Gold Hits New Record High Above $2,500: What’s Driving the Price and How to Invest?

Physical Gold: Demand may vary seasonally, such as for the Diwali festival in India and the Chinese New Year

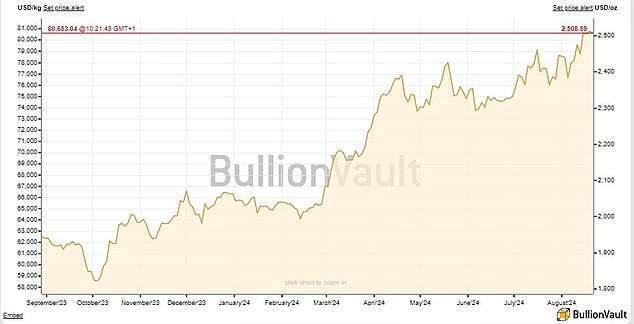

Gold prices hit a record high of $2,531.60 an ounce on Tuesday, ahead of a series of US interest rate cuts before the end of this year.

The prospect is generating excitement among ‘gold diggers’, who are always optimistic about the precious metal.

Even more sceptical investors are alert to buying opportunities in gold, which has risen by more than a fifth since January.

Bitcoin may have dominated the news for years, but gold still has the power to grab attention, especially now that the mighty US central bank is about to embark on a cycle of rate cuts.

You certainly don’t have to be a gold digger to recognize the benefits of a well-balanced portfolio.

Precious metals are a way to store wealth and protect against inflation. They are a useful way to diversify and a safe haven during financial and political turmoil.

However, you must keep a clear eye because gold does not generate income and its price can be unpredictable. There are many factors that work together or conflict with each other and that can have a weaker or a more dominant influence at any given time.

Sometimes price can result in a tug of war between opposing parties.

A few years ago, the US Federal Reserve started raising interest rates, which reduced the demand for gold. However, inflation and volatile stock markets still caused the price to rise.

The following factors may have an influence.

Purchases of physical gold: Ask about coins, bars and jewelry, which can be seasonal. For example, the festival of Diwali is a popular time to buy gold jewelry in India, and so is the Chinese New Year for all types of physical gold.

Inflation expectations and future interest rate decisions: The most important are the measures taken by the world’s most powerful central bank, the US Federal Reserve.

Interest rate cuts, or even the expectation of them, make gold more attractive to investors because they weaken the dollar and can fuel inflation.

A strong market consensus on what a determined Fed will do next could outweigh a number of competing factors driving gold prices.

Central bank purchases: Many people love to own gold and have deep pockets, although some reportedly conduct their transactions under the radar – see below.

Gold Price: Investors have seen value rise by more than a fifth since January (Source: BullionVault)

Mysterious buyers: In recent years, there has been much speculation that secret trading activities influence the price of gold.

The main suspects are either the Chinese or Russian central bank, or perhaps both.

The invasion of Ukraine led to sanctions against Russia, which has the world’s second-largest gold mining industry.

Meanwhile, there is speculation that China is understating its central bank’s gold reserves, possibly because it wants to build up a war chest against Western sanctions if it invades Taiwan.

The US can prevent sanctioned countries from trading dollars through their financial system.

Even less powerful countries than China or Russia might be tempted to quietly build up gold reserves to bolster their financial position in case they come into conflict with Washington and the West.

The US dollar: A strong dollar makes gold more expensive, which can scare off all kinds of buyers and depress the price.

This is because it is denominated in the US currency, so when the dollar is strong it can price out foreign buyers. Conversely, a weaker dollar can help boost the price of gold.

Geopolitical events and crises: Gold is seen as a safe haven in times of trouble. But so is the dollar, which can also strengthen in times of trouble, so these two trading trends sometimes work against each other.

Institutional investors and hedge funds: Even if demand for physical gold is high, this can be offset by the volatility of ‘paper gold’, in the form of ETFs held by institutional investors such as banks and hedge funds.

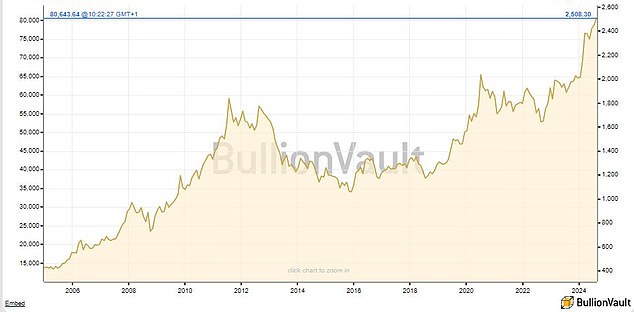

Two Decades of Gold Prices in Dollars

Source: BullionVault

Commenting on recent price trends, Ben Seager-Scott, Chief Investment Officer at financial advisory firm Forvis Mazars, said: ‘Investors are clearly still attracted to gold, likely due to its traditional role as a safe haven, particularly given the volatility we have seen in recent weeks and increased geopolitical concerns.

‘It is somewhat surprising that gold is still in demand as a non-yielding asset given current interest rates. But with cuts on the horizon, this could stimulate new demand.’

Adrian Ash, director of research at online gold service BullionVault, said previous gold price records have also coincided with the peak of the summer trading season – in August 2011 and 2020 – when trading offices are empty for the holidays.

Adrian Ash: The risk of an economic recession plus the current ongoing geopolitical turmoil is likely to boost investor demand for precious metals

But he said: ‘Rather than fighting the crisis from the beach, traders are bidding up stocks and bonds, as well as gold, this time on expectations that the US Fed will cut interest rates from 20-year highs.’

Ash revealed that BullionVault customers have been using gold’s new highs to cash in on profits since last weekend.

Still, he thinks lower interest rates will support new record gold prices and the stock market.

“The risk of an economic recession and today’s ongoing geopolitical violence are likely to bolster investor demand for precious metals, alongside record pace of central bank buying in Asia and other emerging markets,” he stressed.

Sheridan Admans, head of fund selection at investment platform Tillit, says this about how investors can use precious metals in a balanced portfolio: ‘Gold and silver can often be good diversifiers for a portfolio, with weak correlations to equities, bonds and other commodities.

‘However, gold is seen as a better diversifier of the two. Silver’s correlation with industrial demand can cause the supply and demand factors to change dramatically depending on the market backdrop.’

According to Admans, investors turning to precious metals as a safe haven in uncertain times may find it reassuring that they are physical assets, even if you are buying through a fund.

“Gold and silver have historically been reliable hedges against inflation and have performed well during periods of US dollar weakness,” he added.

‘However, investors should be cautious. There is no such thing as a free lunch. While gold and silver can provide an element of protection within the portfolio, they do not provide returns and can be very volatile in terms of price.

‘In general, it is recommended to limit your exposure to precious metals to, say, 5 or 10 percent.’

Admans offers tips on the following precious metal funds. Also check out our guide to investing in gold, which contains even more recommendations.

Sheridan Admans: Gold and silver can often be good portfolio diversifiers, with weak correlation to stocks, bonds and other commodities

Hanetf The Royal Mint Responsibly Sourced Physical Gold ETC (Ongoing costs: 0.25 percent)

Passive alternative investment fund that offers exposure to gold without having to physically own the precious metal directly. writes Admans.

It is a responsibly sourced, low-carbon, physical gold product that holds investors’ gold reserves in dedicated accounts within the Royal Mint’s vaults.

Because the Royal Mint holds the gold in this fund, it is kept outside the commercial banking system. This provides investors with some security against systemic failure.

Jupiter Gold & Silver (Ongoing costs: 0.92 percent)

Fund that invests exclusively in gold and silver through shares and precious metals, obtained through physical gold or silver traded on the stock exchange.

The composition of the fund varies depending on how bullish or bearish the manager is. In general, if the manager has a bullish outlook, the fund will hold significantly more equities than precious metals and a fairly even split between gold and silver.

Conversely, if the manager has a pessimistic view, the fund will typically maintain a roughly equal split between equities and precious metals, with a higher weighting towards gold.

Most precious metals funds focus on gold mining companies. The silver and precious metals factors, along with the overall flexibility, make this fund quite unusual.

DIY INVESTMENT PLATFORMS

AJ-Bel

AJ-Bel

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive investor

interactive investor

Fixed investment costs from £4.99 per month

Saxo

Saxo

Get £200 back on trading fees

Trading 212

Trading 212

Free trading and no account fees

Affiliate links: If you purchase a product, This is Money may earn a commission. These deals are chosen by our editorial team because we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.