FTX worker recruited by fraudster Sam Bankman-Fried for its charitable giving sues for his $275,000 bonus after being forced to deny he aided and abetted the disgraced crypto exchange founder’s wrongdoing

- A former FTX employee says he owes hundreds of thousands of dollars to the company that imploded last November

- Ross Rheingans-Yoo said he was recruited by Sam Bankman-Fried to run parts of the company’s charity

- He has denied having any knowledge of the large-scale fraud taking place at the company, for which Bankman-Fried was recently convicted.

A former FTX employee claims he is owed $275,000 in a bonus he never received after denying knowledge of the massive fraud that occurred at the company.

Ross Rheingans-Yoo, a former Jane Street trader who was recruited by Sam Bankman-Fried to join the crypto firm, says he is owed hundreds of thousands of dollars, court documents show.

In early 2022, Rheingans-Yoo was hired by Bankman-Fried to lead FTX’s charity drive.

He was told he would serve as a program officer for the FTX Foundation and be paid a base salary of $100,000, which he acknowledges receiving. Before the company’s implosion, he was Reportedly paid approximately $375,000.

He said the terms of employment at the time of his hiring were set out in a Bankman-Fried Google document.

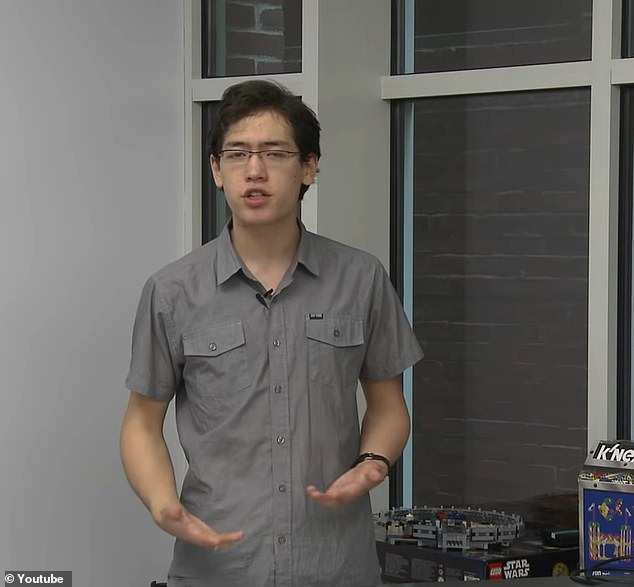

Ross Rheingans-Yoo, a former FTX employee, is suing what’s left of the company for hundreds of thousands of dollars in bonus payments

Rheingans-Yoo claims he was recruited to work at FTX from his job at Jane Street, where Bankman-Fried previously worked

Earlier this year, FTX’s new management alleged that Rheingans-Yoo aided and abetted the company’s disgraced leader while working with FTX’s charity arm.

In an affidavit, Rheingans-Yoo denies the allegations, saying: “I was not part of Bankman-Fried’s inner circle that knew about and enabled the embezzlement of FTX client funds.

‘I had no knowledge of the Bankman-Fried fraud. I did not support his breach of fiduciary duty to the debtors.”

The former employee has now become part of the larger web of legal efforts by FTX’s bankruptcy team to recover some $71.5 million in funds they believe were taken by the exchange’s charitable arm – FTX Foundation – and the nonprofit organization led by Rheingans. Yoo called Latona Bioscience Group.

The company’s bankruptcy advisers alleged in July that Latona is a “sham” nonprofit that, along with the FTX Foundation, has made investments and donations to life science companies “for the personal aggrandizement of Bankman-Fried.”

Rheingans-Yoo denied accusations that Latona was not real, claiming it was an organized nonprofit funded through intercompany loan agreements with Alameda Reserach, FTX’s sister trading arm.

He said his role included researching charities that would have a positive impact on society. His lawyers say he took the role seriously and met with potential recipients.

In addition to the remainder of his bonus, Rheingans-Yoo is asking for $650,000 in what he calls “foundation direction units,” which he says he will donate to charity.

But FTX advisors said the petitioner’s belief that he is entitled to $275,000 “has no merit and must be denied.”

Rheingans-Yoo (pictured here in a video filmed several years ago) was hired to lead FTX’s philanthropic organization and choose life science companies to invest in

Bankman-Fried was convicted several weeks ago on seven federal fraud charges in connection with the collapse of FTX and the loss of billions of dollars in customer funds

He denies having any knowledge of the fraud that Bankman-Fried committed

FTX advisors claim that Rheingans-Yoo has already paid his bonus because he opted to get the amount partially repaid through options in the crypto company’s affiliate before the time it filed for bankruptcy. Rheingans-Yoo has denied the claim.

Whether Rheingans-Yoo is entitled to compensation from the bankrupt company will be determined by the Delaware bankruptcy judge, who is overseeing FTX’s Chapter 11 case.

Earlier this month, Bankman-Fried – who also previously worked at Jane Street – was convicted of seven federal fraud charges that culminated in the company’s collapse.