First-time buyers spend €350 more on mortgages every month than five years ago

First-time buyers are paying significantly more in mortgage costs than five years ago, despite home loan costs having fallen in recent months.

Higher interest rates mean mortgage payments for people on the first rung of the property ladder remain 61 per cent higher on average than in 2019, according to Rightmove.

The average first-time buyer now pays €931 in monthly mortgage repayments, compared to €578 in 2019, the property portal revealed, which amounts to more than €350 extra per month.

More expensive: The average monthly mortgage costs for a starter have increased by 61 percent compared to five years ago

Rightmove’s calculations are based on the fact that a first-time buyer can put down 20 per cent and spread the cost of the mortgage over 30 years on a house with two bedrooms or less.

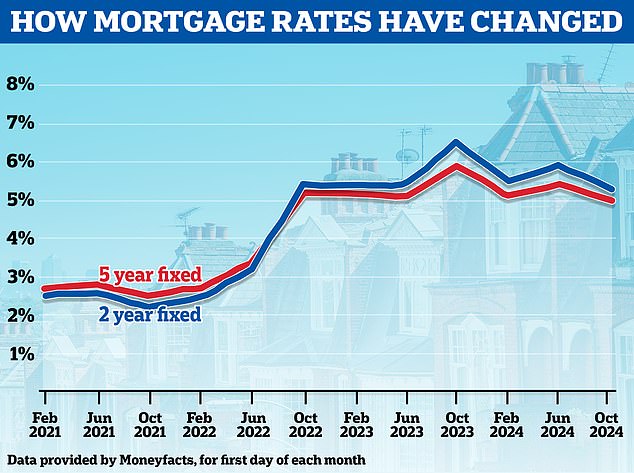

The typical five-year fixed mortgage rate that most first-time buyers can expect with a 20 percent down payment is now 4.58 percent, the real estate portal said. This compared to just 2.13 percent in 2019.

The average number of starter homes in Britain with two bedrooms or less has also risen by 18 per cent in the past five years, from £192,221 to £227,570, meaning they require a larger mortgage as well as higher rates.

How do starters deal with it?

In reality, many first-time buyers will earn more than those who bought a home five years ago.

In the five years between July 2019 and July 2024, average earnings increased by about 28 percent.

Yet the cost of living has also increased significantly. The cost of the average package of goods and services has risen at a similar pace thanks to the inflation spike in 2022 and 2023.

This means that first-time buyers in the property market rely on different coping mechanisms to find their way onto the property ladder.

> Best mortgage interest rate for starters: how long should they be fixed?

Down again: Mortgage lenders have cut interest rates in recent months, but they remain much higher than before the 2022 rate hike

To start with, first-time buyers wait longer to buy a house and spread the mortgage payments longer.

The average age of a first-time buyer is now 33 years, up from 32 in 2019, while the average mortgage term for a first-time buyer is now 31 years, up from 29 years in 2019, based on data from UK Finance.

According to the trade association, more than one in five took out mortgages with a term between 36 and 40 years in the three months between April and June this year.

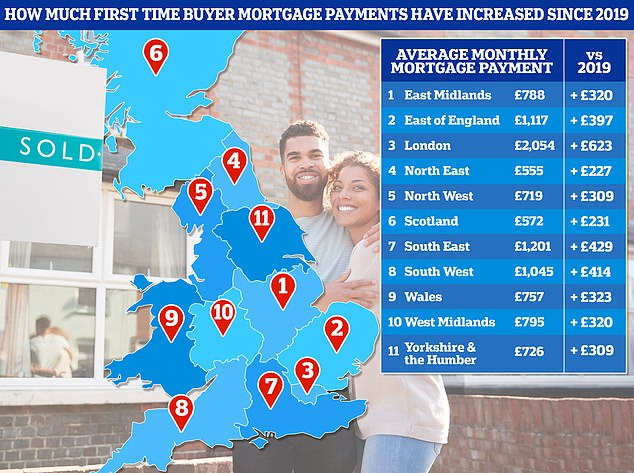

Where are starters confronted with the largest mortgage increases?

In London, a typical starter home now costs almost five times the average annual salary of two people, the highest of any region.

This means that many first-time buyers may struggle to borrow enough to afford the home they want, with lenders typically able to mortgage up to 4.5 times a joint income.

Those who want to buy for themselves will find it even more difficult.

Despite this, first-time buyers in the capital have to pay 44 percent more in mortgage payments than those who bought a mortgage five years ago. The smallest increase of any region.

In the Northwest, the average monthly mortgage payment has increased by 75 percent compared to five years ago.

This is because alongside higher interest rates, house prices have risen at a greater rate in the North West, with the average asking price for a home increasing by 29 per cent over the past five years, the highest increase of any region.

In Wales, average mortgage payments have also increased by 75 percent, while in Yorkshire and The Humber the average monthly mortgage payment has increased by 74 percent compared to five years ago.

Regional trends among first-time buyers: In the North West, the average monthly mortgage payment has increased by 75 percent compared to five years ago, while in London it has increased by 44 percent

Tim Bannister, property expert at Rightmove, said: ‘Improving market conditions compared to last year have led to a recovery in activity in the typical start-up sector.

‘We are seeing more choice for potential first-time buyers in this sector, and more potential buyers contacting estate agents than last year.

“While mortgage rates have improved from their peak, they are still high compared to recent norms.

‘This has led to first-time buyers taking longer terms, waiting longer to build their deposit and looking for cheaper areas to get on the ladder.

“Affordability for first-time buyers remains limited and any support that can help further get on the ladder would be welcome.”

It’s not all bad for first-time buyers

However, there is good news for starters.

Firstly, there is plenty of stock on the market – at the end of August Zoopla reported that the number of homes for sale has risen to the highest level in seven years, according to Zoopla – with the average agent having 33 properties for sale.

Because there are more properties to choose from, they also currently have fewer investors to compete with buy-to-let. Meanwhile, upsizers and downsizers are also reluctant to move, experts say.

The share of homes bought by landlords fell to the lowest level in fourteen years in the first half of this year, according to Hamptons.

The estate agent revealed that in the first half of this year, only one in ten homes sold went to a buy-to-let investor. This was the lowest share since records began in 2010.

An abundance of housing and less competition should give some first-time buyers an advantage in negotiating a better price.

Nicholas Mendes, mortgage technical manager at estate agent John Charcol, said: ‘Buy-to-let landlords are either selling their properties or holding off on buying, especially as the upcoming budget is unlikely to be kind to them.

‘Starters, on the other hand, are in a fortunate position. There is less competition because homeowners are delaying their moves, landlords are not actively competing for properties, prices are just starting to rise, and mortgage rates are, for the most part, on a downward trend. Expect us to have a few busy weeks ahead.’

George Smith, mortgage broker at LDN Finance, says he sees a similar story playing out.

“We are seeing a lot more properties on the market and many of them appear to be off-chain, with second home owners and investors looking to get rid of their homes before any potential changes to capital gains and the like in the coming budget,” Smith said.

This makes starters even more attractive and fast transactions are the flavor of the month.’

It is also increasingly possible for starters to borrow more than 4.5 times their income from certain lenders.

In September, Nationwide announced it was giving first-time buyers the option to borrow six times their income, even to those with a 5 percent down payment.

This means couples earn £50,000 to borrow £300,000 for their first home, which is around £75,000 more than a standard loan.

It was a follow-up to Halifax, which announced at the beginning of September that it had made £2 billion available for first-time buyers who need to borrow up to 5.5 times their annual income.

To qualify for what Halifax calls its ‘starter boost’, buyers need a total household income of £50,000 or more, which must come from employment.

They must also purchase a property with a minimum 10 percent down payment.

Some links in this article may be affiliate links. If you click on it, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow a commercial relationship to compromise our editorial independence.