Louis Vuitton.

‘All this doesn’t happen overnight. You have to involve the consumer.’

Supermodel Irina Shayk is among the many celebrities who are fans of Burberry’s iconic handbags, but the company is slashing prices after being accused of alienating its loyal customers

Yves Saint Laurent has also started cutting prices as its bid for exclusivity has hit profit margins

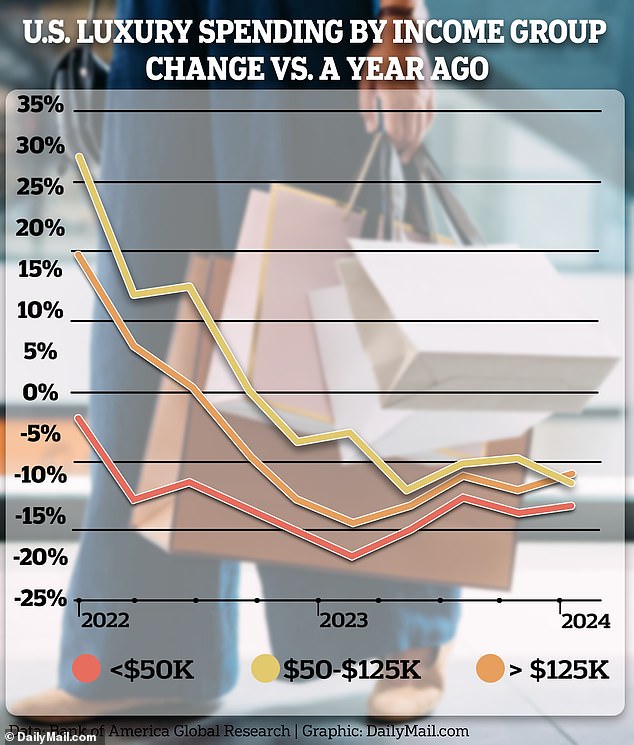

According to an analysis by the Boston Consulting Group, there are approximately 2.5 million people worldwide who spend more than $20,000 a year on luxury goods.

Yet they account for only 10 percent of sales, while more than half of sales are made by the approximately 330 million people who spend less than $2,000 a year.

Burberry has slashed 22 percent off the price of its mid-sized Knight handbag

Spending by both groups has plummeted since the pandemic, as consumers tighten their belts while luxury brands raise prices to maintain their “exclusive” image.

But Burberry fired its CEO last week after issuing its fourth profit warning in nine months, while its share price fell to a 14-year low.

German designer Hugo Boss has also issued a profit warning and Swatch’s net profit has fallen 70 percent so far this year due to a “huge drop in demand” from customers in China.

Burberry has now significantly reduced the price of its Knight handbag and given a 5 percent discount on all bags designed by top designer Daniel Lee.

While Yves Saint Laurent Loulou bags are now selling for $2,650 in U.S. stores — down $300 from January, according to the WSJ.

And the stakes have risen even higher, with handbag sales now accounting for an average of 45 percent of luxury brands’ revenues – up from 34 percent in 2008.

Burberry’s new CEO Joshua Schulman has pledged to make the brand’s luxury goods more accessible to its most loyal customers.

But the small Lola bag still costs well over $2,000, up 40 percent from pre-pandemic levels, while YSL’s Loulou bag retailed for $2,050 in early 2021.

Only the most exclusive brands seem to be able to ignore the purchasing power of the middle class. Cartier owner Richemont, for example, last week reported a four percent increase in sales for its jewelry brands, including Van Cleef & Arpels.

Gucci is set to target its wealthiest clients even more, the WSJ reported, as analysts closely monitor earnings reports from Hermès and Louis Vuitton later this week.

The decline in US sales is also being seen in the huge Chinese market, where consumers are struggling due to the continued decline in home prices.

And luxury brands are watching with bated breath as lower-priced competitors attempt to woo customers they have alienated.

Chinese manufacturers including Songmont, which produce quality products that are much cheaper than their more expensive competitors, are eroding a luxury market previously dominated by Western brands, the WSJ reports.

“Brands cannot afford to alienate these customers,” warned Bain & Company analyst Claudia D’Arpizio.