Fixed term savings rates stop rising but easy-access deals edge up

>

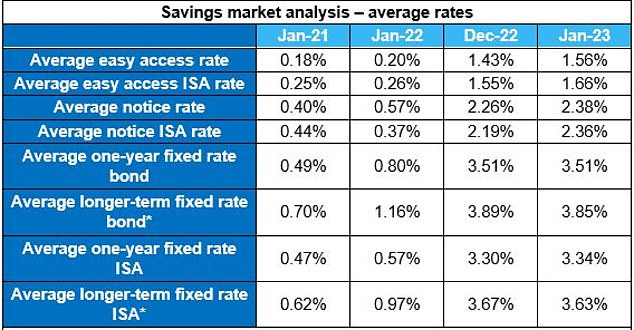

Savings rates are starting to level off after 11 months of consecutive increases, new data shows.

Typical interest rates on fixed-term savings contracts are even starting to fall slightly, according to the latest figures from Moneyfacts.

The average fixed one-year bond remained at 3.51 percent in January, the first time since January 2022 that the monthly report did not register an increase.

Meanwhile, the longer-term typical fixed deal fell to 3.85 percent — the first drop since March 2021.

– Check out the best fixed rate savings deals here.

Have rates peaked? Market trends suggest a period of stability has arrived in the wake of interest rate volatility in 2022

Moneyfacts considers any account with a term longer than 18 months as a long-term savings deal.

Since January last year, the typical one-year fixed-rate deal has risen from 0.8 percent to 3.51 percent, while the longer-term fixed rate increased from 1.16 percent to a high of 3.89 percent last month.

However, anyone who closely monitors This is Money’s tables of the best savings rates will have noticed that the best fixed rates have fallen since the beginning of November.

The one-year top deal peaked at 4.65 percent in early November, while the longer-term fixed rate crossed 5 percent.

The best one-year fixed rate savings deal now pays 4.26 percent, while the best longer-term deal is a three-year fixed rate that pays 4.56 percent — both courtesy of SmartSave Bank.

Do savers now have to pin down to a fixed account?

There will probably be some savers who waited for higher interest rates who may now be disappointed.

At one point, it seemed likely that we would see a one-year best-buy fix that would pay 5 percent. However, that now seems less likely, at least in the short term.

And any gains made by savers continue to be eroded by much higher inflation.

Mixed picture: Easy-access rates continue to rise, but fixed bonds are flatlined or down

CPI inflation has hit a 40-year high in recent months. It rose 10.7 percent in the 12 months to November 2022, up from 11.1 percent in October.

This means that savers actually lose money in real terms.

The good news, however, is that many, including the Bank of England, are predicting that CPI inflation will begin to fall.

The Bank of England forecasts that inflation will fall to around 5.2 percent in the last three months of this year, before falling to just 1.4 percent by the end of 2024.

So while the savings rate may have fallen, the inflation outlook could mean that those who close fixed income deals this year will be better off in real terms.

Will the low-threshold savings interest rate continue to rise?

Low-threshold interest rates on savings and accounts with notice periods rose for the eleventh month in a row, albeit only marginally.

The average low-barrier rate rose to 1.56 percent and is the highest since December 2008, while the average cancellation rate rose to 2.38 percent, now the highest rate since December 2008.

The low-threshold Isa rate also rose month-on-month to 1.66 percent and is at its highest point since November 2012.

>> Find the best easily accessible savings rates using our independent tables

With inflation still at its highest level in 40 years, rates in the easy access market are expected to continue rising this year as the Bank of England attempts to bring inflation down by raising key rates.

Today, Yorkshire Building Society has rocketed under easily accessible savings rates with a new 3.35 per cent deal that far outpaces rivals.

Find out more about the new rate, how it compares to rivals and how to get it here.

A spokesperson for savings advisory firm The Savings Guru said: ‘This is good news for savers as it is likely to force others to respond and it is only a matter of time before there are more easy access rates at or above 3 percent.

“With the Bank of England meeting on February 5 to decide on key interest rates, and the market widely anticipating another rise, we expect easily accessible savings rates to continue rising in the first quarter of 2023.”

Despite plenty of reasons for optimism for savers with easily accessible accounts, data from Moneyfacts showed that in the savings market as a whole, the share of accounts paying above the base rate fell this month.

It found that currently 70 percent of savings accounts pay below the base rate, which is currently 3.5 percent.

Savers are being urged more than ever to make sure they check their savings and verify that they are happy with the rate they are receiving.

Beat the base rate: While the savings market in general has been blessed by rate hikes in 2022, nearly 70 percent of bills are now paying below the base rate (3.50%)

Rachel Springall, financial expert at Moneyfacts: ‘The savings market appears to have entered a period of stability, a remarkable contrast to the volatility of recent months.

‘Fixed savings providers adjusted their market positions and for the first time in almost two years, the longer-term average interest rates for fixed-income securities and ISAS fell.

These movements show the changed attitude of providers in the wake of the interest rate uncertainty in the last quarter of 2022.

When the Bank of England decided to raise interest rates in December 2022, it was somewhat inevitable that the share of savings accounts paying above the base rate would fall.

Successive increases in base rates should spur savers to check their existing savings accounts, especially as challenger banks and building societies offer some of the best rates on flexible accounts.

“As the cost of living continues, savers may need to dip into their pockets, so easy access and cancellation accounts could be the most appropriate option that offers flexibility.”

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and use it for free. We do not write articles to promote products. We do not allow any commercial relationship to compromise our editorial independence.