Gen Z worker on average salary reveals she’s ‘no longer broke’ after ‘money hack’ trick to budget her income

A Gen Z worker on an average salary reveals she’s ‘no longer broke’ after a ‘money hack’ trick to budget her income

A Gen Z worker on an average salary has revealed her budget tips that she claims saved her from going broke.

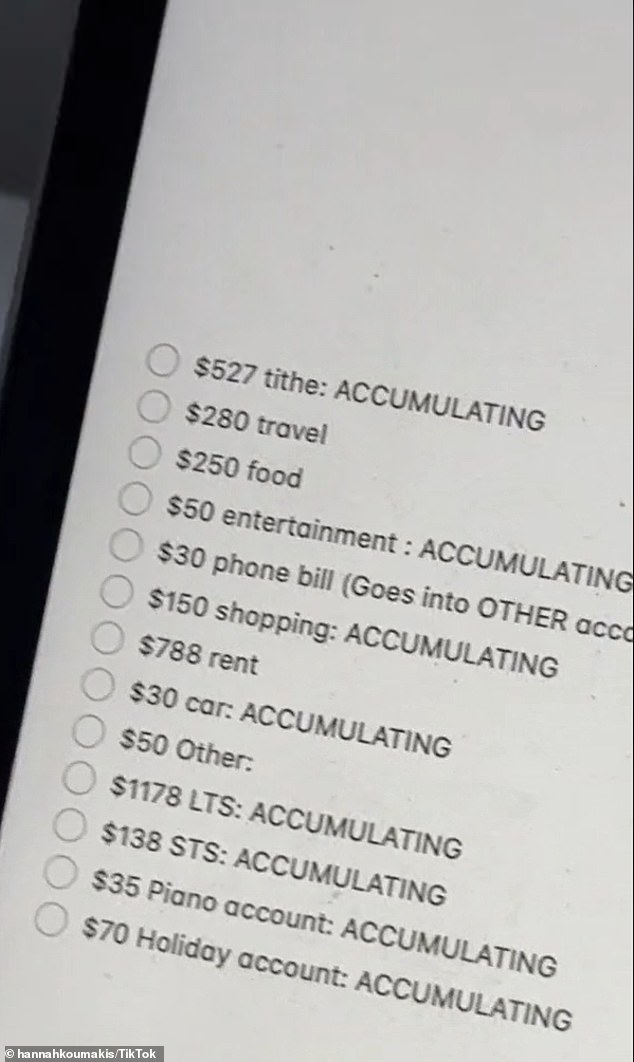

Hannah Koumakis, 24, from New Zealand, splits her monthly salary across 16 different bills, including items like rent, groceries, clothing and travel expenses.

“I have a very average salary, like I kid you not, it’s below the New Zealand average,” she says in a now-viral TikTok video with more than 1.1 million views.

“But I still manage and I still manage to save money for so many different things.”

An average salary in New Zealand is approximately $8,200 ($A7,580) per month or $97,300 ($A89,680) per year.

Ms. Koumakis sets aside $788 each month for “fixed money,” which includes her rent, bills and groceries.

Her next biggest expense is $1,100 ($A1,013) a month for the mortgage on her investment property where she does not live, and then $500 ($A460) to a ‘tithing’ account for her church.

Every month she gives herself $280 ($A260) for gas, $250 ($A230) for food, $50 ($A45) for entertainment, $150 ($A138) for shopping, $30 ($A28) for her car, $70 ($ A65) ) for holidays, $95 ($A88) in insurance and $80 ($A74) for ‘other’ costs, such as her phone bill.

Every month she puts aside $35 ($A32) to save for a baby grand piano, $50 ($A46) in a “blessing” account to “bless people” and $125 ($A115) a month in a short-term savings account.

Anything left over goes into her EFTPOS account or longer-term savings.

Hannah Koumakis (pictured), 24, from New Zealand, splits her monthly salary across 16 different bills, including items like rent, groceries, clothing and travel expenses

Some of her bills, including more than $500 a month for her church

Some of her bills are “cumulative,” meaning that if she doesn’t spend it all, she’ll still transfer the full amount.

While for some, if she doesn’t spend the full amount, she just transfers the difference.

Ms Koumakis said she is currently ‘rentvesting’, which means she is renting in an area where she wants to live, while also paying a mortgage on an investment property.

“I rent with five other housemates, I pay $US185 ($A170) a week in Auckland and then I rent out my investment property,” she said 7Life.

‘The reason I do this is because my investment property is a two-hour drive away from where I work.’

Earlier this year, Ms Koumakis revealed she received $200 in pocket money every month from her parents.