Financial planner Terence Nugara who swindled clients out of $10 million in fake investments is jailed for 10 years as judge rips into him

Financial planner Terence Nugara, who defrauded clients of $10 million in fake investments, gets 10 years in prison as judge goes against him

<!–

<!–

<!– <!–

<!–

<!–

<!–

A financial planner who conned clients out of $10 million in fake investments lulled a client into a sense of security with visits to her retirement home, flowers and lunches.

Terence Nugara received a 10-year prison sentence Thursday for a long-running real estate development scam in which he deceived 28 clients into investing $10 million from their savings and retirement funds.

Questioning their pensions, he lined his pockets with cash, filled his garage with luxury cars and bought himself a boat and a helicopter.

His actions were despicable, insensitive and selfish and took place during a period when his financial planning and advice license was suspended and later terminated, County Court Judge Trevor Wraight said.

He sentenced Nugara on Thursday to nine years and eleven months behind bars.

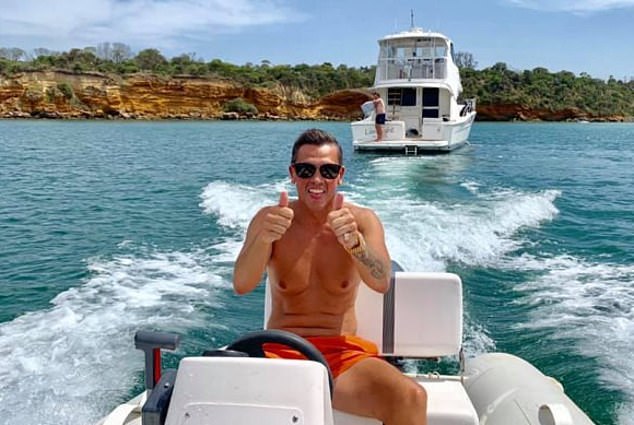

Terence Nugara (pictured) was jailed for 10 years after tricking 28 clients into investing $10 million from their savings and retirement funds in a real estate development scam

The financial planner often led a lavish lifestyle full of luxury cars, yachts, helicopters and $400 bottles of Dom Perignon

The court heard Nugara used his position as a financial planner to convince clients to convert their superannuation accounts into self-managed super funds and invest in property development.

Nugara represented itself as developing properties in Malvern, Kew, Sandringham and Glen Iris, as well as villas in Bali.

In some cases he promised returns of up to 98.93 percent.

Nugara had pre-existing relationships with many victims.

One woman said he visited her at her retirement home, brought her flowers and took her out to dinner.

Another woman became a client after the death of her accountant husband, who previously managed her investments.

A man who was lured into investing was also tricked into involving his parents in the scam.

“You took advantage of people who placed their trust in you, many of whom were older and looking forward to a comfortable retirement,” Judge Wraight said.

Nugara was caught by several customers who visited the supposedly developed properties, only to discover that the previous building had yet to be demolished.

One learned of the scam when they were advised by the financial watchdog to contact police, while another found out years later through her lawyer.

The victims – including some who had to defer their pensions or rely on Centrelink – have had some or all of their money repaid through financial institutions since the pre-sentence hearing last month.

Judge Wraight said it was alleged Nugara, who had moved abroad before the police investigation began, had voluntarily returned to Australia to appear in court.

County Court Judge Trevor Wraight branded his actions as despicable, insensitive and selfish

Nugara, who pleaded guilty to 27 charges of obtaining financial advantage by deception and two charges of theft, will be eligible for parole after six years and six months.

But before he left, he noted that Nugara had thrown away belongings, including his home, and was clearly trying to start over abroad.

When international business ventures failed, the Sri Lankan native returned to Australia, where he had citizenship.

“Whatever the reason for your return to Australia, I am not convinced it was motivated by your remorse,” he said.

Nugara, who pleaded guilty to 27 charges of obtaining financial advantage by deception and two charges of theft, will be eligible for parole after serving six years and six months of his prison sentence.