Glamorous Florida woman sentenced to 20 years in prison for running $200M animal rescue Ponzi scheme

South Florida’s glamorous “Mother Teresa” has been sentenced to 20 years in prison after she led a nearly $200 million Ponzi scheme that defrauded several investors.

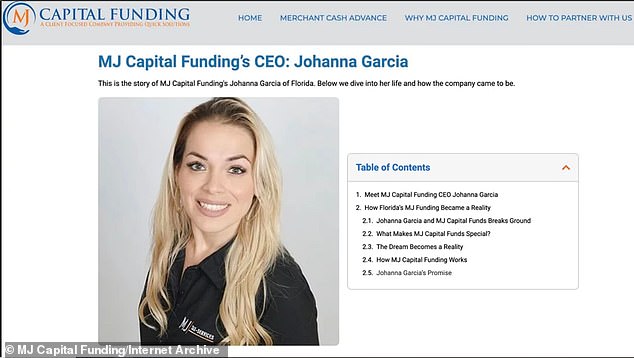

Johanna Michley Garcia, 41, has been sentenced to 20 years in prison after pleading guilty for her role in a $190,700,000 Ponzi scheme as the former CEO of MJ Capital Funding, LLC.

In July, Garcia pleaded guilty in Broward County, Florida, to conspiracy to commit mail and wire fraud against more than 2,000 investors.

She and her co-conspirators used entities not registered with the Florida Division of Corporations to raise between $3.2 and $4 million from at least twenty investors. Miami Herald.

A Ponzi scheme typically pays early investors with money from later investors to create the illusion of profit. Her company, founded in 2020, promised to connect investors with small businesses through merchant cash advances, or MCA.

One of the investors, Steven Shulman, was “devastated” to learn that his money, intended for a nonprofit organization, had been lost.

“I researched her and she came to me with her story and her background,” he said NBC. ‘I was blind, I was devastated, I cried, I was sad, I realized: what should I do?’

Shulman is the CEO and founder of Animal Care Now, a nonprofit organization that provides emergency funding to animals in need and has entrusted $50,000 to Garcia.

Johanna Michley Garcia, 41, has been sentenced to 20 years in prison after pleading guilty for her role in a $190,700,000 Ponzi scheme as the former CEO of MJ Capital Funding, LLC

Garcia conspired with others to “fraudulently solicit money from investors to fund MJ Capital Funding’s MCAs” and recruited other people with paid commissions to solicit investors, the law firm said

She and her co-conspirators used entities not registered with the Florida Division of Corporations to raise between $3.2 million and $4 million from at least 20 investors, according to her guilty plea.

‘The money I lost would save the lives of animals in need. My insurance business faltered, Covid put an end to it, and my real estate business put an end to it, so this came at an opportune time.”

Despite heartbreakingly losing his money, he is satisfied that justice is being served.

“I wouldn’t get any money back, I lost everything, but at least she won’t be able to hurt anyone and her nefarious ways of doing things are over,” he told the outlet.

Her business biography described Garcia as a “hard-working woman who has her priorities in line.” She boasted that she was a down-to-earth businesswoman who helped ordinary people generate wealth and was even called “Mother Teresa” in her community. New York Post reported.

The conspiracy involved Garcia who led others, including Pavel Roman Ruiz Hernandez, in the Ponzi investment fraud scheme, the Southern District of Florida Attorney’s Office said.

Garcia conspired with others to “fraudulently solicit money from investors to fund MJ Capital Funding’s MCAs” and recruited other people with paid commissions to solicit investors, the law firm said.

“However, the company made few loans and failed to generate anywhere near the profits needed to pay investors the promised returns,” they said.

Due to the lack of income, Garcia allegedly paid investors with other investors’ money, “while embezzling millions of dollars for her own personal benefit.”

“I wouldn’t get any money back, I lost everything, but at least she won’t hurt anyone and her nefarious ways of doing things are over,” said investor Steven Schulman.

After the Federal Bureau of Investigation and the SEC shut down MJ Capital Funding, Garcia, Ruiz Hernandez and others began a new, similar scheme. Garcia led the new scheme until her arrest, and then she served time in jail

Due to the lack of income, Garcia allegedly paid investors with other investors’ money, “while embezzling millions of dollars for her own personal gain.”

Of the nearly $200 million raised, investors lost nearly $90 million, according to the law firm.

In April 2021, MJ Capital was accused of running a Ponzi scheme. Garcia sued the anonymous whistleblower for defamation and continued to collect investments until August 2021, when the Securities and Exchange Commission filed a formal complaint against the company.

According to the court documentthe SEC alleged that Garcia’s company used investors’ money to finance “beyond annualized ‘returns’ of 120% to 180%, while the company’s superiors hid the money for their own expenses.”

After the Federal Bureau of Investigation and the SEC shut down MJ Capital Funding, Garcia, Ruiz Hernandez and others began a new, similar scheme.

Garcia led the new scheme until her arrest, and then she served time in jail. The new fraud scheme included New Beginning Global Funding LLC, New Beginning Capital Funding LLC, Lion Heart Capital Group LLC, GMR Remodeling LLC and Group Management LLC.

The scheme functioned similarly to the original MJ Capital Funding program, using investors’ money to pay previous investors and fund the conspirators’ lifestyles.

Garcia’s co-conspirator, Ruiz Hernandez, was charged in August 2022 and found guilty in August 2023. Ruiz Hernandez was subsequently sentenced in September 2023 to 110 months in prison with three years of supervised release.