Finance guru reveals the simple steps ordinary Americans need to take to make their first $1M

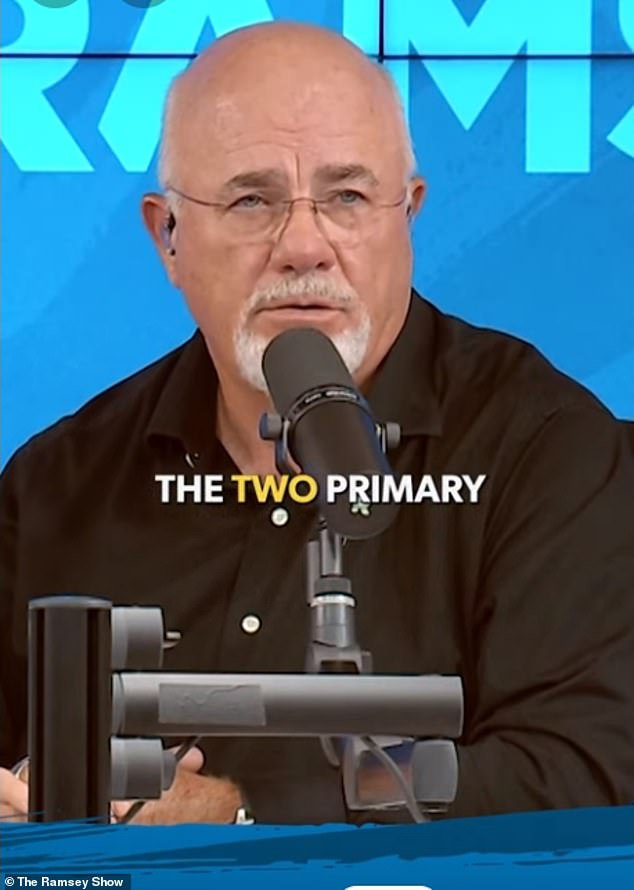

Professional financial strategist Dave Ramsey has revealed that average Americans can become millionaires by consistently investing in growth stocks and paying off their homes.

Between November 17, 2017, and January 31, 2018, his company, Ramsey Solutions, conducted a survey of more than 10,000 millionaires nationwide, in what he claims is the largest study of its kind.

After reviewing the results, Ramsey discovered that there are two simple ways that ordinary people can gain immense wealth. He also hosts a nationally syndicated radio program on finance.

The first step to becoming a millionaire is to invest regularly in growth-oriented mutual funds.

Professional financial strategist Dave Ramsey has revealed that average Americans can become millionaires by consistently investing in growth stocks and paying off their homes

Between November 17, 2017, and January 31, 2018, his company, Ramsey Solutions, surveyed more than 10,000 millionaires nationwide, claiming it was the largest study of its kind.

In Ramsey’s survey, eight out of 10 millionaires surveyed said they invested in their company’s 401(k) plan.

Of the millionaires surveyed, 75 percent said long-term investing was one of their most important sources of wealth.

In a video from The Ramsey Show, the financial guru put it bluntly: “There are two things that make people their first $1 million to $5 million in net worth.”

He continued, “The two most important things are that they invest steadily in their retirement plans and in good growth stock funds, like 401K and Roth IRA.”

According to money wiseGrowth investment funds have performed remarkably well in recent years.

If someone invested $10,000 in the Fidelity Growth Company Fund ten years ago, that initial amount would now be worth more than $56,000. That works out to a compound average annual growth rate of 18.8 percent.

The fund holds some of the most successful technology stocks of the past decade, including Apple and Nvidia.

A smart and cautious investor with a lucrative job could have used this fund to become a millionaire, money wise pointed out.

If the Fidelity Fund were to maintain its 18.8 percent growth rate, a person making $100,000 could save 10 percent of their salary and invest it in the fund. Over 18 years, the investor could accumulate $1.1 million.

The second important step an average person can take to become a millionaire is paying off his house.

The first key to becoming a millionaire is to routinely invest in growth-oriented mutual funds

“They’re paying off their house,” Ramsey said simply.

According to Ramsey Solutions, the average millionaire pays off their home in just 10.2 years.

In 2022, the percentage of mortgage-free U.S. homes rose to a record high: just under 40 percent, according to money wise.

Between 2012 and 2022, the percentage of mortgage-free homeowners increased by as much as five percentage points.

For the average American, owning real estate is an important way to accumulate wealth.

However, this step has become more difficult to achieve in recent years.

The second crucial step an ordinary person can take to become a millionaire is paying off his house

According to a report by the Commission, housing costs for around 12 million renter households amounted to more than half of their income in 2022. money wise.

Because the costs are so high, it is difficult for the average American to save enough for a down payment.

This difficulty has been exacerbated by higher mortgage rates. In addition, there is a housing shortage. According to Church pewthere is a shortage of four to seven million units.

To make their first million dollars, ordinary Americans may find it easier to invest in mutual funds than to pay off their house.