Five crucial graphs from the Bank of England – and why it says the budget WILL lead to a rise in inflation

The Bank of England’s Monetary Policy Committee has published a 90-page report outlining its reflections on the future of inflation and the economy.

On Thursday, the Bank cut interest rates from 5 percent to 4.75 percent, the lowest level in more than a year.

But it also published its quarterly Monetary Policy Report, an in-depth look at where it sees the UK economy going and how it plans to use interest rates to keep inflation in check.

According to the Bank, the measures announced by Rachel Reeves in the budget will contribute to a rise in inflation, while GDP growth is expected to slow as the year progresses.

We pick five crucial charts you need to see – and explain what they mean.

The budget will stimulate inflation

Impact: The Bank of England said the fiscal measures will have an impact on inflation

Consumer price inflation fell to 1.7 percent in September but is expected to rise to around 2.5 percent by the end of the year “as energy price weakness falls outside the annual equation,” the Bank said in its latest Monetary Policy Report. .

It noted: “The Budget is tentatively expected to boost CPI inflation by just under half a percentage point at its peak, reflecting both the indirect effects of the narrower margin of oversupply and the direct impact of the fiscal measures.”

The Bank added: ‘The impact of the budget announcements on inflation will depend on the extent and speed with which these higher costs feed through to prices, profit margins, wages and employment.’

Looking ahead to 2025, the Bank said: ‘CPI inflation is expected to rise to around 2¾ percent in the second half of 2025 as energy price weakness falls outside the annual equation, more clearly highlighting ongoing persistent domestic inflationary pressures brings. ‘

The inflation forecast is crucial to understanding what the Bank of England might do to interest rates and how this could impact mortgage and savings rates. These are strongly influenced by market expectations about when interest rates will fall.

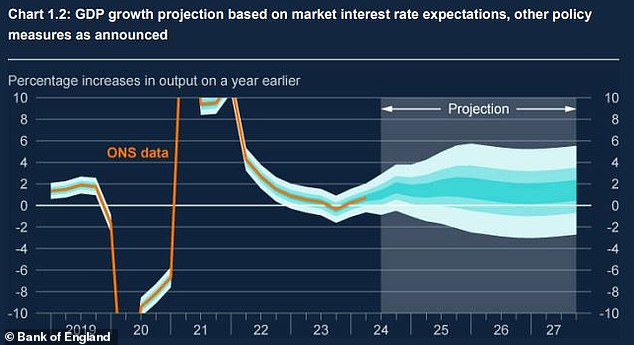

The UK economy will slow this year

GDP: The Bank said GDP growth appears to be slowing in the second half of this year

The UK economy is expected to slow down but continue to grow and ultimately receive a small boost from the budget.

The Bank said GDP growth is expected to slow in the second half of this year, to 0.2 percent in the third quarter and 0.3 percent in the fourth quarter.

It said: ‘Overall GDP growth has been volatile over the past year, with negative growth in 2023 and strong growth in early 2024.’

The Bank added: ‘GDP growth is expected to be broadly in line with the Bank staff estimate of underlying momentum in the economy in the second half of 2024, of around ¼ percent per quarter . The latest indications from business surveys currently point to growth around this pace.’

Looking further ahead, the Bank said GDP would grow.

It says: ‘The combined effects of the new measures announced in the 2024 Autumn Budget, including the additional funding for previous spending pressures, are currently expected to lift GDP levels by around ¾ percent at their one-year high compared to Projections from the August report.

“This reflects stronger and relatively progressive developments in government consumption and investment, which more than offset the impact of higher taxes on growth.”

Just after the Budget, the Office for Budget Responsibility upgraded the UK’s economic growth prospects for this year and next year after the Budget, but downgraded its forecasts for the next three years.

The OBR expects the economy to grow 1.1 percent this year, up from a previous forecast of 0.8 percent.

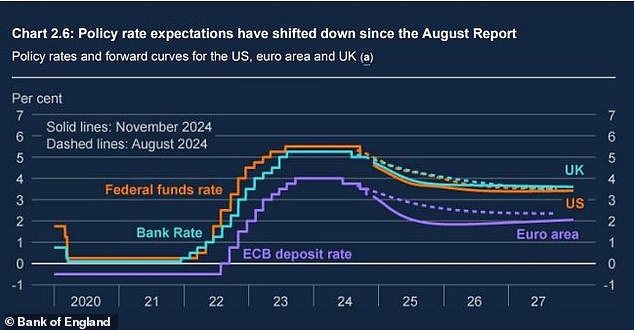

Interest rates at 3.6% over three years

Global interest rates: The Bank has set out projected global policy interest rates

The Bank said UK interest rates were likely to be set at 3.6 percent in three years, leveling off from around the end of next year.

On what lies ahead for UK rates in the short to medium term, the Bank said: ‘Based on the evolving evidence, a gradual approach to unwinding policy remains appropriate.

“Monetary policy will have to remain restrictive for a sufficient period until the risks to a sustainable return of inflation to the 2 percent target in the medium term have further disappeared.”

On global rates, the Bank added: ‘Since the August report, waning US inflation pressures and Fed communications have been associated with a shift in the market-implied path for US policy rates of around 30 basis points in the long term. average over the next three years.’

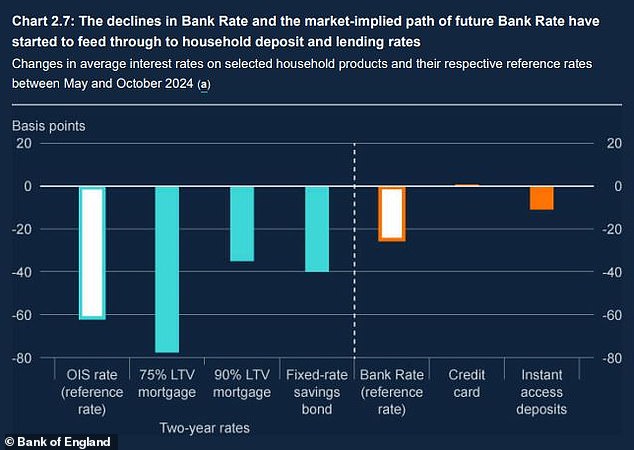

The impact on mortgages and savings rates

Flowing: The Bank outlined the impact of lower interest rates on mortgages and savings

Savers and borrowers are closely watching the Bank of England’s decisions and interest rate forecasts to see what will happen next, especially those with large fixed-rate mortgages about to mature.

Lower interest rates “have had an impact on interest rates on loans to households and on deposits,” the Bank said.

It added: ‘The pass-through to date appears to be in line with expectations, with interest rates taking some time to decline on some retail products, reflecting typical lags between changes in the benchmark interest rate and changes in product rates.’

Interest rates on direct access to deposits fell by an average of 11 basis points in October, just under half of the rate cut.

On mortgages, the Bank said: ‘However, interest rates on variable rate mortgages have fallen, and a growing number of those already paying higher rates may be able to refinance at a lower rate over the next two years.’

About 800,000 fixed-rate mortgages with interest rates of 3 percent or lower are expected to be refinanced each year, the report said.

The Bank also noted that some mortgage holders had started to reduce their spending in anticipation of an increase in their mortgage payments.

> Mortgage interest rate reduction calculator: what consequences does falling interest rates have for you?

House prices: recovery in the housing market

House prices: The Bank said house prices had risen as a result of lower mortgage rates

Amid lower mortgage rates and the recovery in mortgage applications, house prices have continued to rise, the Bank said.

It added: ‘The recovery in house prices partly reflects the waning drag from past interest rate rises, consistent with the impact of higher interest rates that have materialized more quickly than in the past.’

The Bank added: ‘The recovery in housing market activity has led to a small reversal in the growth rate of secured lending to households.

‘However, growth in secured credit to households remains weak in real terms and has been negative since the end of 2021. A sustained recovery in housing market activity should lead to a strengthening of secured lending growth.”

The OBR expects property price growth to stagnate next year.

After last week’s Budget it said: ‘In our central forecast we expect house price growth to fall slightly from 1.7 per cent in 2024 to 1.1 per cent in 2025, as average effective mortgage rates continue to rise.’

Data from the Office for National Statistics from September showed that average house prices rose 2.8 per cent to £293,000 in the year to August, compared with 1.8 per cent in the year to July.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.