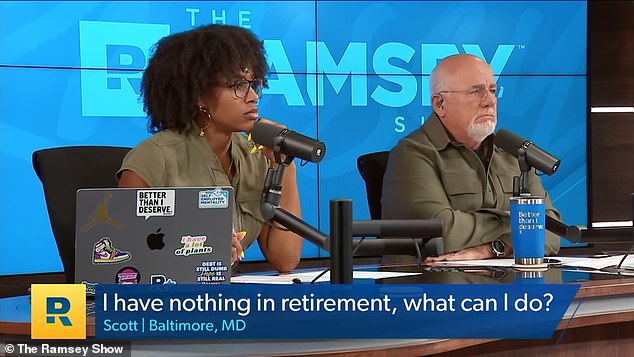

Finance guru gives caller sharp wake up call after saying he wanted to retire at 58 with NO savings

A financial expert confronted a caller with the harsh reality that he hoped to retire at 58, despite having no savings and a costly car loan that was draining his wallet.

Scott, from Baltimore, Maryland, learned the hard way that one bad purchasing decision can undo years of financial discipline when he bought his dream bike: a Harley Davidson.

On a recent episode of The Ramsey Show, Scott confessed to Dave Ramsey that he’s struggling to pay a $20,000 car loan for his bike, almost as much as his $25,000 mortgage on his house.

“That’s weird,” Ramsey said. “You were doing so well on the house and so bad on the bike. That was a weak moment.”

While many Americans have loans for essential vehicles, Scott’s debt stems from a luxury purchase, so Ramsay advised him to sell the bike.

“I’m sure it’s a great bike, but it’s gone. It’s someone else’s great bike now,” he said.

Financial expert Dave Ramsey gave a harsh reality check to a caller who hoped to retire at 58 despite having no savings and a hefty car loan that was draining his wallet.

Scott, who went through a costly divorce eight years ago and depleted all of his savings, is faced with the challenge of building up a nest egg.

According to Bloomberg, he now has just $25,000 left on his mortgage, putting him close to the 40 percent of Americans who no longer have a mortgage.

He also has $23,000 in cash saved as an emergency fund.

But despite his age and lack of savings, Ramsey sees a glimmer of hope for Scott’s financial future.

Ramsey believes Scott’s greatest asset is his career as a carpenter in the luxury real estate market.

“The good news is that as a carpenter in luxury properties, you are in high demand. You have always had more work than you could handle,” Ramsey said.

Ramsey laid out a possible roadmap for Scott, suggesting he increase revenue through more contracts and higher rates as a freelance contractor.

If Scott could save an additional $2,000 each month, Ramsey estimates he could retire at age 67 with $500,000 in retirement assets and a paid-off house.

“Make sure you have a plan of action, man,” Ramsey urged.

On a recent episode of The Ramsey Show, Scott confessed to Dave Ramsey that he’s struggling with a $20,000 car loan for his bike — nearly as much as his $25,000 mortgage

Scott’s situation reflects a larger problem facing Americans: Many of them are being crushed by sky-high auto loans.

This comes as the auto loan crisis in America has reached unprecedented heights.

A 2021 Consumer Reports investigation found that lenders are increasingly able to exploit the vulnerable, especially those with lower credit scores, by charging them higher interest on such loans and ultimately allowing them to repossess cars.

Auto loans are a major source of stress for car-crazy Americans, leaving more and more people with mountainous debt.

According to the U.S. government, total auto loan debt in the second quarter of 2024 was a whopping $1.63 trillion. Fed’s Household Debt and Credit Report.

This makes it the largest source of non-mortgage debt, larger than both credit cards and student loans, according to Money wise.

Ramsey suggested selling the bike — and taking on extra jobs. If Scott could save an extra $2,000 a month, Ramsey estimated he could retire at age 67 with $500,000 in retirement savings and a paid-off house

Last year, auto debt in the US reached a record high of $1.6 trillion, an average of more than $13,000 per household.

In February, the Federal Reserve released figures showing that Americans are the most behind on their car payments since 2010.

In recent years, the cost of car ownership has increased dramatically. Not only are car manufacturers charging more for new cars, but used cars are also becoming more expensive.

Used car and truck prices have increased by more than 50 percent in the two years since January 2020, according to figures from the U.S. Bureau of Labor Statistics.

Meanwhile, insurance costs are also rising. In March, it was one of the main drivers of inflation, as measured by the Consumer Price Index (CPI), rising 2.6 percent month-on-month.