Freetrade introduces stock lending feature: what is it and how does it work?

Freetrade will allow its customers to lend their sought-after shares to borrowers in exchange for a small fee, This Is Money has revealed.

Share loans, a form of stock lending, are typically used by financial institutions for trading activities and to hedge risks. This is somewhat comparable to renting out shares.

Some DIY investment platforms, such as Trading 212, offer it to their clients and it is especially popular in the US.

However, it carries risks and is often used to short borrowed shares, which can put downward pressure on the price.

We explain how stock lending works, why people borrow and lend stocks and the risks involved.

Stock Lending: Freetrade clients can lend out desirable stocks and earn a fee

How does stock lending work?

In stock lending, also known as securities lending, shareholders temporarily transfer their shares to a borrower in exchange for compensation.

Typically, the lenders are ETFs, pension funds and insurance companies, while the borrowers are banks, hedge funds or brokers looking to sell shares or support the settlement.

In this case, the lender will be Freetrade clients. They can choose to have their shares matched with a ‘high quality’ lender, including global investment banks.

All shares, investment trusts and ETFs in GIAs and SIPPs are eligible, but not those in an Isa. The platform also says it will not lend out ETFs that its fund managers deem to be low risk.

If there is demand, the shares are transferred and the borrower pays a fee. This usually depends on how much demand there is for that particular share.

Clients keep half of the fees they earn from lending stocks, with the other half held by Freetrade and their partner who manage the program.

Freetrade says there will be no changes to the way customers can manage their portfolio and that customers can still sell loaned shares as usual.

However, if your shares are lent out, you may not be able to vote if the opportunity arises and may have to recall them.

Why do people borrow and lend stocks?

Investors can generate income by lending out their shares, but this depends entirely on the interest the borrower is willing to pay and the number of shares lent.

This can vary from day to day depending on the demand for the shares you earn. The platform indicates that on a normal day most shares are not lent out.

Freetrade says clients can generate passive income by lending stocks, but the returns are minimal.

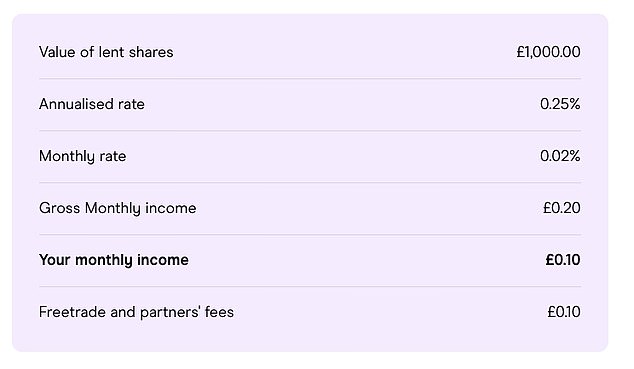

According to their conservative estimate, if you were to lend out £1,000 in shares, at a monthly interest rate of 0.02%, a customer would make 10p per month on a gross monthly income of 20p per month.

However, stocks in high demand may carry even higher annual fees, which can help offset the monthly subscription fee, depending on which stocks are held.

Monthly Income: Freetrade says customers can supplement their income through loans

Viktor Nebehaj, CEO of Freetrade, said: “Our stock lending programme opens up a new source of passive income for our clients, allowing them to grow their wealth over the long term, which has not previously been widely available in the UK market.

“These earnings can compound the return on their portfolio over time. Private investors now have the opportunity to participate in such programs if they believe it will help them achieve their long-term financial goals and if it fits their risk appetite.”

However, borrowers often borrow shares and then sell them again, putting pressure on the price.

How are investors protected and what are the risks?

According to Freetrade, ‘losses for lenders in the securities lending market are very rare’.

To protect lenders, the borrower will send collateral to Freetrade. If the borrower does not return the shares, Freetrade will sell the collateral and buy back the shares.

Freetrade says it only accepts government bonds as collateral because they carry lower risk and are easy and quick to sell to buy replacement shares as soon as possible.

It is also guaranteed that the collateral value is at least 105 percent of the value of the shares lent.

If the collateral does not cover the amount, Freetrade says they will top up the difference.

“As a regulated firm, we hold capital to protect customers in these types of scenarios and ultimately the FSCS provides a final safety net for customers,” the report said.

Share lending is regulated by the Financial Conduct Authority. There are rules in place requiring hedge funds to disclose short positions when they reach certain thresholds.

However, lending shares also involves risks. The biggest risk is that the borrower will not return the shares when they are reclaimed.

This may be because market liquidity is too great and the borrower cannot repurchase the shares, or because the borrower becomes insolvent and cannot repay the debt.

It could also simply be the result of an administrative error.

Freetrade says: ‘Since shares are lent out and the return is linked to purchases, the settlement becomes dependent on the next stage in the chain.

‘Lenders and borrowers have processes and controls in place to mitigate these types of situations and resolve situations quickly.’

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free. We do not write articles to promote products. We do not allow commercial relationships to influence our editorial independence.