Furious homeowner reveals shocking tactic insurer used to spy on his property – before refusing to renew his vital cover

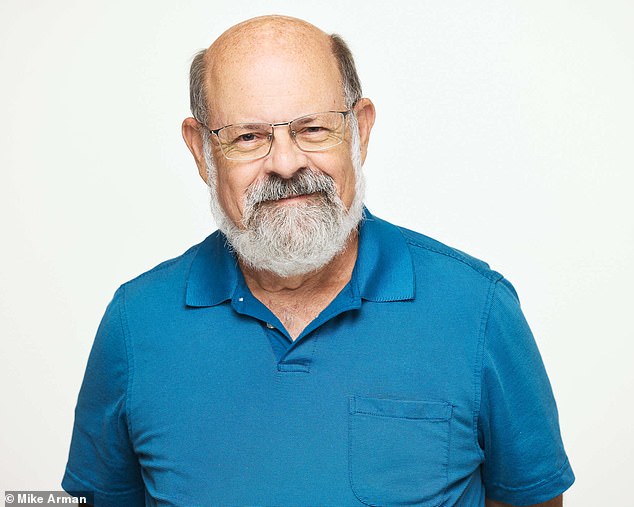

An angry Florida resident has revealed he has twice been “spied on” by home insurers and had his premium increased or his coverage cut.

Despite living near hurricane-prone Daytona Beach, Mike Arman hadn’t filed a claim on his home insurance in 52 years.

He was therefore shocked when his company indicated two years ago that it would not renew his policy and later dropped coverage on the grounds that there were problems with his roof.

Arman, the city of Oak Hill’s economic development director, found replacement coverage, but the price skyrocketed, he said.

In both cases, the insurers had taken aerial photographs of his roof and used them to change coverage.

This comes amid growing claims that insurance companies are “spying” on their customers with drones, causing homeowners to lose coverage without knowing their property is being watched from above.

Insurance companies flying drones is a growing tactic in the industry

According to Arman’s agent, the first insurer had taken a satellite photo of his roof and decided it “looked bad,” Makelaar.com reported.

“The photo looked like it was taken in 1936,” Arman told the newspaper, adding that the roof was only six years old, while it normally lasts 20 to 30 years.

When he asked if someone from the insurance company would come and look at the roof in person, he was told that a home visit was not an option.

This is despite the fact that the headquarters are only three miles away, Arman told DailyMail.com.

Three months later, Arman’s policy was revoked despite him providing proof of the age of the roof.

“At one point I showed Google Earth photos of the roofers replacing the roof,” Arman told DailyMail.com.

“Their response was that their satellites were better than Google’s.”

He found replacement insurance with Citizens, a state insurer that can ultimately pay for damages, and hired a home inspector who said his roof was in good condition.

But when his policy came up for renewal, Arman discovered that Citizens had also taken photos of the roof.

“Citizens didn’t use a satellite — they used a drone,” he said. “And the pictures were taken from very high up, not even close to the roof.”

Arman, who is a pilot, estimates the photos were taken at an altitude of at least 400 feet.

He said the company charged a $250 inspection and eventually renewed his policy, but with a 25 percent increase in price.

Mike Arman revealed how he was ‘spied on’ twice by home insurers and had his premium increased or his cover cut

Despite living near hurricane-prone Daytona Beach, Mike Arman hadn’t filed a claim on his home insurance in 52 years

“Florida policyholders are not protected from predatory, arbitrary or capricious decisions by insurance companies,” Arman told DailyMail.com.

“Part of the problem is that the insurance companies don’t really know much about houses or construction. They judge houses primarily on location, not on how well it’s built or what it’s made of.”

They also don’t seem to look at historical losses, he claimed, except to deny people if they’ve ever suffered a loss of any kind.

And Arman is certainly not alone. Satellite images and drones are increasingly being used by insurers to keep an eye on homes.

A California woman alleged last month that her home insurance company spied on her with drones while she was doing renovations, then used the footage of “clutter” to sever her coverage.

Joan Van Kuren said she was stunned when CSAA, her insurer of nearly 40 years, took the drastic decision to remove her as a customer because of “dangerous” construction debris they saw in her yard.

The Modesto, California, resident had been renovating her home for more than three years and had spent hundreds of thousands of dollars updating her kitchen, bathrooms and driveway, she said. CBS News.

However, she said that when almost all the work was completed, the CSAA sent her a letter citing “hazards” and unsanitary conditions on her property that posed a risk.

“(The company) said they were flying a drone over the house,” she claimed. “It almost feels like someone is looking in your windows, you know, when they tell you they flew a drone over your house and looked at it.”

California homeowner Joan Van Kuren said she was stunned when her home insurance was canceled after the insurer took aerial photographs of her house without her knowledge

Van Kuren said she was shocked when the insurance company flew over her. She said it “almost feels like someone is looking through your windows.”

CBS News reported that when contacted by the CSAA, the company stated that it does not specifically fly drones, but does use aerial imagery captured by satellites and third-party fixed-wing aircraft.

Cindy Picos of Auburn, California, also said CSAA Insurance dumped her after she obtained aerial photographs of her roof.

Nichole Brink, a former Farmers Insurance agent who left the company in protest of its surveillance policies, said The Wall Street Journal in April that the insurer was dropping customers because of aerial photographs that were two or three years old.

She alleged that the agency sent notices of non-renewal on everything from trampolines to moss on the side of a house.

“It seems like they’re doing everything they can to get people off their books,” Brink told the newspaper.

Some argue that the insurance industry needs better regulation to control the level of oversight that companies can exercise.

“There is a need for updated insurance regulations,” Albert Fox Cahn, founder of the privacy think tank Surveillance Technology Oversight Project, told Realtor.com.

‘State legislation has not yet been adapted to the technology.’

Experts say homeowners have certain rights when their homes are being searched by drones, including requesting the footage captured to identify errors or misunderstandings.

Cindy Picos, a resident of Auburn, California, said she was dropped by her home insurer, CSAA Insurance, after they obtained aerial photographs of her roof

Nichole Brink, a former Farmers Insurance agent, left the company in protest of its surveillance policies

Cahn advises Americans to take action if their insurer won’t renew their policies because of aerial surveillance footage.

Ask to see the aerial photographs, ask to know exactly what the problem is and ask for a chance to fix it, he said.

Mark Friedlander of the Insurance Information Institute, an insurance-funded research group, disagrees that aerial surveillance qualifies as “spying.”

He told Realtor.com, “It’s a much less invasive way to inspect your home than having someone come to your property.”

According to him, aerial photography is more accurate and safer than human inspection.

He urged most insurers to let their customers know what day the checks were scheduled and that they would be given the chance to resolve issues and appeal if their insurance was not renewed.

“Talk to your insurance agent,” he added. “Tell them, ‘I understand my insurance company may be doing an air inspection. What can I do to prevent problems and what are they looking for?’

‘Be proactive. Don’t wait until you get a letter saying your policy won’t be renewed.’