Footsie eyes record high as recession fears ease

>

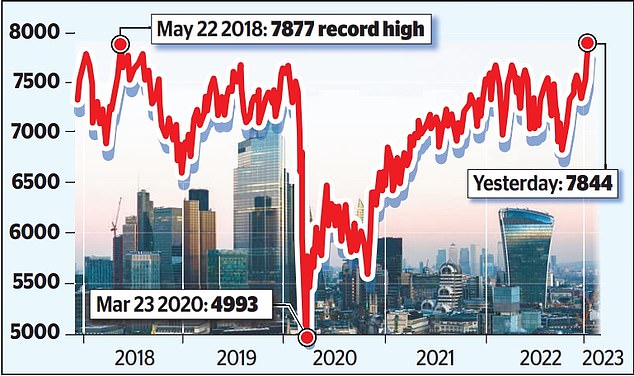

FTSE 100 closes above 7800 for just the third time in its history as it races to record high: milestone could be beaten in days to come

- On another day of gains, the blue chip index rose 0.6%, or 50.03 points, to 7844.07

- Footsie closed above 7800 just twice before – on consecutive days in 2018

- Up more than 5% so far this year, up on eight of the first nine trading days

<!–

<!–

<!–<!–

<!–

<!–

<!–

The FTSE 100 closed above 7800 for just the third time in its history last night as it raced to an all-time high.

On another day of gains in London, the blue chip index rose 0.6 percent, or 50.03 points, to 7844.07.

The more domestically focused FTSE 250, meanwhile, added 0.6 percent or 111.71 points to 19952.84.

The Footsie closed above 7800 just twice before – on consecutive days in May 2018 when it finished trading at 7877 after rising above 7900 earlier in the session.

Hopes are growing that this milestone can be surpassed in the coming days amid signs that the global economy may do better than feared this year.

“Investors have started 2023 with a bang,” said Sophie Lund-Yates, an analyst at Hargreaves Lansdown.

The Footsie has gained more than 5 percent so far this year, rising on eight of its first nine trading days in 2023.

It is up 57 percent since falling below 5,000 during the lows of the Covid panic in early 2020.

Official figures yesterday showed that the British economy grew by 0.1 percent in November, allaying concerns that Britain is in recession.

The report from the Office for National Statistics followed an extensive series of trading updates in recent days from companies such as Marks & Spencer, JD Sports and Next, as well as supermarkets Tesco, Sainsbury’s, Aldi and Lidl, all of which reported optimistic sales over Christmas.

JD’s value is up a whopping 27 percent since early 2023, Next is up 13 percent, and Marks & Spencer is up 18 percent.

Global economic developments have boosted, among others, International Airlines Group, the owner of British Airways – up 27 percent since the start of the year – and aircraft engine maker Rolls-Royce, which has gained a 17 percent lead .

Official data in the US this week showed that inflation in the world’s largest economy fell to its lowest level in more than a year, paving the way for the Federal Reserve to slow and eventually halt its program of rate hikes.

The start of the earnings season on Wall Street yesterday, meanwhile, suggested that the New York banking giants expected a mild but not catastrophic downturn in the coming months.

And the lifting of China’s Covid restrictions is likely to boost the growth of the world’s second strongest economic power. Russ Mould, investment director at AJ Bell, said a record high for the Footsie would “give foreign investors another reason to look more seriously at UK stocks.”

He added: “After the Brexit referendum, UK equities were off the menu for many international investors and valuations plummeted. This continued for a while until some savvy players realized the opportunities.

“Last year was a major turning point with the UK being one of the few major markets in the world not to experience a major slump.

“Now if the FTSE 100 breaks a record it’s another trophy in the UK’s cabinet and a reason to shout from the hilltops that the market isn’t as boring as people think it is.”

Lund-Yates said: ‘The FTSE 100 is approaching record highs as the UK’s unexpected GDP growth created a welcome wave for the market.’